Do I Endorse 401k Rollover Check

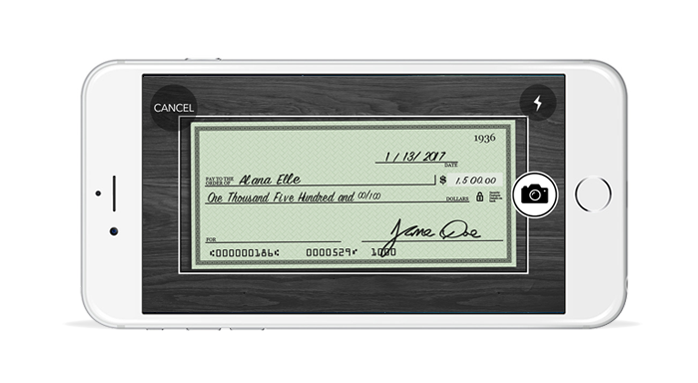

Then please deposit the check with fidelity in one of the following ways.

Do i endorse 401k rollover check. Have them pull the assets from the 401k into the rollover ira. The fbo on the check indicates for the benefit of you will typically encounter this type of check when rolling over certain types of accounts such as iras and 410 k s. Fbo on your 401k rollover check means for benefit of when you do a direct transfer of your 401k to an ira you will probably still receive a check from your 401k company. The check should be made payable to fidelity management trust company or fmtc fbo your name.

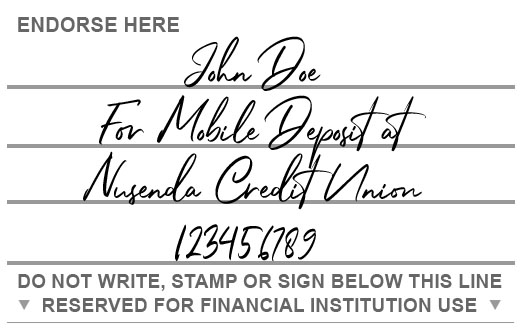

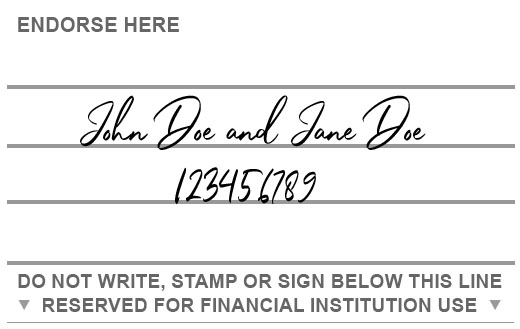

Financial institutions will require you to endorse the rollover check to the new financial institution. As with most retirement plan rules this rule comes with two exceptions one good and one bad. Cashing the check or depositing it is the worst thing you can do because that gives you control over the funds and turns your transaction into a rollover. Usually fbo checks for benefit of are made out to an institutional administrator in a company to company transfer rollover or 1035 exchange where the funds are not to be handled.

However even if you make the mistake of having them address the check to you you can still open an ira and put it in there as long as it is within the 60 day window and it still counts as a rollover. This is a lot safer as far as taxes or penalties accidentally being triggered. The big concern with rollovers is to not have it addressed to you because that is a distribution not a rollover. An fbo check is a check made out to you and another party usually a financial institution.

Deposit an old 401 k check. With most types of accounts that require you to roll over funds to avoid paying a penalty fee you must deposit the proceeds of the check you receive into a qualified account within 60 days to avoid paying the penalty fee. If it s a direct transfer the check will be made out the ne. If you are trying to do a transfer and not a rollover and you get a check from your old 401k company or ira company that is made out directly to you without the fbo return the check immediately.

Generally when you receive a check from your ira custodian or employer plan you have 60 days to rollover the funds to another retirement account either an ira or an employer plan. Before depositing an fbo check you must endorse.