Current Interest Rates For Business Loans

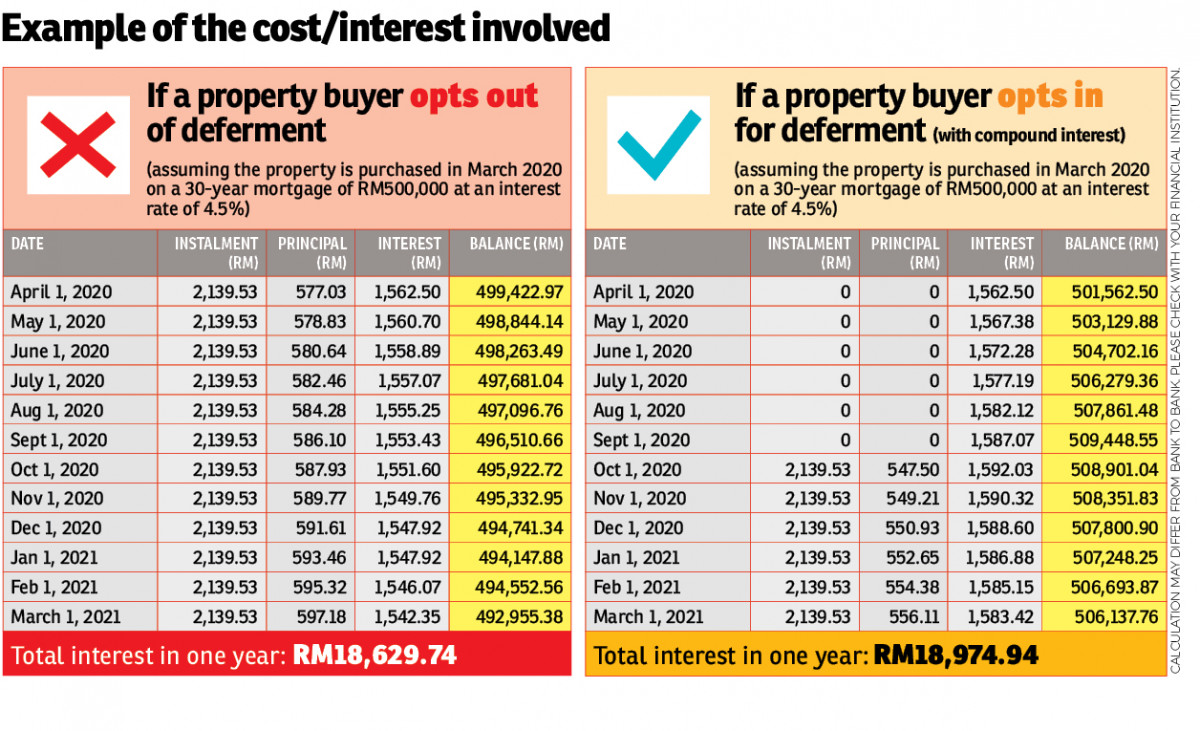

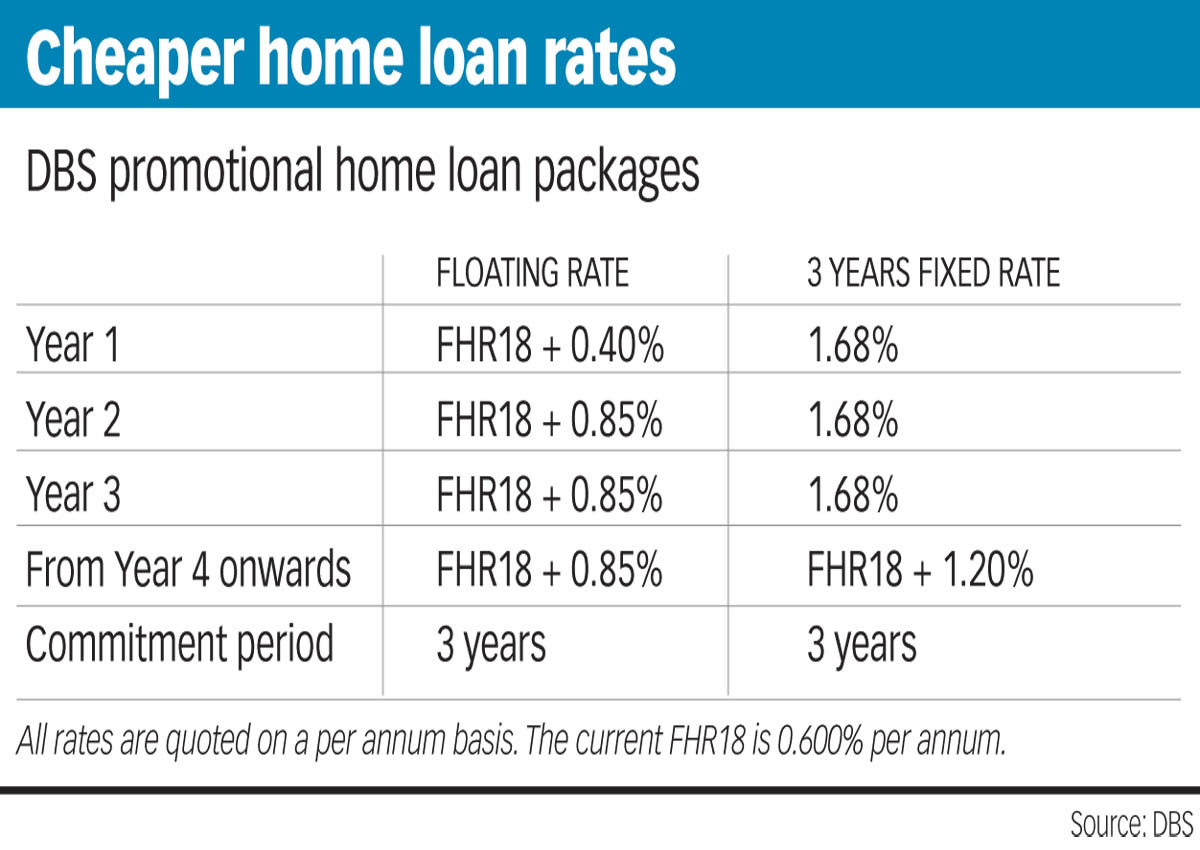

Alternatively if rates increase you may need to speak to your lender about increasing your monthly repayment.

Current interest rates for business loans. Overall cdc 504 loans carry lower interest rates than the sba s 7 a loans. Business loan interest rates in 2020 by loan type as you search for a business loan for your company you ll likely come across several different types of lenders and loans. Below are the current estimates as of september 2020. Current sba cdc 504 interest rates.

