Factoring Invoices In Quickbooks

Our how to record invoice factoring transactions on quickbooks guide includes easy steps and instructional screenshots regarding the.

Factoring invoices in quickbooks. Are you factoring receivables and need to record invoice factoring on quickbooks. Which is the best way to record an invoice in quickbooks and correctly keep track of outstanding balances and the factoring rates paid to the factoring company once the transaction is complete. You work with a company that gives you a percentage of your unpaid invoices or accounts receivable. Invoice financing works similarly to factoring.

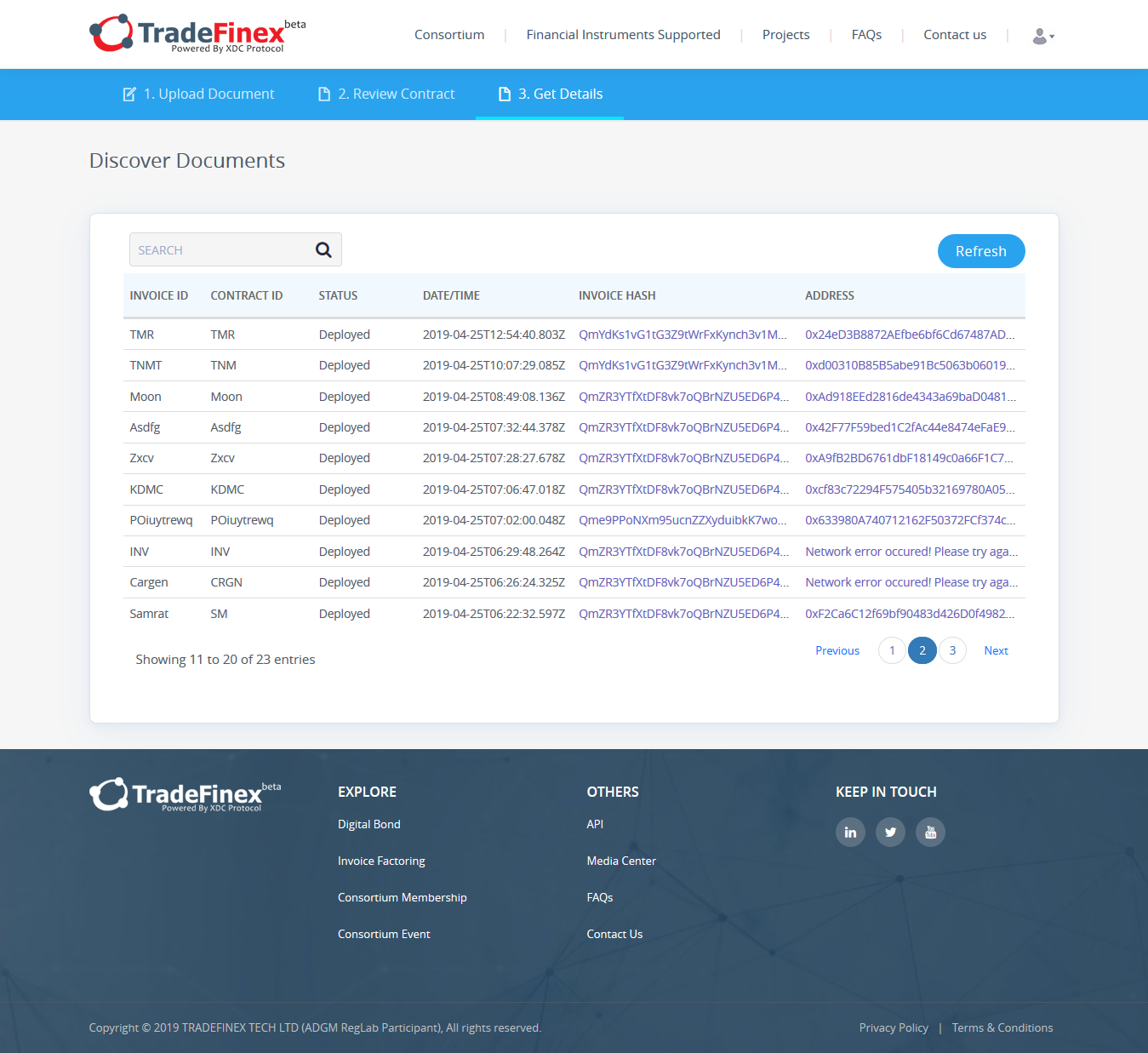

Whenever your factoring company buys one of your company s invoices and wires the invoice advance agreed to your bank account you can record this transaction as follows. If you use quickbooks without factoring your receivables the flow is generally like this. When your customer pays the payment is recorded. An invoice is created and sent to the customer.

