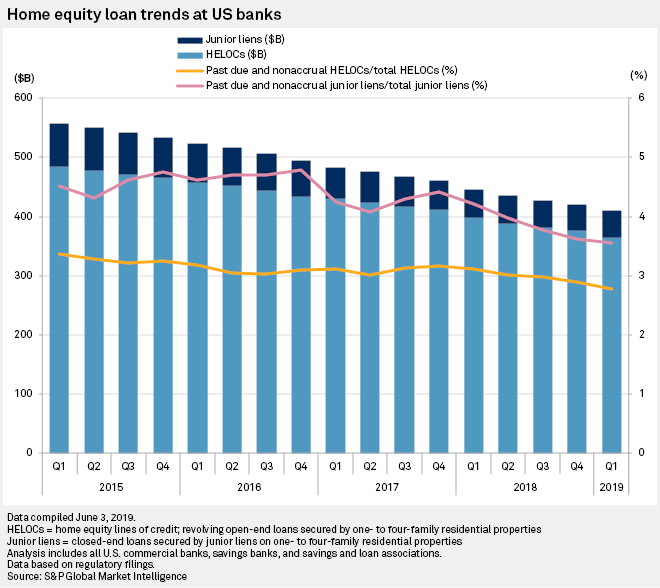

Home Equit Loans

Home equity loans are often used to finance major expenses such as home repairs medical bills or college education.

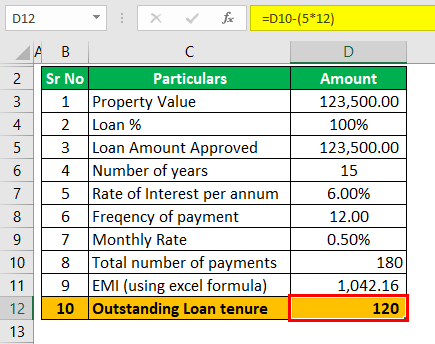

Home equit loans. Your home equity is calculated by subtracting how much you still owe on your mortgage from the. A home equity loan is a type of loan in which the borrower uses the equity of his or her home as collateral. A home equity loan also known as a second mortgage term loan or equity loan is when a mortgage lender lets a homeowner borrow money against the equity in his or her home. This timeline could be as short as five years or as long as 15 years or more.

The interest rates are competitive with other types of loans and the terms. A home equity loan is a second mortgage that allows you to borrow against the value of your home. A home equity loan is a type of second mortgage. A home equity loan is a second mortgage that borrows against the equity in your home and uses your house as collateral to secure the loan.

With a home equity loan you get all of the money at once and repay in flat monthly installments throughout the life of the loan. Tapping home equity accesses the portion of the home. If you haven t already paid off your first mortgage a home equity loan or second mortgage is paid every month on top of the mortgage you already pay hence the name second mortgage. A home equity loan creates a lien against the borrower s house and reduces actual home equity.

Home equity loans allow you to borrow against your home s value minus the amount of any outstanding mortgages on the property. The loan amount is determined by the value of the property and the value of the property is determined by an appraiser from the lending institution. As the name implies a home equity loan is secured that is guaranteed by a homeowner s equity in the property which is the difference between the property s value and the existing mortgage.

:max_bytes(150000):strip_icc()/home-equity-loans-315556_final3-23fa1237c577475f811fe9fc06eedec2.png)