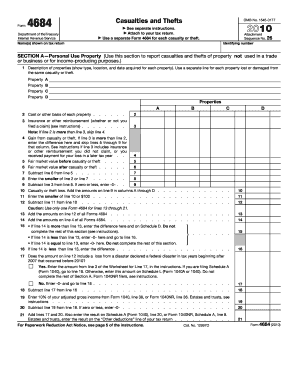

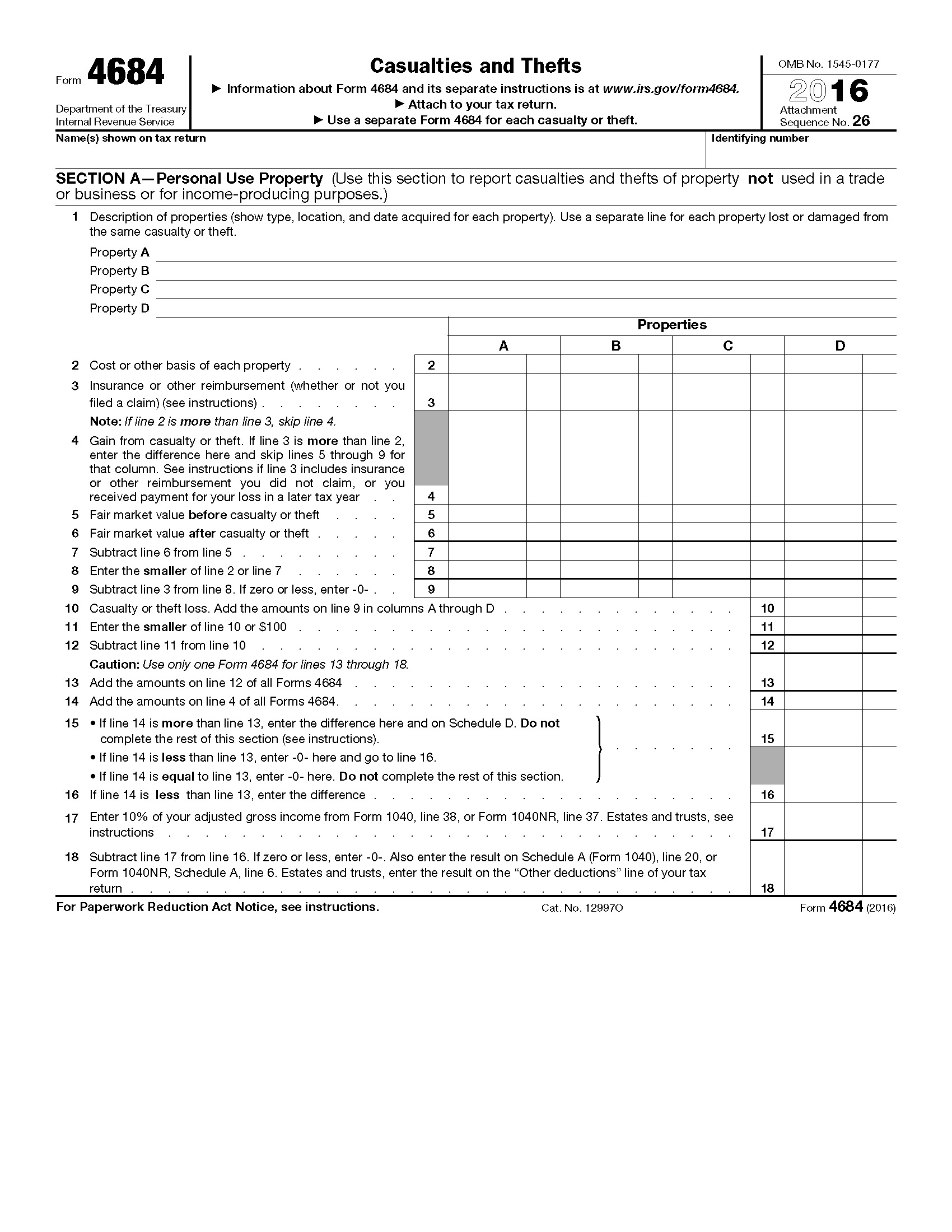

Form 4684

Do not enter name and identifying number if shown on other side.

