Home Equity Loan Repayment Period

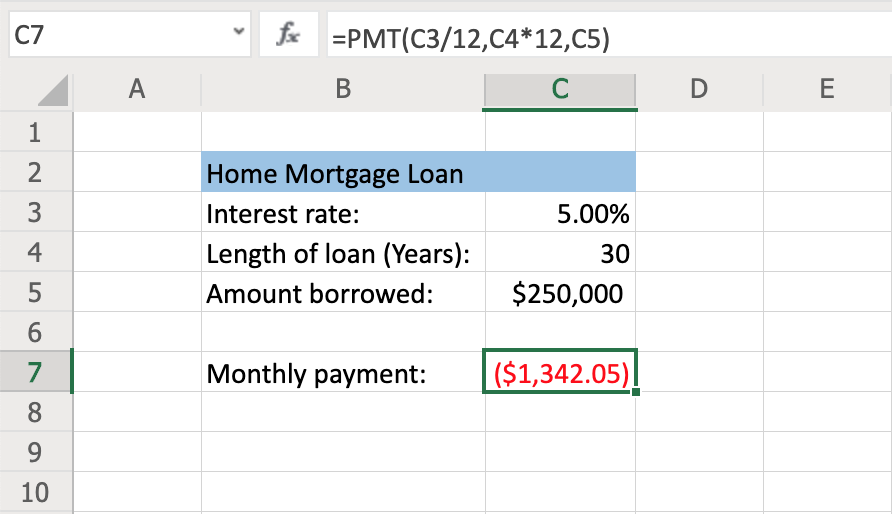

You can also use the calculator to see payments for a fixed rate home equity loan.

