Getting A Pre Approval Letter For Mortgage

In general the paperwork you ll need to assemble for your lender.

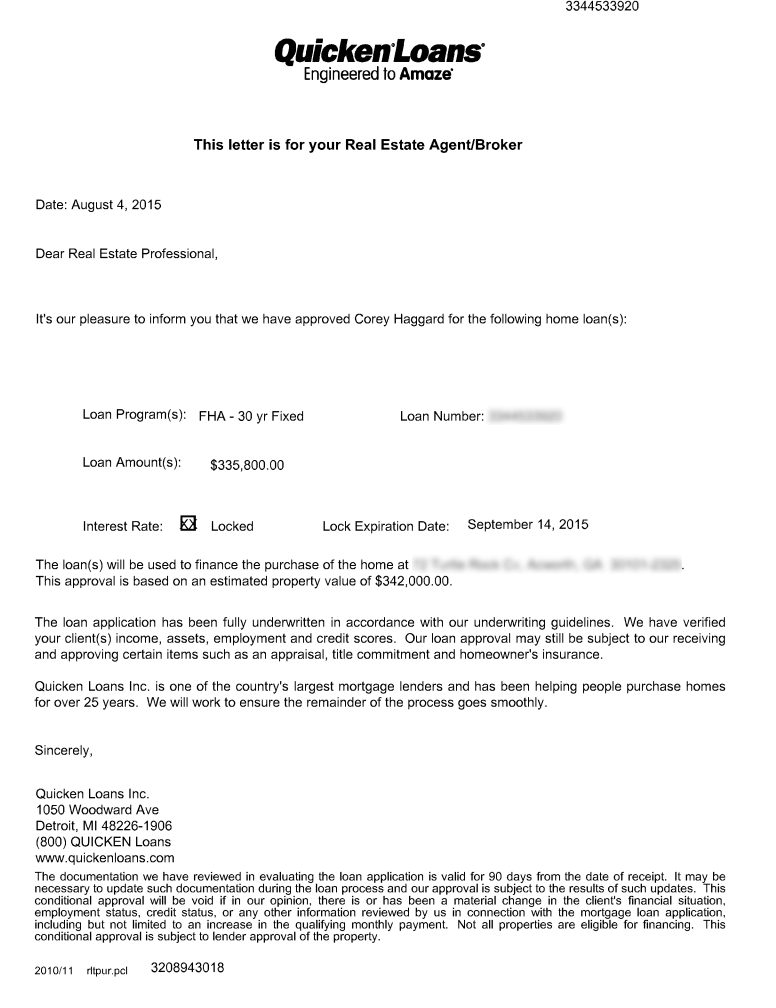

Getting a pre approval letter for mortgage. For an even stronger approval you can contact a home loan expert to get a verified approval. Income documentation you ll be asked to provide your most recent pay check stubs covering a 30 day period as well as your two most recent w2 forms. When the pre approval expires you ll have to update your paper work to get a new one. If you have to wait for an income audit though it can take a couple of weeks to.

With a pre approval you can. Get your approval letter. Getting preapproved for a mortgage helps you shop for homes. From there we ll give you a prequalified approval letter that you can use to shop for homes.

Know the maximum amount of a mortgage you could qualify for. Pre approval letters are subject to modification or cancellation if your financial situation or other conditions change. Lenders put an expiration date on these letters because your finances and credit profile could change. A mortgage pre approval letter provides the necessary third party verification that what you told your loan officer is documented.

Once you ve chosen your mortgage option you can see if you re approved for it. Depending on the situation and your finances it can take up to a few days to receive your mortgage preapproval. All mortgage pre approval letters have an expiration date. Estimate your mortgage payments.

To get pre approved for a mortgage you ll need five things proof of assets and income good credit employment verification and other types of documentation your lender may require. The preapproval letter is issued after the lender has evaluated your financial history including pulling your credit report and score. When to get a preapproval mortgage preapproval letters are typically valid for 60 to 90 days. The paperwork you need be prepared to submit some paperwork to earn your pre approval.

Many things can change after you get pre approved such as your income credit history or even the interest rate. Because of this your pre approval normally lasts for 60 to 90 days. A pre approval is when a potential mortgage lender looks at your finances to find out the maximum amount they will lend you and what interest rate they will charge you.

/PreQualification.folger-5c19152c46e0fb0001719e6b.jpg)

/PREAPPROVEDMORTGAGEJPEG-e4fb5ba8d0164c7699b4b376a1492293.jpg)