Conventional Mortgage Refinance

Conventional mortgages make up the majority of all home loans about 64 in total.

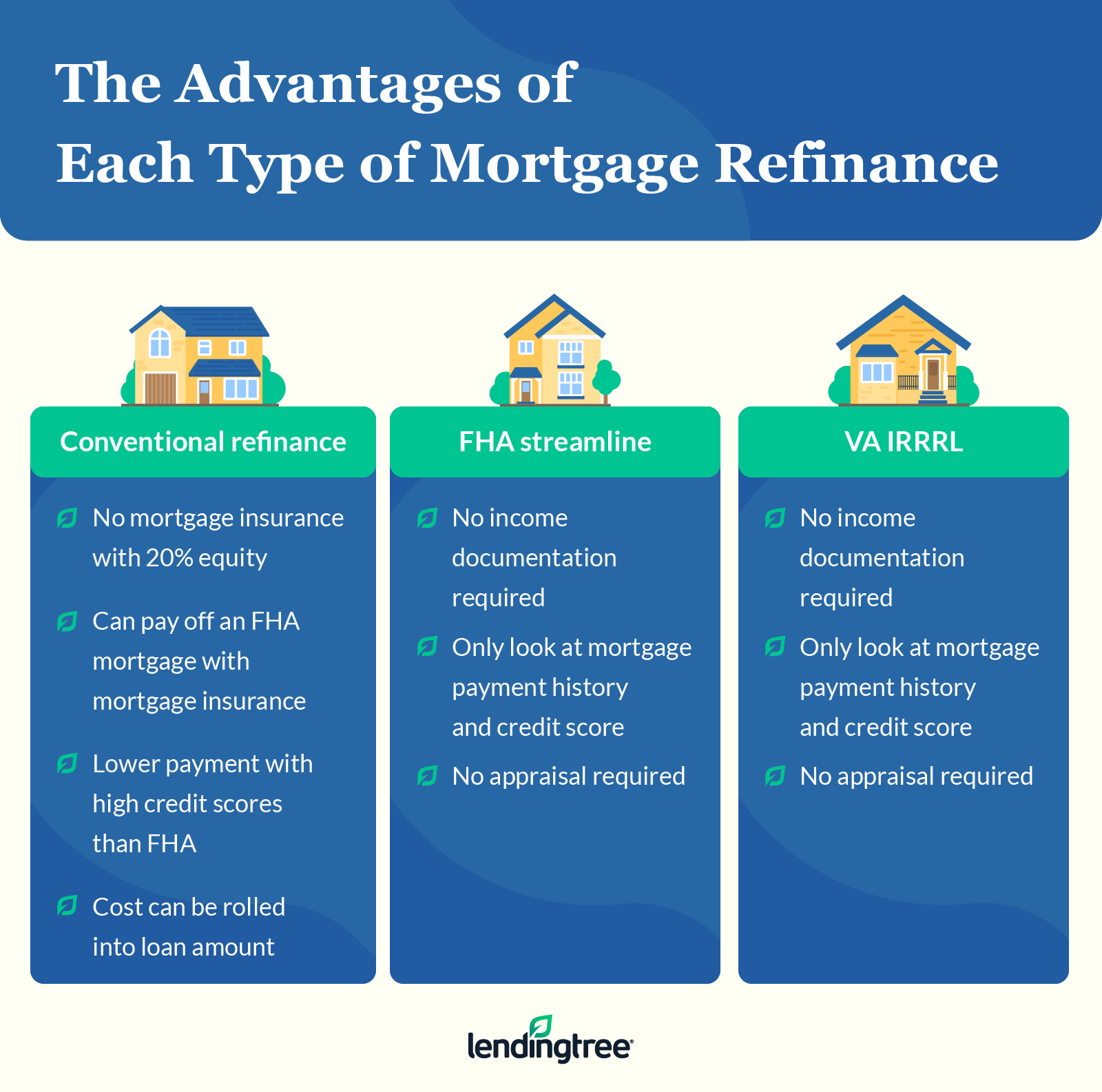

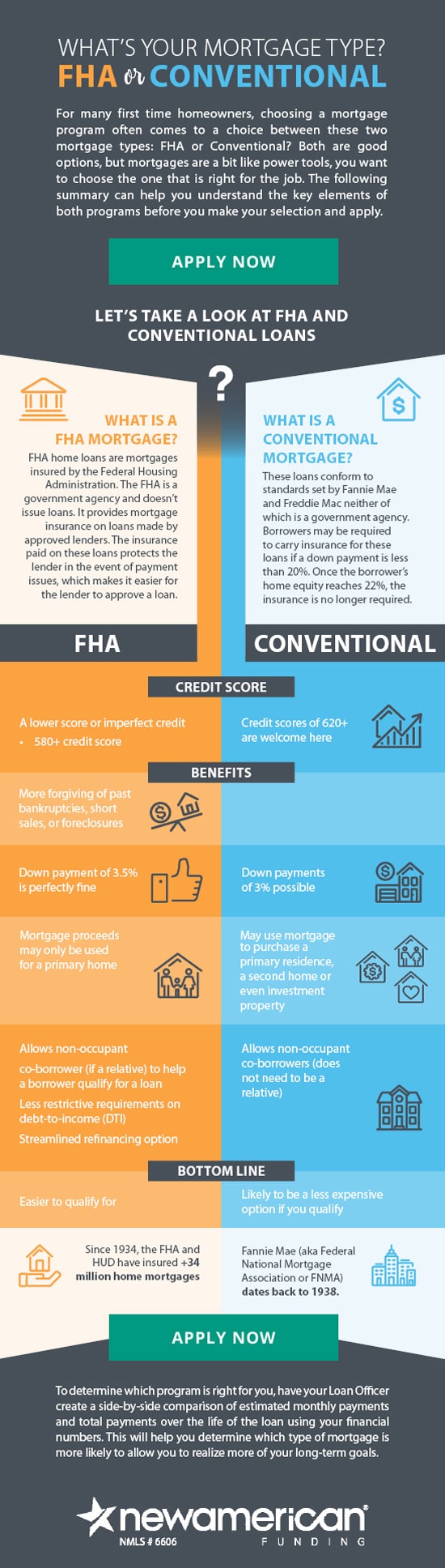

Conventional mortgage refinance. With the same refinance the borrower can lower the rate or change the loan term length if current interest rates allow. One type of non conforming conventional mortgage is a jumbo loan which is a mortgage that exceeds conforming loan limits. Conventional mortgages are issued by banks and other lenders and are often sold to government backed entities. These expenses are tax deductible if they are business or work related.

Conventional mortgages are backed by federally controlled agencies fannie mae and freddie mac. Conventional mortgages may require less documentation than fha loans or va loans which could speed up the overall processing time. Conventional loans offer low down payments to qualified buyers and are readily available from most mortgage lenders. A conventional cash out refinance is a mortgage where the borrower pulls out equity from the property in the form of cash.

If you re curious about the costs associated with refinancing use our mortgage refinance cost calculator to get an estimate of how much it will cost. These quasi government companies purchase loans meeting certain standards like loan to value ratio credit score and type of property. Any travel expenses incurred while at a business convention. Some loans are ideal for first time homebuyers with a small down payment and mediocre credit score like fha loans but they also come with more restrictions than conventional mortgages.

Conventional mortgages do not require an upfront funding fee or mortgage insurance premium as do fha va and usda loans. Because there are several different sets of guidelines that fall under the umbrella of conventional loans there s no single set of requirements for borrowers. Find and compare conventional mortgage rates from lenders in your area.

/what-is-a-conventional-loan-1798441_FINAL-cd12be4836c94eb6ae68117635d2dc19.png)

/GettyImages-1133438028-28bdfa483acd4544a110002711c2f224.jpg)