Homeowners Insurance Covers All Except

That would include repairing or rebuilding your home or replacing your possessions if they were damaged by the event.

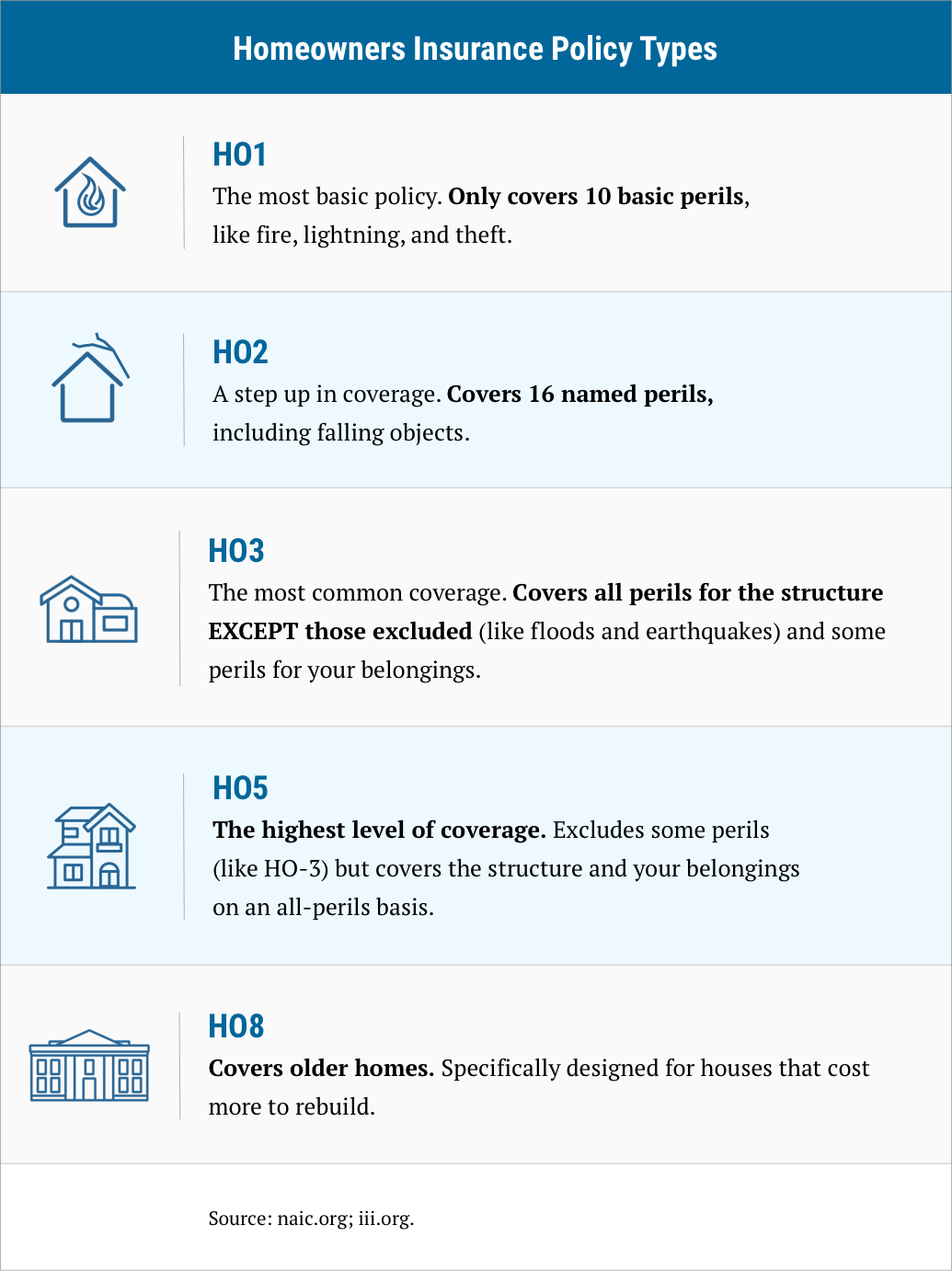

Homeowners insurance covers all except. The standard homeowners insurance policy also known as an ho 3 covers your home for multiple perils but there are some important exclusions. Knowing what s covered and what isn t can save you a lot of money and heartache down the line. Earthquake and water damage. Article table of contents skip to section.

In a named peril policy insurance covers perils specifically stated in the policy. Homeowners insurance covers all of the following except is a tool to reduce your risks. Knowing what s covered and what isn t can save you a lot of money and heartache down the line. Medical costs for a visitor who slipped on your steps and broke his ankle.

A fire that damages your neighbor s roof that was caused by a spark from your grill. Theft of a diamond necklace valued at 25 000. Earthquake and water damage. Dwelling protection may also help cover other structures that are attached to the home such as a garage or a deck against certain risks.

Medical costs for a visitor who slipped on your steps and broke. Your actual physical dwelling should be covered as well as some other structures on the property like a garage fence. And if the accident insurance event occurs the insurance company will bear all or all of the costs in full or in part. The house s foundation walls and roof.

A diamond necklace valued at 25 000 c. An open peril or all risk policy insurance covers all perils except those specifically excluded in the policy. Homeowners insurance covers all except. One of the basic coverages of a homeowners insurance policy is dwelling protection which helps cover the structure of the home in which you live e g.

A three year old television d. The standard homeowners insurance policy also known as an ho 3 covers your home for multiple perils but there are some important exclusions. Homeowners insurance typically covers a broad range of possible damages. Depending on the chosen program you can partially or completely protect yourself from unforeseen expenses.

Flood damage is not covered by homeowner s insurance and requires a separate flood insurance policy. Damage from an aircraft car or vehicle it may not be often that a plane or car crashes into a home but when it happens the images can be pretty dramatic. A fire that damages your neighbor s roof that was caused by a park from your grill e. Homeowners insurance typically covers damage that results from such acts.

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)

/GettyImages-509535654-1c6ccb13add848e184b26487a6012a66.jpg)

:max_bytes(150000):strip_icc()/insurance-endorsement-or-rider-2645729-FINAL-5bdb553b46e0fb00518eef20.png)

/insurance-life-protect-help-secure-care-1576403-pxhere.com-5c8a23f1c1334141a8d06c62c25bac5f-27a50b1c409e4895974bced9f7a506af.jpg)

/insurance-bc8e3bc369964adea475b886c7a93055.jpg)