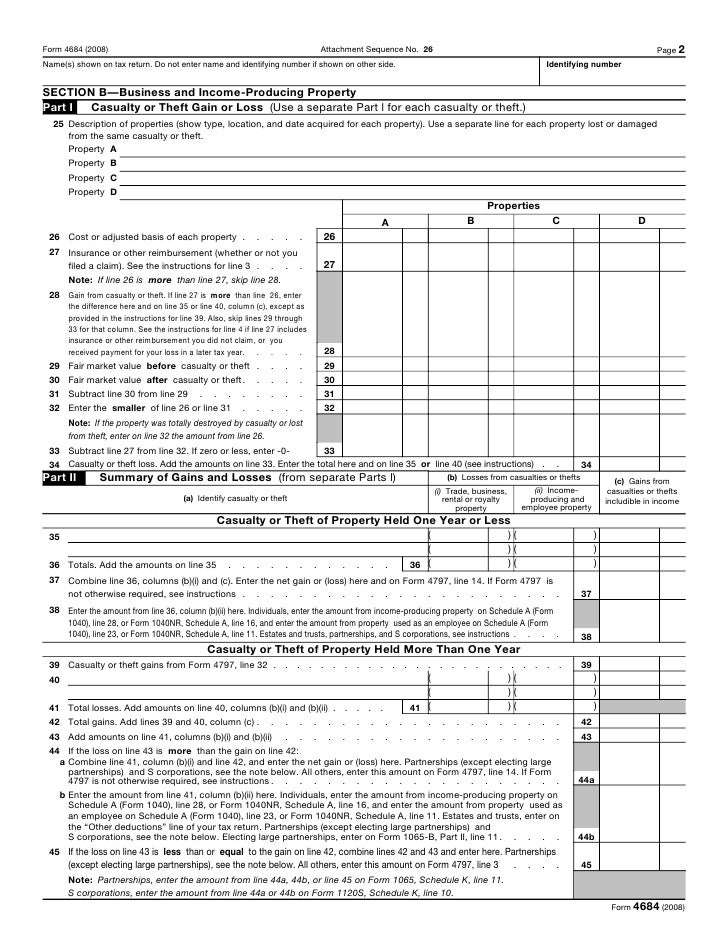

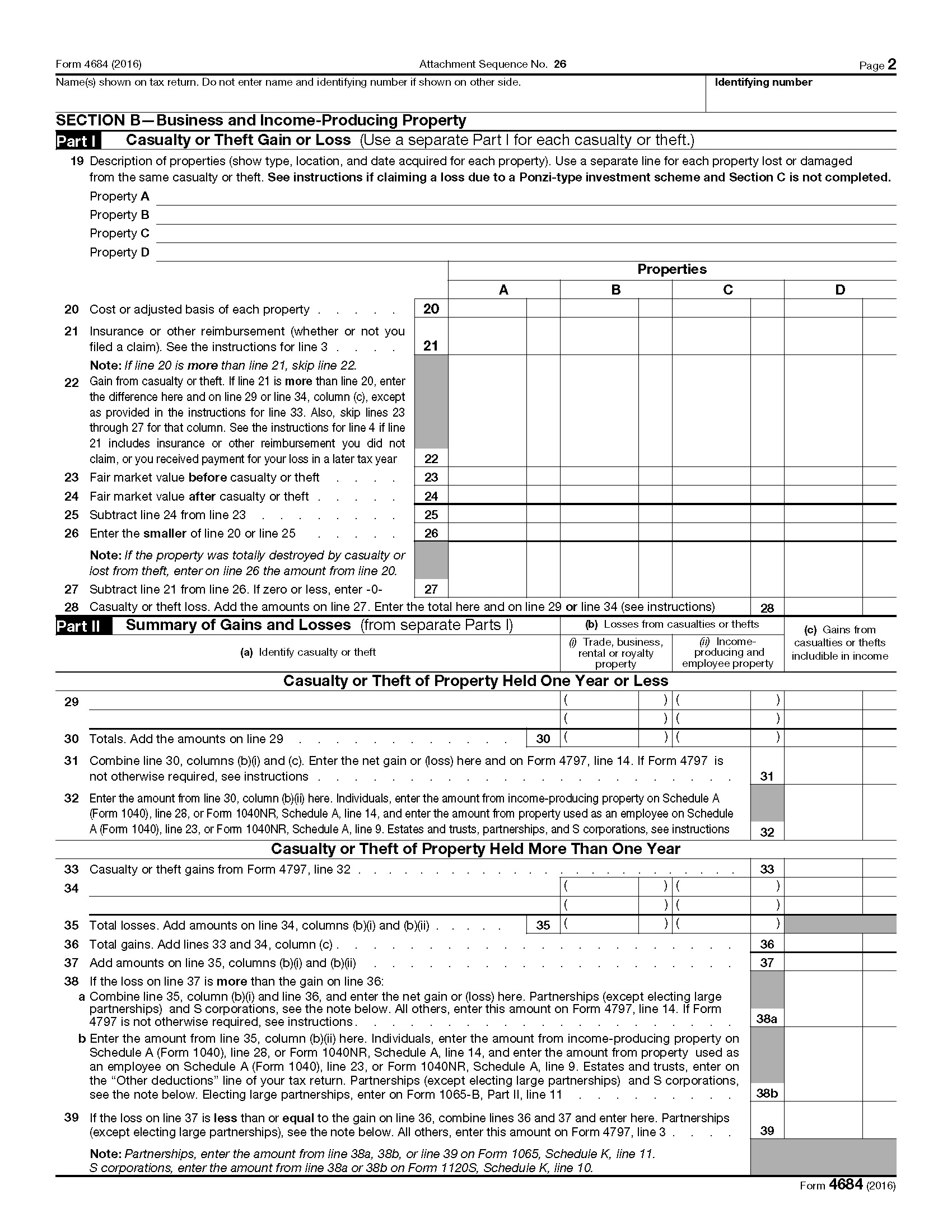

Form 4684. Name s shown on tax return. Instructions for form 4684 casualties and thefts 2009 form 4684. Instructions for form 4684 casualties and thefts 2008 publ 4684. Section b business and income producing property.

