Cost Of Health Insurance For Family Of 4 Self Employed

What does self employed health insurance cost.

Cost of health insurance for family of 4 self employed. The health care cost per person covered by a policy will be set according to their age with rates increasing as the individual gets older children up to the age of 14 will cost a flat rate to add to a health plan but premiums typically increase annually beginning at age 15. In 2017 the average individual premium for people buying individual health insurance was 397 per month but depending on your income you may be eligible for government subsidies to reduce your monthly premiums. If you qualify for this deduction it means you re allowed to deduct 100 of your health insurance premiums from your adjusted gross income every year. If you re self employed you can use the individual health insurance marketplace to enroll in flexible high quality health coverage that works well for people who run their own businesses.

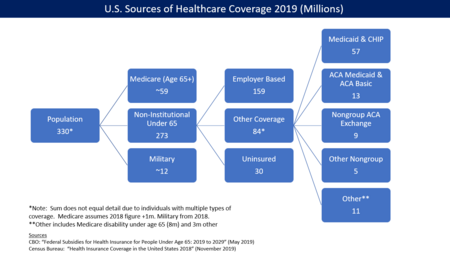

Health insurance companies determine the set of policies offered and the cost of coverage based on. 6 this is a deduction for self employed individuals and their dependents not for small businesses. On january 1 2014 the affordable care act became fully implemented. If you re self employed the entire cost of health insurance coverage is yours.

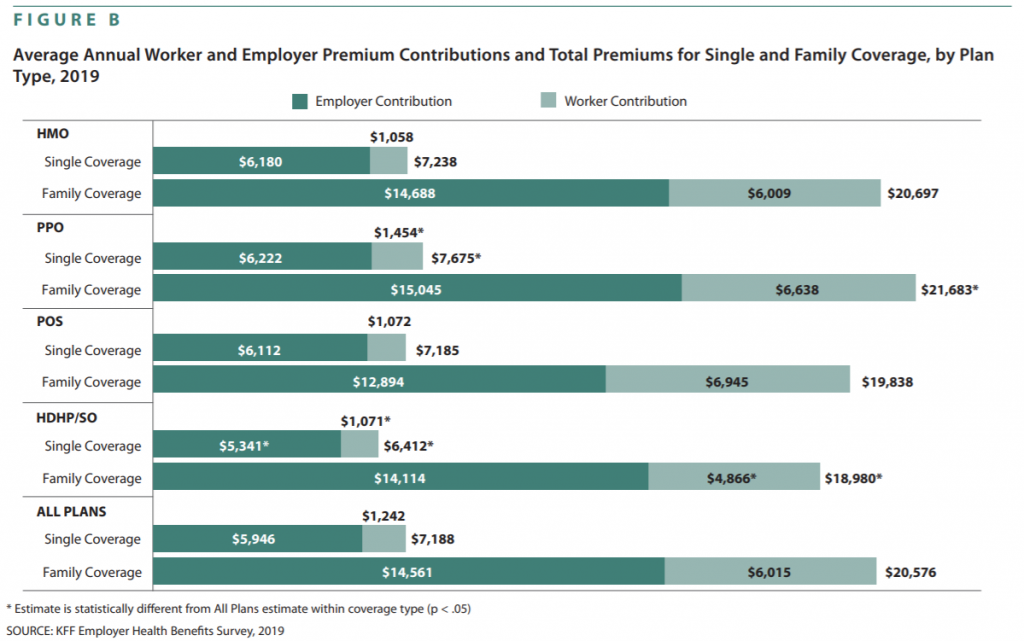

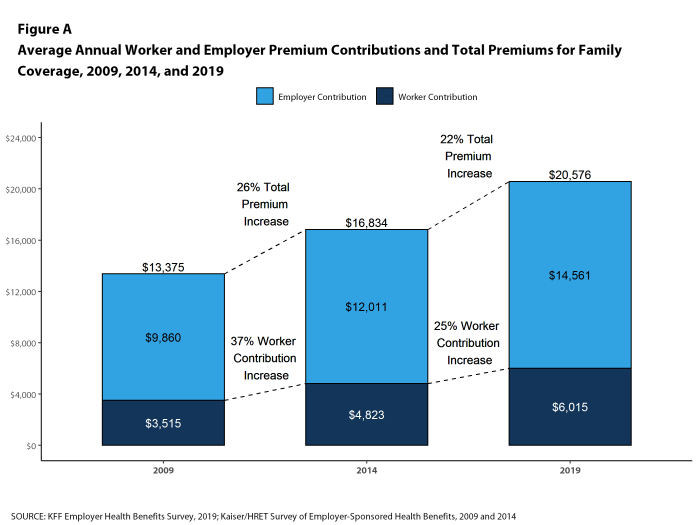

When employers offer health insurance as a benefit the employer may pay over 80 of the cost. There are also savings available called cost sharing reductions which lower out of pocket costs. That means individual and family health policy changes can make a big impact on our finances. While you won t get all of the benefits and protections that you would with an aca compliant individual health insurance plan you could consider some alternatives to obamacare if you need to save money.

Combining these types of savings can certainly help with the average cost of health insurance for a family of 4. You re considered self employed if you have a business that takes in income but doesn t have any employees. And these subsidies still allow for the self employed to deduct health insurance premiums from their tax return. This means individuals and employers alike are mandated to have health insurance coverage or forced to pay a fine.

And you can do that with the health insurance tax deduction for the self employed.

/self-employment-health-insurance-deduction-3193015-final-c6496da4c8c64e838ee4875236d13c41.png)