Deadline Roth Ira Contribution

By the employer company s tax filing deadline plus extensions usually april 15 or oct.

Deadline roth ira contribution. Obtaining an extension of time to file a tax return does not give you. Since the deadline for ira contributions has been extended to july 15 along with the filing deadline. Roth ira conversion deadlines. Those ira assets would have already been counted as part of annual contributions for previous years.

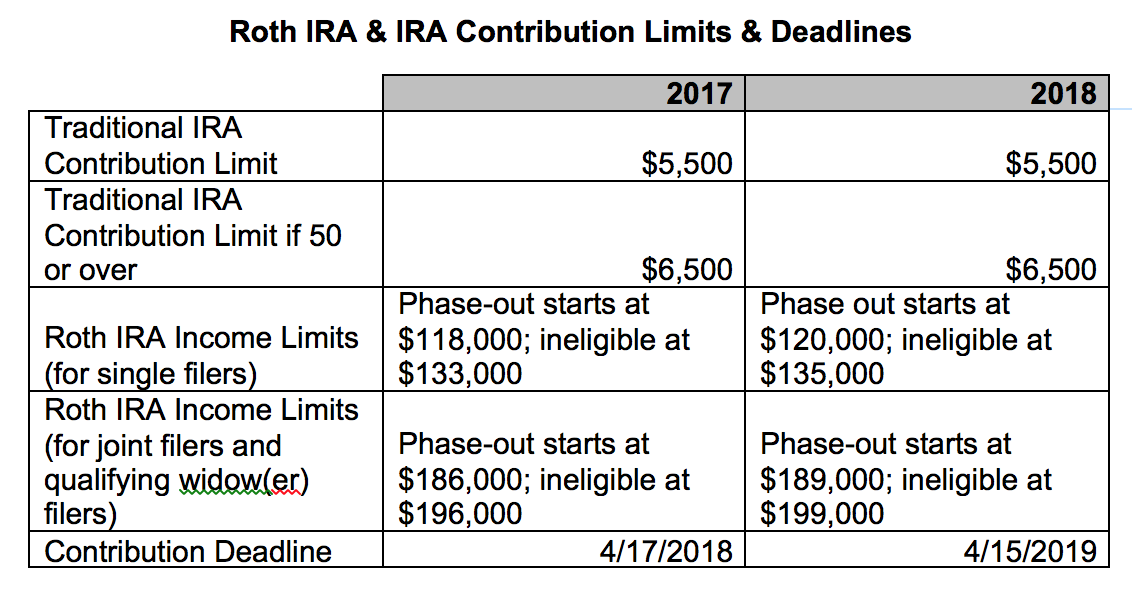

Sep ira deadline for 2019 contributions. For 2018 5 500 or 6 500 if you re age 50 or older by the end of the year. If you haven t made your 2019 contribution yet and are worried that you may need the money for emergencies a roth ira can provide a double benefit. One consideration for the contribution deadline is ira conversions which do not have deadlines or limits.

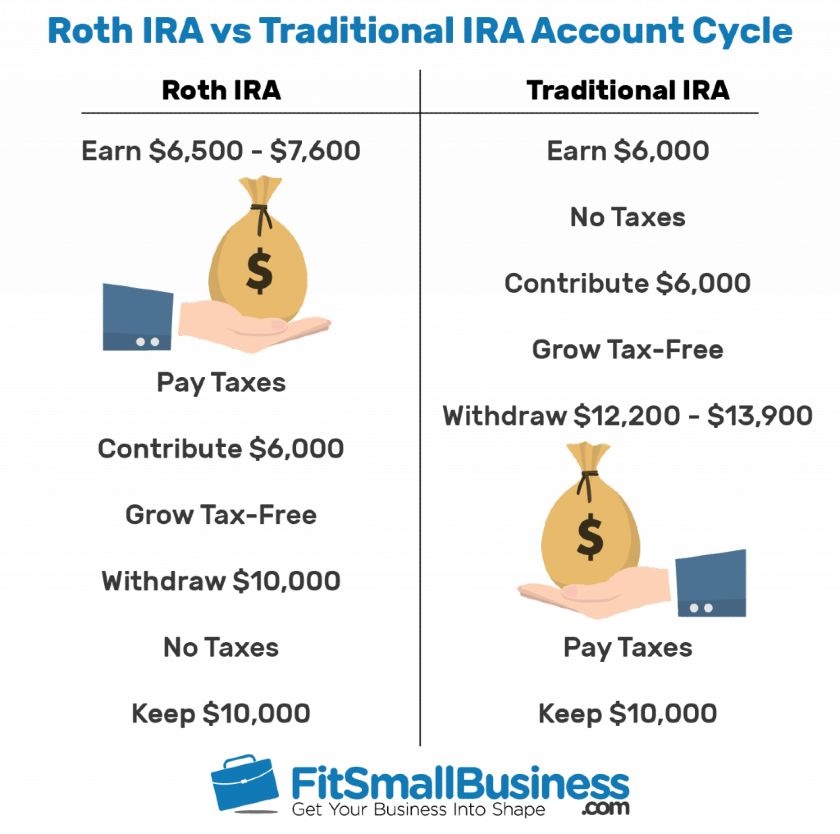

Up to 25 of. The most you can contribute to all of your traditional and roth iras is the smaller of. Because the due date for filing federal income tax returns has been postponed to july 15 the deadline for making contributions to your ira for 2019 is also extended to july 15 2020. Your money grows tax free for retirement but you can withdraw your contributions without penalties or.

Normally the deadline to make regular traditional and roth ira contributions is by the ira owner s federal tax return due date april 15. En español when the irs extended the 2019 tax filing deadline to july 15 2020 it also extended the deadline for contributing to an ira. For tax year 2019 you could make roth ira contributions through july 15 2020 as a result of the delayed tax filing deadline. Sep ira contribution limit.

How much can i contribute. So contributions to a roth ira for 2021 can be made through the deadline on april 15 2022 for filing income tax returns. As a result of the treasury department and internal revenue service extending the 2019 tax filing deadline for 2019 to july 15 2020 both traditional and roth ira contributions for 2019 may also be made by july 15 2020. Now that treasury secretary steven mnuchin has extended the 2019 tax filing date to july 15 the deadline for making a 2019 contribution to an individual retirement account or roth ira is.

Your contributions aren t deductible. There is a 6 000 aggregate contribution limit for traditional and roth iras. You can deduct your contributions if you qualify. Are my contributions deductible.