Factoring Loans

In this purchase accounts receivable are discounted in order to allow the buyer to make a profit upon the settlement of the debt.

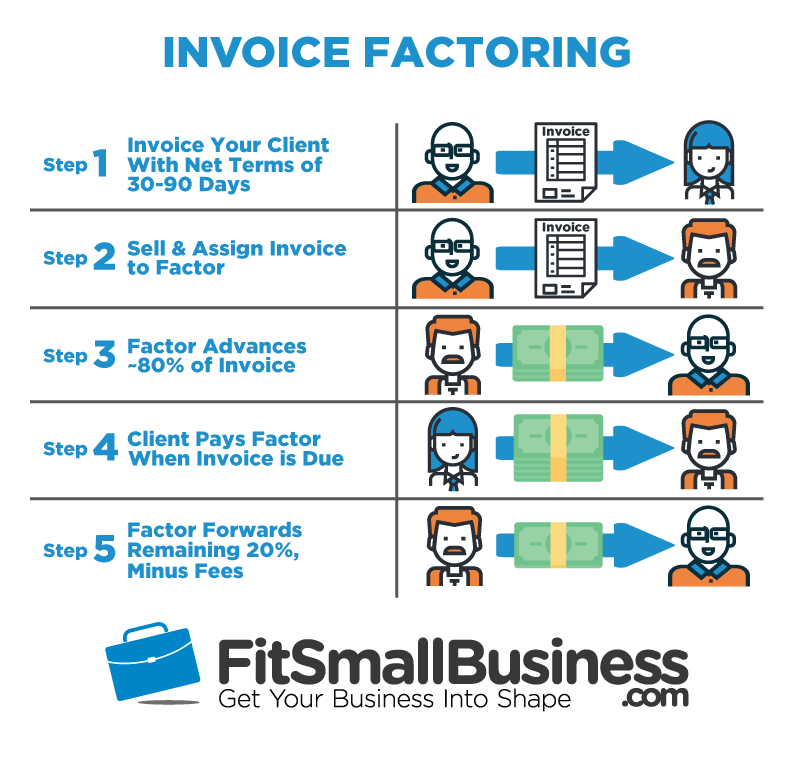

Factoring loans. Factoring is a short term solution. Like accounts receivable factoring invoice financing allows you to access financing based on the value of your receivables. Factoring invoices is a debt free form of financing. The main reason that companies factor is to get paid on their invoices quickly rather than waiting the 30 60 or sometimes 90 days it often takes a customer to pay.

Is factoring a loan. It is the purchase of future receivables. But with the latter product you aren t selling your receivables to the business lender. Factoring is sometimes referred to as accounts receivable financing.

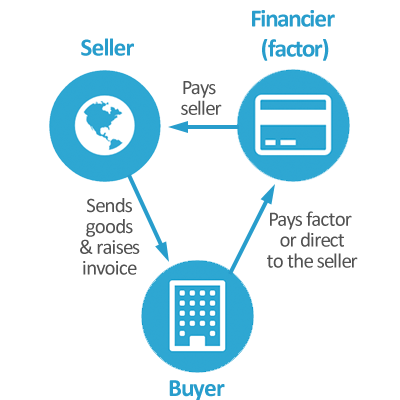

Essentially the factor is purchasing the right to collect on an invoice when it s paid minus a discount of 2 to 6. The factor will pay around 75 of the invoice up front followed by the remainder once they ve collected on the invoice. Conventional bank loans are pretty cut and dry. The factor collects payment on the receivables from the company s.

The factoring company then collects payment on those invoices from your customers. The funds provided to the company in exchange for the accounts receivable are also not. Plant says the factor s role is to help clients make the transition to traditional financing. A business will sometimes factor its receivable assets to meet its present and immediate cash needs.

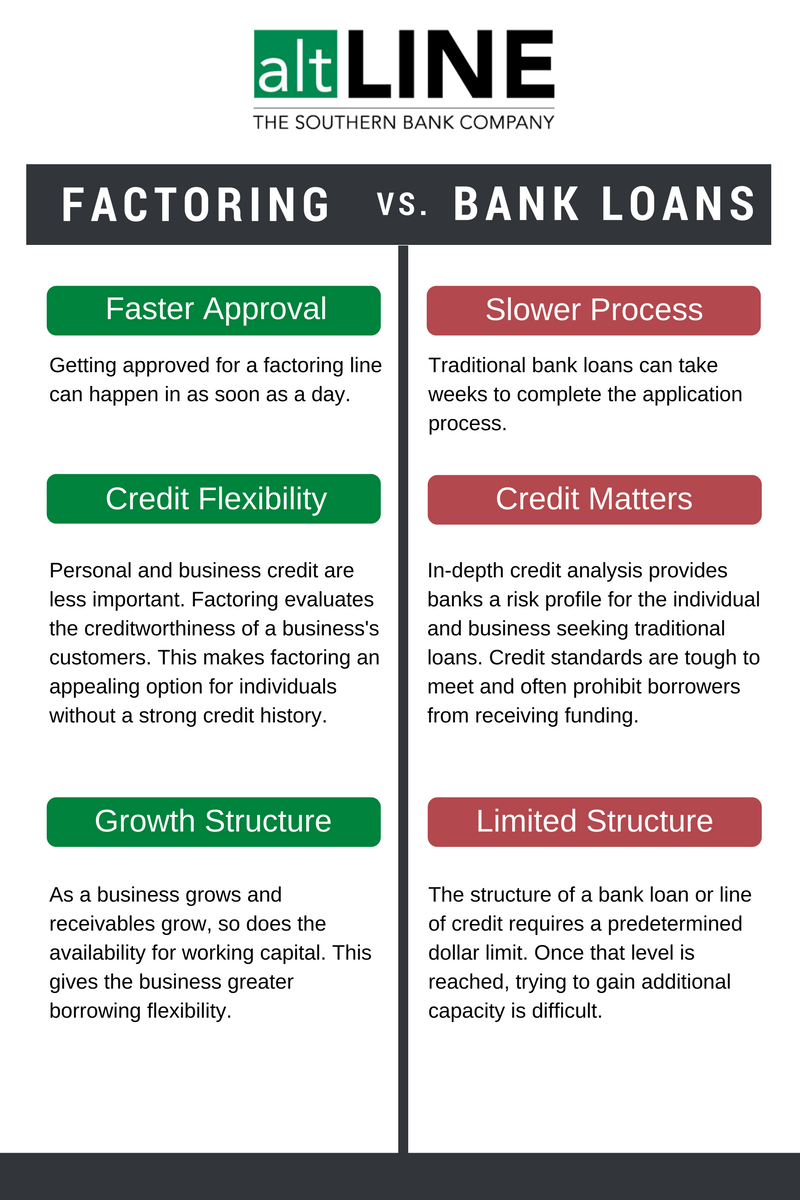

Understanding how accounts receivable factoring works. They loan you an amount of money which you re expected to pay back over a specific amount of time in addition to a generally high amount of interest. A third party known as a factor purchases a company s invoice s or purchase order s at a discount giving a business owner access to a percentage of that invoice or purchase order now instead of when the invoice or p o. Technically factoring is not a loan.

Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable i e invoices to a third party called a factor at a discount. Instead the receivables merely act as collateral for a loan. Factoring is not a business loan it s the sale of an asset the invoice. Factoring is not considered a loan as the parties neither issue nor acquire debt as part of the transaction.

Forfaiting is a factoring arrangement used in international trade finance by exporters who wish to sell their. Most companies factor for two years or less.