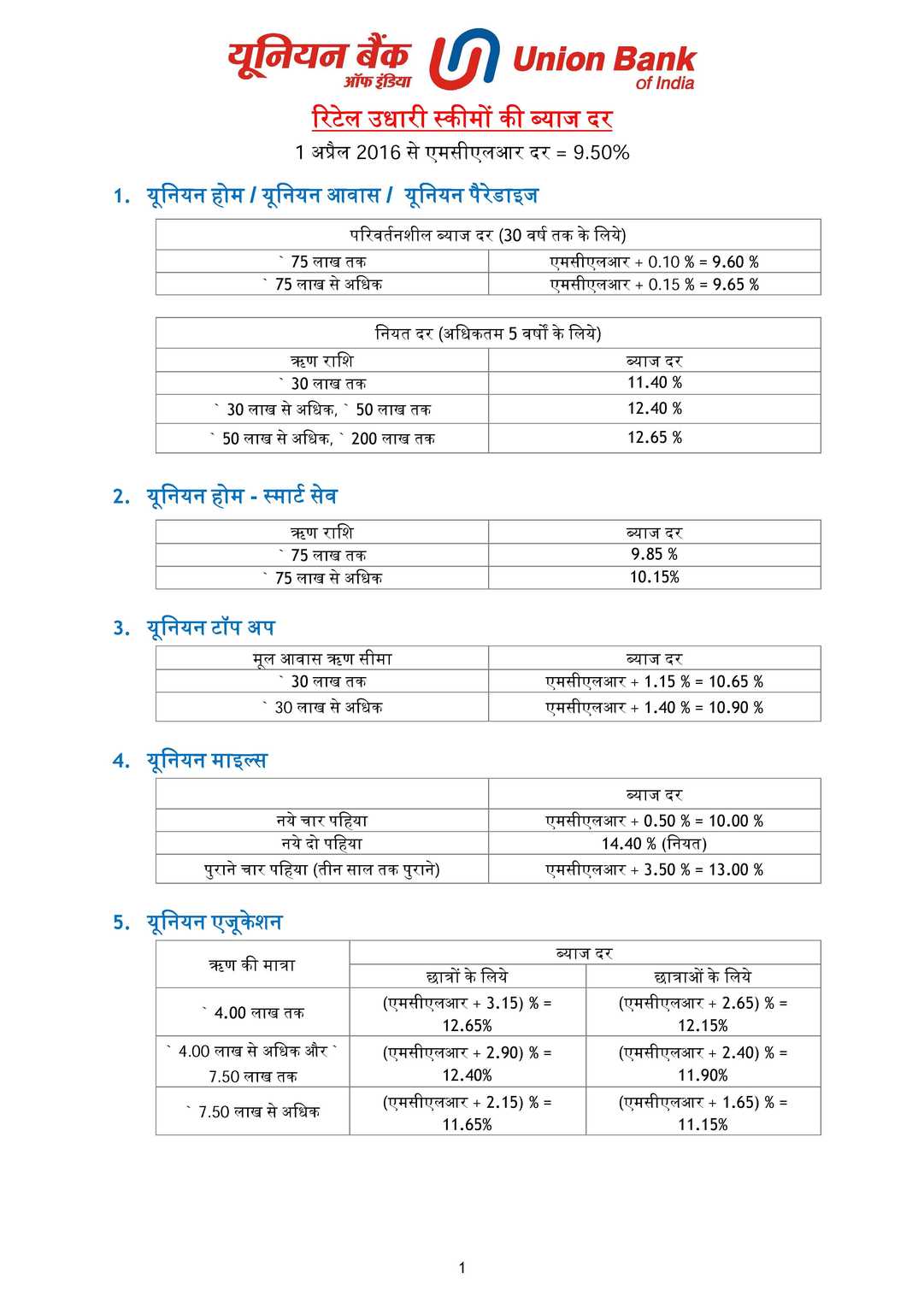

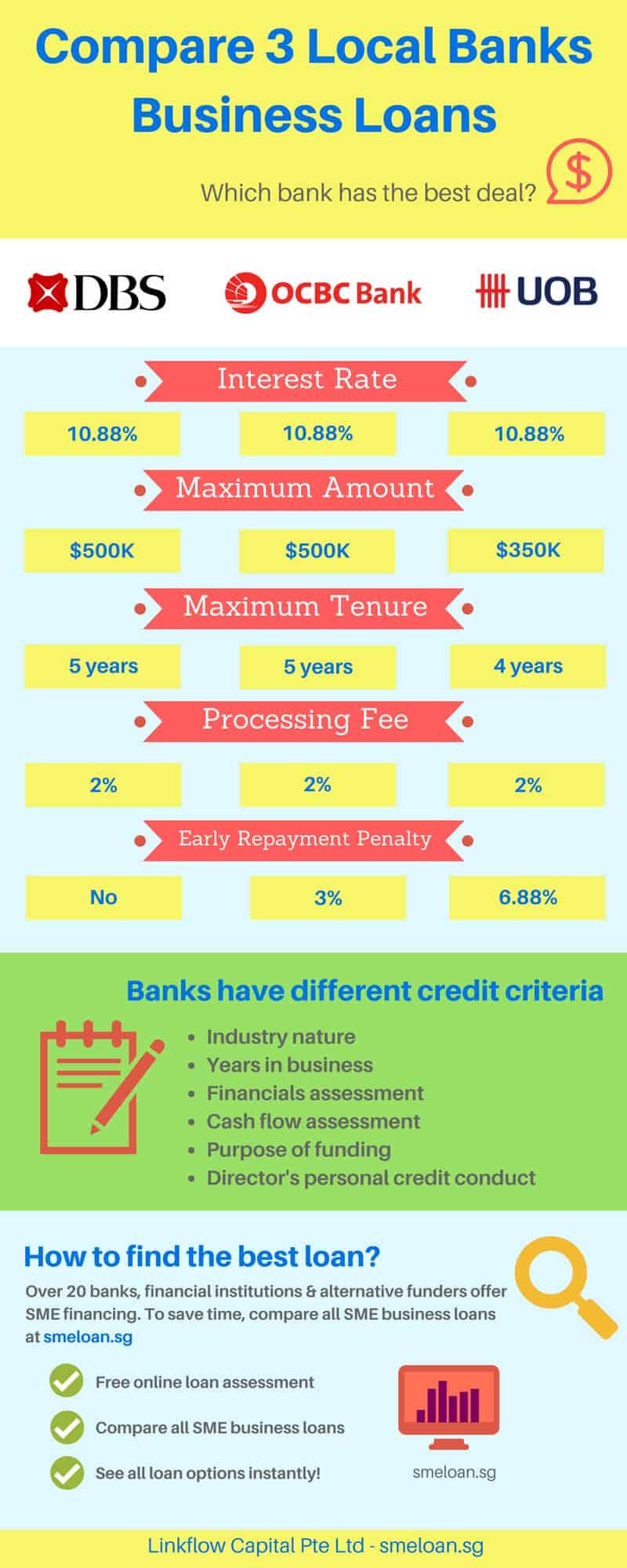

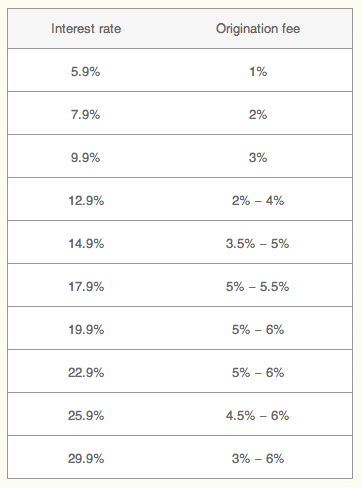

If you plan on taking out a business loan in the future it s important to know the typical market interest rates that way you can tell whether a lender is offering you a fair deal or if you re being overcharged. The rate of interest in business loans broadly range between 15 24 p a. Effective rate for 10 year loans. This article looks at the average loan rates for different types of business loans heading into 2020 as well as the factors that can help you land better terms.

The final rate of interest is dependent on the profile of the borrower credit score financials existing leverage business stability industry outlook and various other risk assessment parameters. Variable rates current on and from 6th april 2020. Small business