Explain Liability Car Insurance

In some circumstances it may even cover lost wages and or legal fees if the injured party files a lawsuit.

Explain liability car insurance. Even the best driver can cause an accident and even the most careful person can be unlucky. Here we ll take a look at car insurance liability coverage. The following table lists commonly recommended limits and deductibles for various coverage involved in. Uninsured and underinsured motorists liability coverage.

If you re in an accident with another driver who doesn t carry any or enough liability coverage uninsured or underinsured motorists liability coverage allows you to collect damages that you personally experience from the accident. Auto liability coverage limits are typically written out as three numbers like 25 50 25. Examples of liability coverage limits. Requirements for liability car insurance.

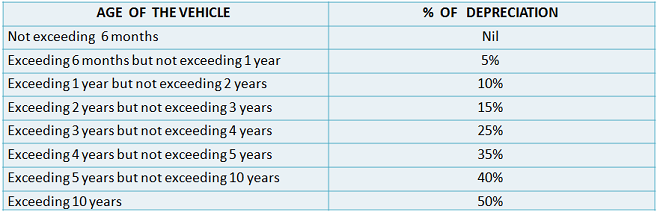

Liability insurance actually consists of two types of auto coverage. Bodily injury liability protection applies to the medical expenses of the other party if you are found at fault in the accident. That means you have a 25 000 limit per person for bodily injury in an accident a 50 000 total limit per accident for bodily injury and a 25 000 limit per accident for property damage. Some auto insurers however are now offering supplemental insurance products at additional cost that extend coverage for vehicle owners providing ride sharing services.

Liability car insurance is designed to protect your finances when you cause an accident. Are required to prove they can afford to pay for their mistakes if someone or something is hurt. By michelle megna posted. Each state sets a minimum for how much liability coverage a motorist must carry.

Liability insurance is different from other types of car insurance coverage in that it covers your liability or fault in an accident as it relates to other parties bodily injury or property damage. Auto liability insurance is a type of car insurance coverage that s required by law in most states. Auto liability insurance explained. If you cause a car accident in other words if you are liable for the accident liability coverage helps pay for the other person s expenses.

Bodily injury each person bodily injury each accident and property damage. In some ways it s an odd piece of car insurance because your car isn t the thing you re. That s why drivers in the u s.

/auto-accident-involving-two-cars-on-a-city-street-970958674-a196dc719c4a464a99c5cf128f2b1aa2.jpg)

:max_bytes(150000):strip_icc()/car_insurance-928675064-5bbe7d28c9e77c0058d884e9.jpg)

/car_accident-e79ae57204b34f5589a2967bff98e89a.jpg)

:max_bytes(150000):strip_icc()/SwitchingCarInsurance_GettyImages-1029356602-0e311271353c47a99e61036d78e0fdff.jpg)