But in this situation you maintain control over your invoices. Deposits are made the next business day and automatic weekly repayments begin the following week. We have put together for you a comprehensive 38 page step by step guide that includes everything you need to know about receivable factoring accounting in quickbooks. Get this and a whole lot more blog posts and videos on my website.

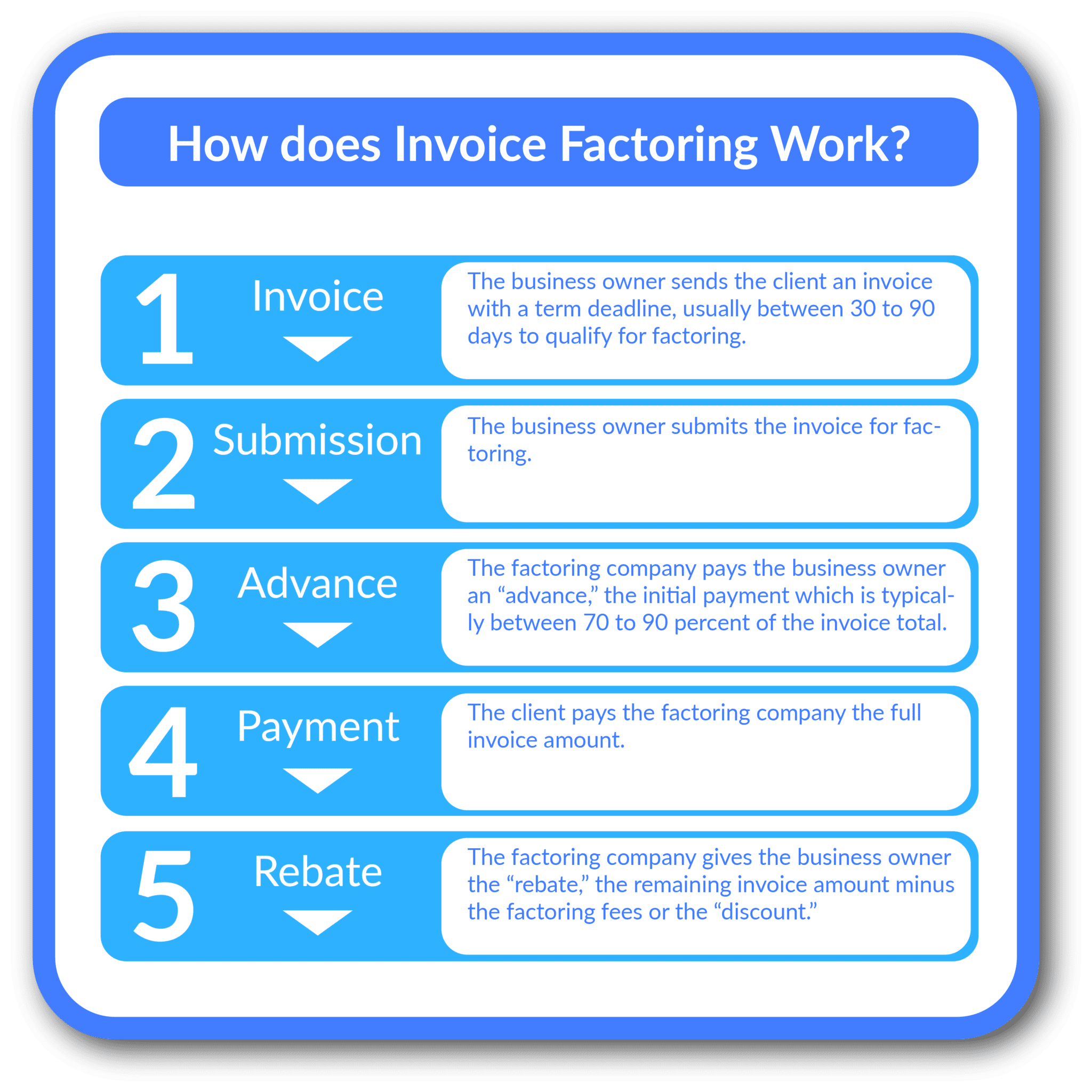

Quickbooks can also be a great way to keep you on track with all your factoring needs making it easy for you to spare time for other essential things. Factoring company pays your business the balance of the invoice after deducting a commission fee based on a percentage of the invoice value. Alternatives to small business invoice factoring. Flow chart of factoring receivables process to explain the process of factoring receivables we have set out the seven steps involved in the flow chart diagram below using typical example values based on accounts receivables invoices of 5 000.

In addition to invoice factoring there is also invoice financing. How to reconcile quickbooks when factoring invoices one of our factoring clients recently asked about the proper way to reconcile quickbooks or other accounting software when factoring invoices. We are a trucking company and we have created invoices for our customers brokers and we are billing through a factoring company to get paid sooner. For example we have a batch of 6 invoices from 6 different brokers in amount of 16 600.