Factor Loan

And before you sign on the dotted line for any business loan with a factor rate make sure you know just how much that financing will be costing your business.

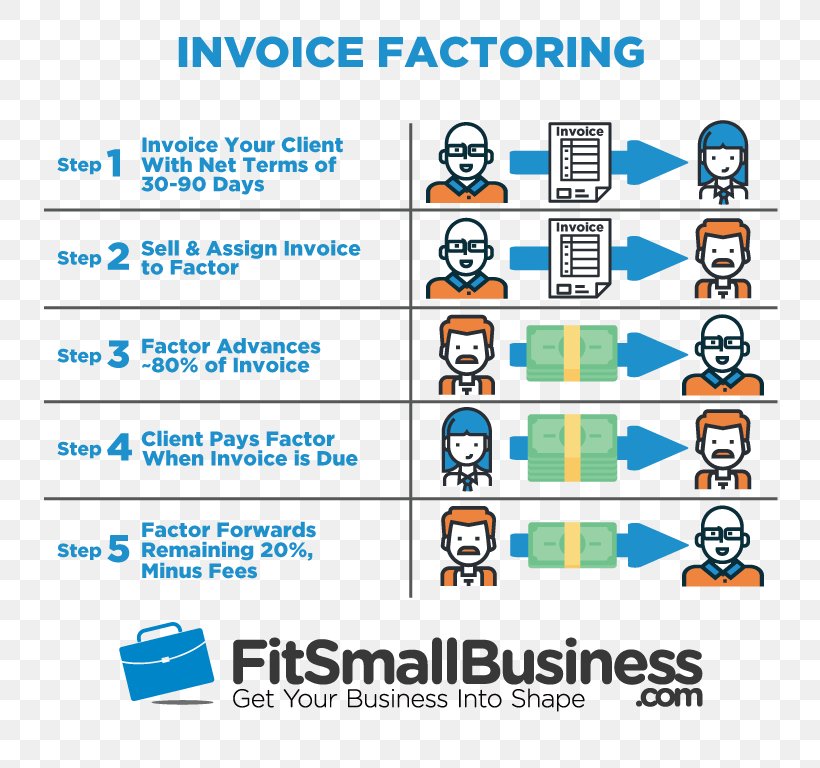

Factor loan. Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable i e invoices to a third party called a factor at a discount. For a printable table please click. The bottom line on factor rates. To calculate how much money you will need to repay on a loan you simply multiply the amount you re hoping to borrow by the factor rate.

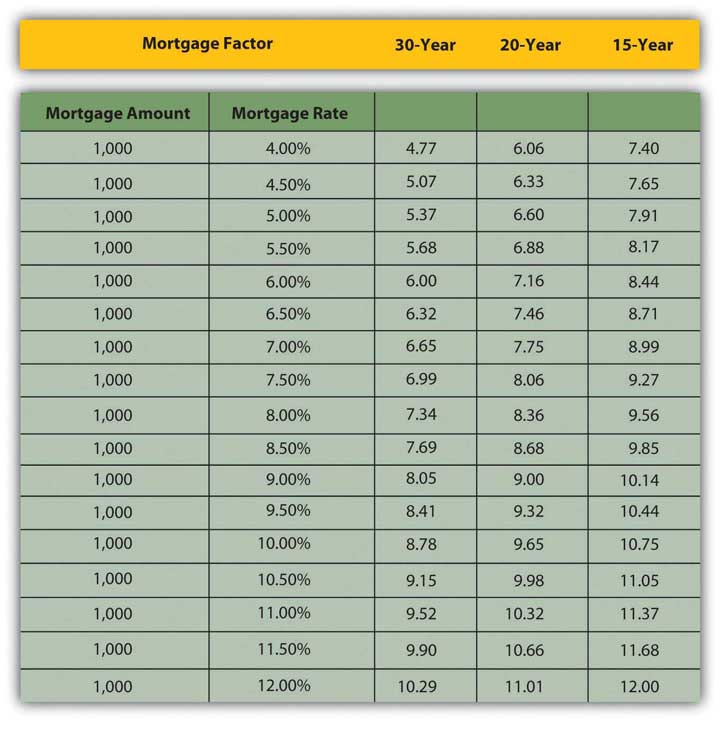

Multiply the factor by the loan amount to calculate your monthly payment. A factor rate is expressed as a decimal figure and not in percentages the way interest rates are calculated. When you see a factor rate the first thing you need to know is that it doesn t mean the same thing for your business as an interest rate or apr does. As an example the factor for a 30 year 9 loan is 0080462.

This determines how much you need to pay back on your business loan. The factor 0080462 times loan amount 182 500 equals monthly payment i e. For example if you were going to borrow 100 000 and the factor rate was 1 18 for a 12 month term the amount to be repaid would be 118 000. A loan s annual percentage rate or apr determines the cost of borrowing for some loans but others use a factor rate instead.

They loan you an amount of money which you re expected to pay back over a specific amount of time in addition to a generally high amount of interest. Many business owners are less familiar with a rate factor. It s the total cost of borrowing for one year when the interest rate and loan fees are added in expressed as a percentage. Factoring invoices is a debt free form of financing.

It agrees to pay the invoice. Therefore a 9 30 year fully amortized loan payment can easily be figured as follows. Conventional bank loans are pretty cut and dry. The decimal figure typically ranges from 1 09 to 1 47.

Forfaiting is a factoring arrangement used in international trade finance by exporters who wish to sell their. Apr is the interest rate on a loan in annualized form. From defaulting on its loan payments with a creditor such as a bank.