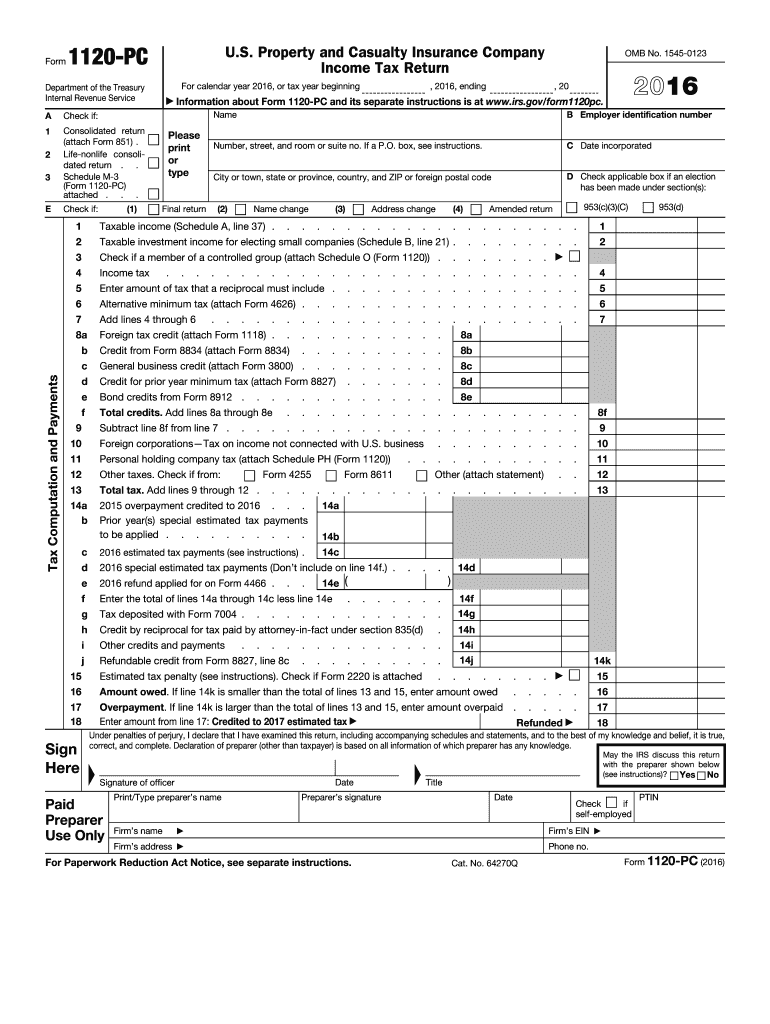

That adjustment will appear on line 26 of the form 4684 and on line 23 of the form 4797 p 2. Internal revenue service irs form for reporting gains or losses from casualties and thefts which may be deductible for taxpayers who itemize deductions. Estates and trusts enter on the other deductions line of your tax return. Attach form 4684 to your tax return to report gains and losses from casualties and thefts.