administration sba typically charge the lowest interest rates but they also tend to have stricter criteria for approval. Loans that come from traditional lenders or are insured by the u s.

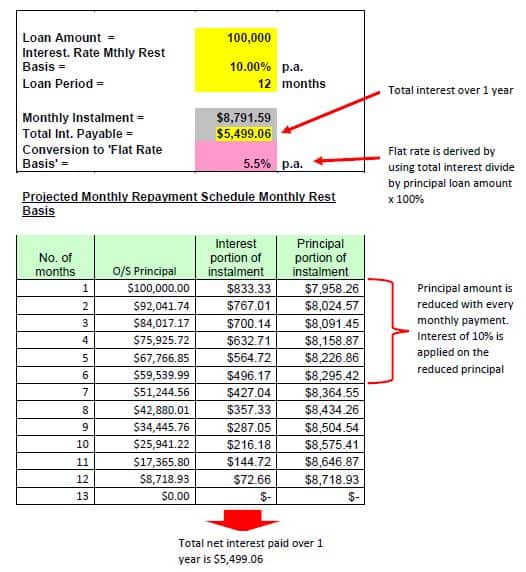

The interest rate advertised by your lender doesn t represent the true cost of your business finance especially for borrowing where the interest compounds i e. The average interest rate for a small business loan varies depending on your qualifications as a borrower the type of loan you re applying for and which lender you select. Loans from traditional lenders such as banks or credit unions can have annual percentage rates aprs ranging from 4 to 13 while alternative or online loans can have aprs ranging from 7 to over 100.

:strip_icc()/what-are-interest-rates-and-how-do-they-work-3305855-FINAL2-2f4b8e003d8d475fa79182d2a5cd4aa4.png)