Cpi Annuity

The cpi e is essentially a price index for the elderly.

Cpi annuity. Dedicated local cpi annuity analyst assigned to your account. Our exclusive patent audit service improves your ability to manage acquisitions and or divestitures efficiently. The composition of the cpi e is different from other bls indexes such as the consumer price index for urban consumers cpi u and the consumer. We assume the account manager will be the main client contact listed at the annuity service.

Computer packages will only disclose user ids and passwords to the account manager via email. Immediate annuity fixed vs. Computer packages provides patent and trademark intellectual property management systems and patent annuity payment services. Inflation indexed immediate annuities are tied to the cpi.

Pension incomes and values can be affected by moves in the economy. This type of annuity is an investment vehicle guaranteeing you a lifetime monthly income that will increase based on increases in the federal government s consumer price index which tracks. This includes the hyper inflation period of the late 1970 s. The cola is computed based on the consumer price index for urban wage earners and clerical workers or cpi w.

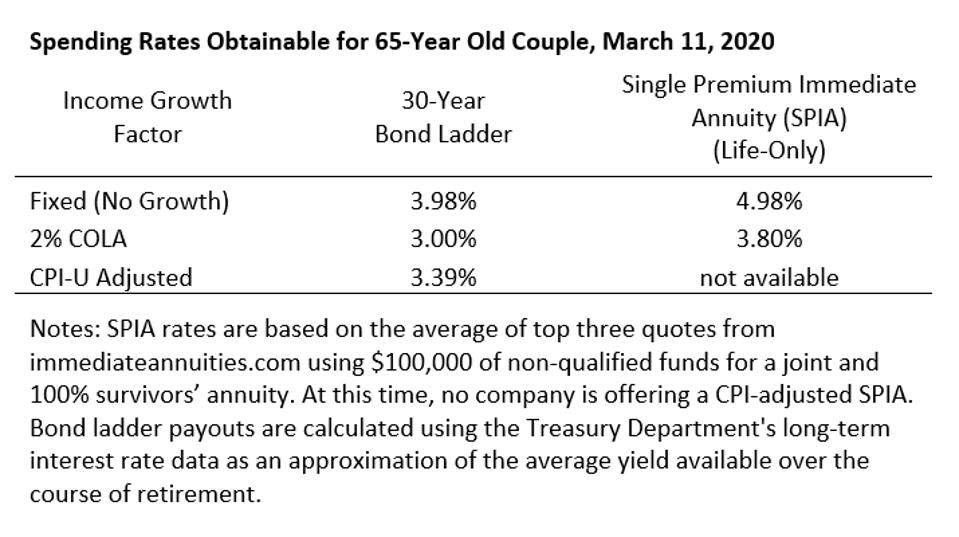

The amount of monthly income usually starts as much as 20 or 30 percent lower than the payout of other annuities but it will increase over time as inflation rises. Inflation protected fixed annuity inflation protected annuity 4 cpi chart 2 illustrates that the inflation adjusted annual annuity payments will start to exceed the non inflation adjusted payments in year 9 when inflation runs at an effective annual rate of 4. This feature is also referred to as a cost of living adjustment rider. Data is checked in over 100 countries.

The account manager will review all applications for instructcpi for your organization and can add and edit account information from their account. Unlimited instant assistance without charge. You also need to know that with a cpi indexed annuity your monthly income amount can decrease in years when the cpi goes negative. Would own a pra at retirement worth 904 982 which would pay an annuity of up to 7 372 per month.

A cpi rpi consultation will end this week will your retirement income change. We have unique capabilities to help you reduce cost of patent trademark and annuity management. For your information the average cpi increase reported by the bls during the past 60 years is around 3 00.

/CalculatingPresentandFutureValueofAnnuities1-0cea56f3b4514e44bed8f45d9c74011e.png)

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities2-9c9db03774fd45fc83501879e123f82d.png)

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities3-f5e4d156c37b4fffb4f150266cea32b1.png)

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities4-2813a92710984e7da733f6c5b924d0fb.png)