Etrade Transfer Out Fee

Sub account to sub account transfer fee.

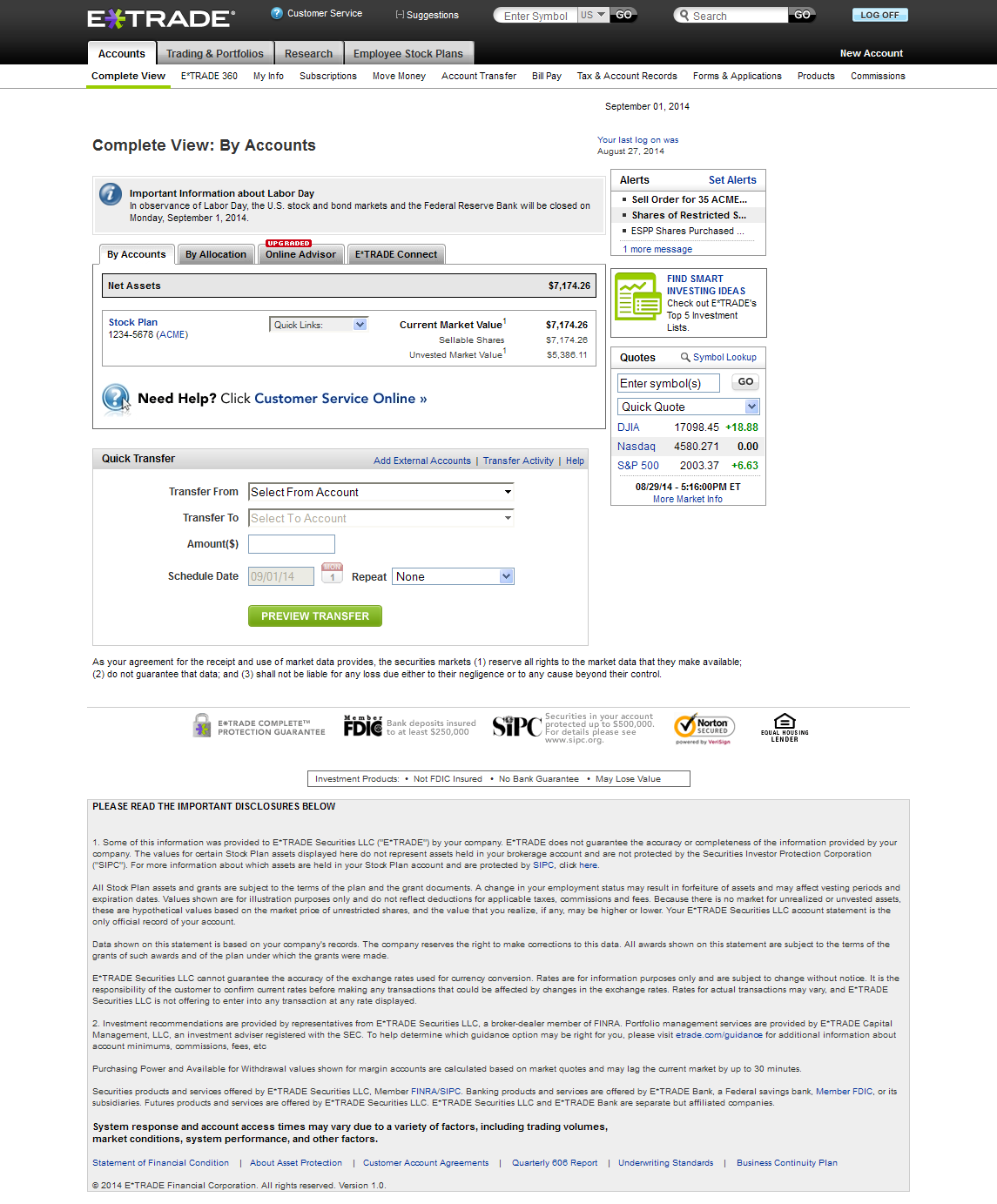

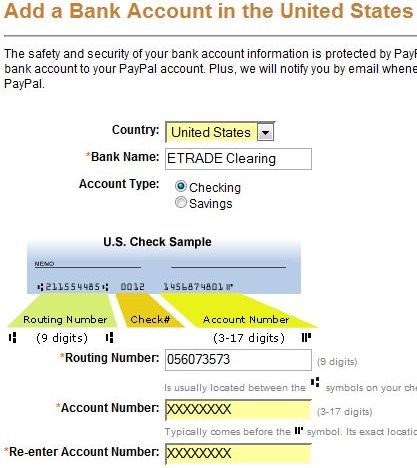

Etrade transfer out fee. Account transfer fee is charged when an account transfer from one brokerage firm to another is initiated by an investor. E trade will waive this fee if at least 5 000 is still in your account after the partial transfer. Understanding brokerage transfer fees. Complete and print out our e trade bank wire transfer form.

The acat fee can be as high as 125. Or if you qualify for our young investor offer. Us 30 per counter. This etrade transfer fee applies also to all ira accounts.

The receiving institution information. You re paying out the nose in fees or commissions. S 30 per counter subjected to gst. Etrade transfer fee acat fee etrade acat fee is 75 for a full account transfer and 25 for a partial account transfer stock positions mutual funds etf s.

25 quarter waived if you hold 25 000. Otherwise you can initiate a full transfer and we ll close your account once the process is complete. Send the completed form to your other financial institution and ask them to wire funds to e trade bank. Recommended articles top 10 brokerage firms etrade annual fee etrade top competitors e trade money transfer by check the final option is to call e trade and request a check to be mailed to you for the cash balance in your account.

Hk 200 per counter. If you want to keep your robinhood account you can initiate a partial transfer. E trade bank c o e trade financial corporation po box 484 jersey city nj 07303 0484. If you establish a recurring electronic funds contribution of 100 a month or more.

100 setup 50 year after first year. Formal trust accounts. Note that there is a 75 fee to transfer your assets out of robinhood whether as a partial or full transfer. The most expensive online discount brokers charge no more than 6 95 for a stock trade but many old school brick and mortar financial firms are.

Shares transfer out fees. If you make a minimum number of commissionable trades. Both full and partial account transfer can incur fees. 100 within first year only.

To cdp s 10 00 per counter subjected to gst. The fees charged by e trade related to a transaction for the account of customer are designed to offset third party fees generally charged to e trade in respect of such transactions including without limitation any regulatory or transaction fee or tax market center fee clearing house fee or depository fee assessed by any regulatory authority self regulatory organization market center.

/ETRADEvs.Fidelity-5c61bd62c9e77c0001d930b0.png)