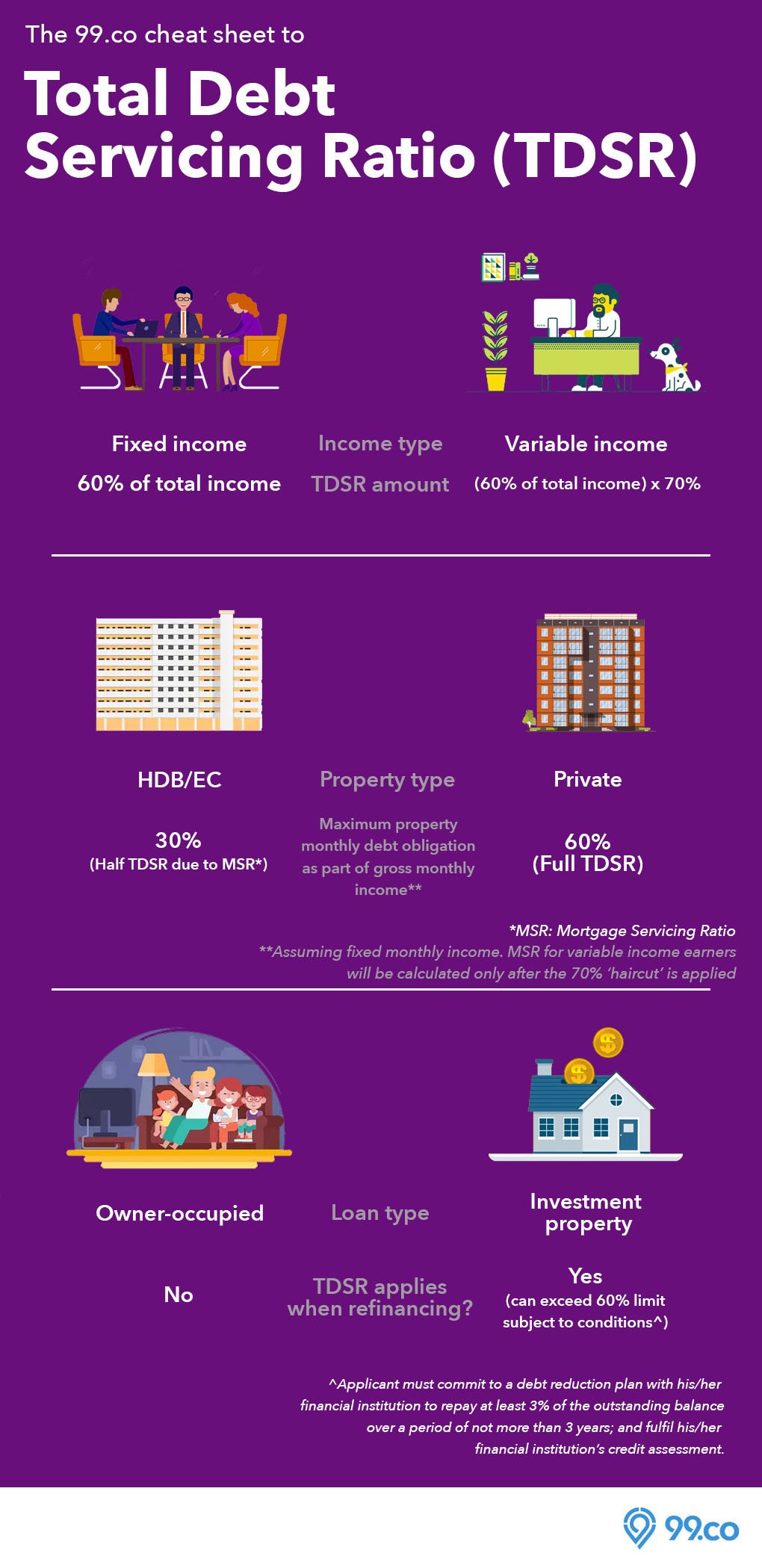

Home equity loan repayment period. Most home equity lenders allow you to borrow a certain percentage of your home equity typically up to 85 percent. Instead you re approved to borrow up to a certain amount of money which you can draw from over time. Heloc lender draw period repayment and interest rate rules vary by the lender. The heloc draw period and the heloc repayment period.

The same amount and interest rate with a 30 year repayment schedule will cost only 268 each month but you will pay 96 480 against the loan when you complete payments. If you have a home equity line of credit you probably know that your heloc includes two main phases. Multiply the result by the balance of your heloc to figure your monthly payments for the repayment period. It shows payments for a heloc with a principal and interest draw period or an interest only draw period.

Here is a table listing current home equity offers in your area which you can use to compare against other loan options. Use our free heloc payment calculator to easily find your monthly payments on any home equity line. Borrow 25 000 for as low as 96 per month. Rising home equity after the great recession many united states homeowners were in negative equity with 26 of mortgaged properties having negative equity in the third quarter of 2009.

Finishing the example if you owe 150 000 multiply 150 000 by 0 010951996 to find your. This relatively short repayment period can result in a large increase in payment after the end of the draw period. A home equity loan is an installment loan based on the equity of the borrower s home. Get your project started with an l n home equity loan.

A home equity line of credit on the other hand doesn t involve borrowing a set amount. For example if you are taking out a 50 000 home equity loan at 4 99 interest a 10 year repayment term will cost you 530 each month for total payments of 63 600 for the life of the loan. Combined these two periods typically. With easy access to funds and flexible draw and repayment options the equity in your home can be used as a valuable savings and financial tool.

:max_bytes(150000):strip_icc()/home-equity-loans-315556_final3-23fa1237c577475f811fe9fc06eedec2.png)

/dotdash_Final_Home_Equity_Loan_vs_HELOC_What_the_Difference_Apr_2020-01-af4e07d43f454096b1fbad8cfe448115.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2019-01-15at3.35.40PM-5c3e475ec9e77c00019b7191.png)

:max_bytes(150000):strip_icc()/how-a-line-of-credit-works-315642-FINAL-b923e17560394229b556ae9adec6f507.png)

/dotdash_Final_Home_Equity_Loan_vs_HELOC_What_the_Difference_Apr_2020-01-af4e07d43f454096b1fbad8cfe448115.jpg)

/ScreenShot2019-01-15at3.35.40PM-5c3e475ec9e77c00019b7191.png)