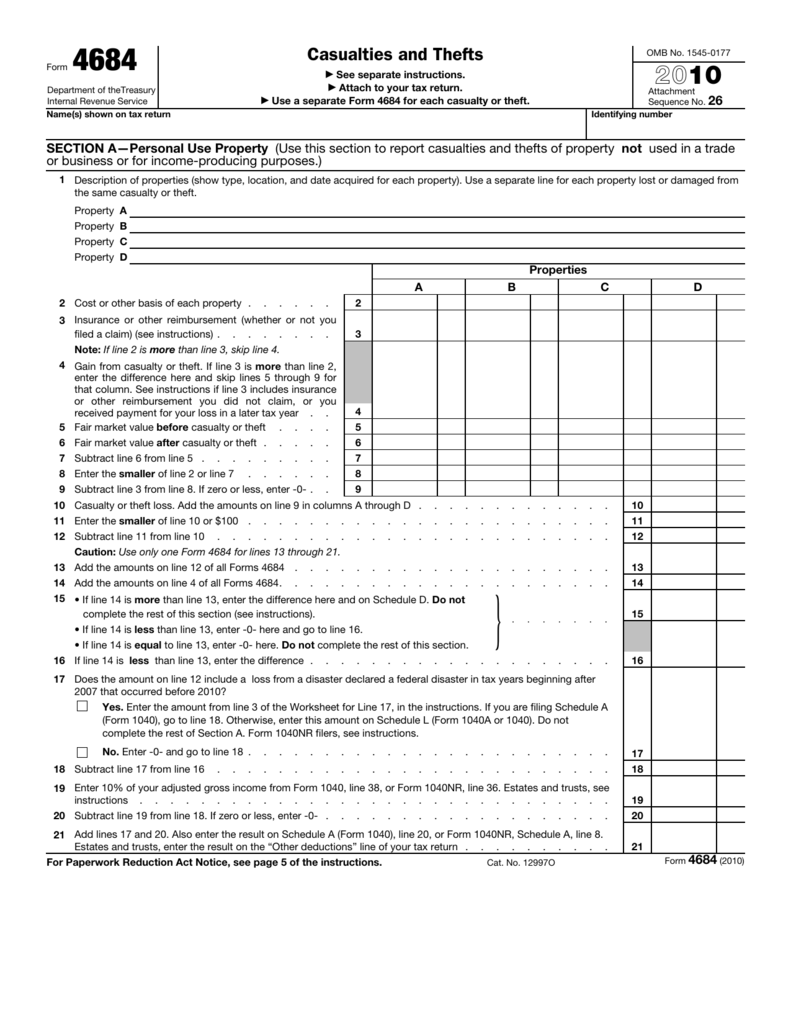

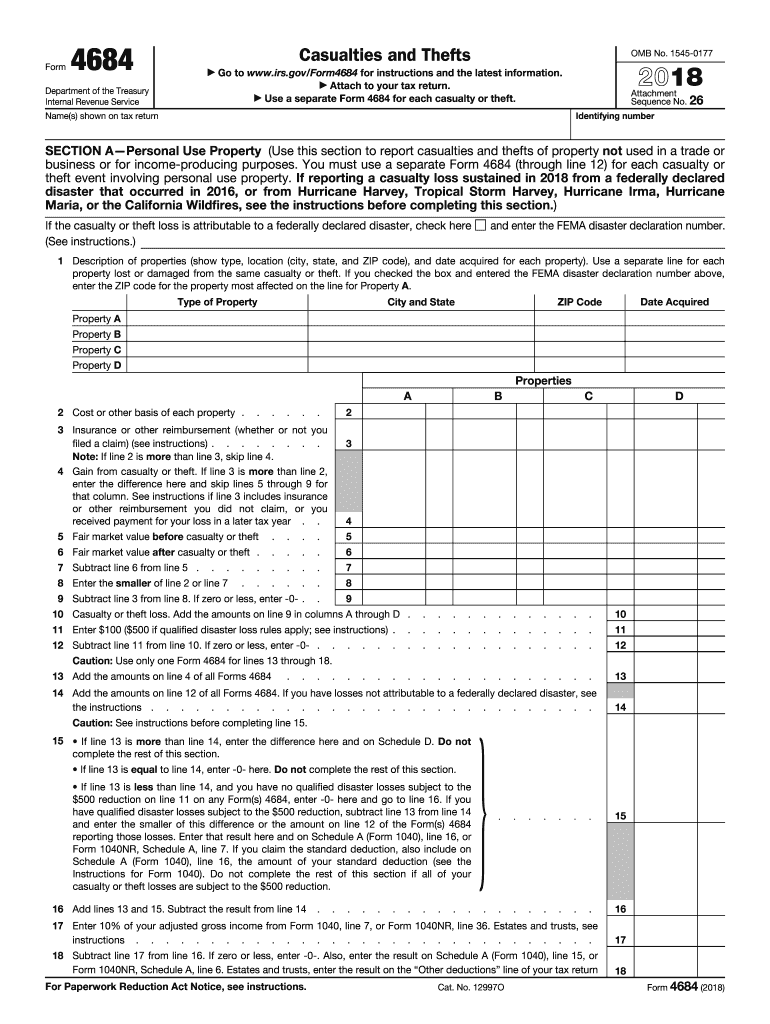

12997o form 4684 2016 form 4684 2016 attachment sequence no. To figure your deduction for a casualty or theft loss first figure the amount of. If you have qualified disaster losses subject to the 500 reduction subtract line 13 from line 14 and enter the smaller of this difference or the amount on line 12 of the form s 4684 reporting those losses. Information about form 4684 casualties and thefts including recent updates related forms and instructions on how to file.

Instructions for form 4684 casualties and thefts 2019 02 14 2020 previous 1 next get adobe reader. Use the instructions on form 4684 to report gains and losses from casualties and thefts. If form 4797 sales of business property is not otherwise required enter the amount from this line on page 1 of your tax return on the line identified as from form 4797. Part i casualty or theft gain or loss use a separate part l for each casualty or theft.

Other related articles individual form 4684 casualty theft losses. Typically you can t take personal lossesexcept there is an exception forcasualty and theft losses now if you arehere to get a little bit moreinformation about disaster relief pleasecheck in the information box below andthere will be information specificallyfor the type of loss that you haveincurredyou can then skip forward to thatparticular section of the. A theft can be claimed on form 4684. Figuring out your deduction amount.

500 reduction on line 11 on any form s 4684 enter 0 here and go to line 16. Casualties and thefts 2007 inst 4684. Attach form 4684 to your tax return. Casualties and thefts 2008 inst 4684.

Figuring and proving a casualty loss form 4684 instructions. Casualties and thefts 2019 10 31 2019 inst 4684. Findings from the free file migration study 2008 form 4684. Next to that line enter form 4684 line 32.