Do I Need To Get Preapproved For A Mortgage

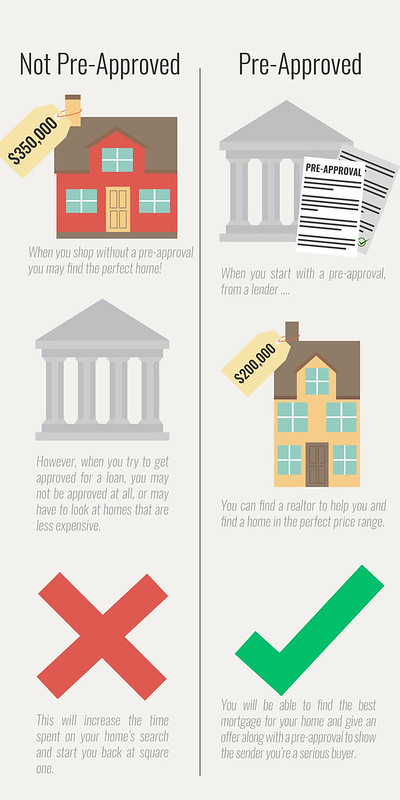

First time homebuyers however are often intimidated by the amount of work that it can take to get approved and end up shuffling this important step to the end of their to do list.

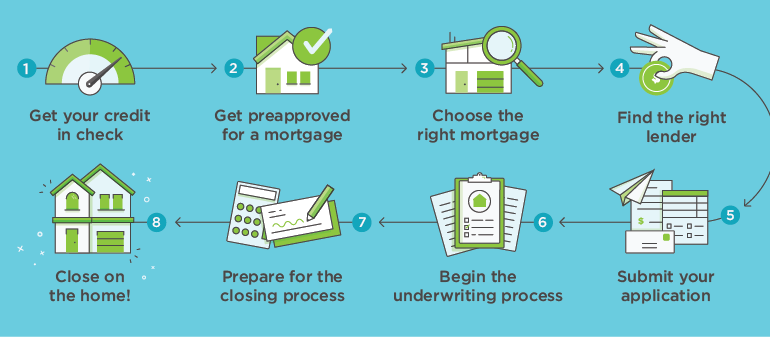

Do i need to get preapproved for a mortgage. Not everyone will get pre approved for a mortgage but there are a few things you can do to get better prepared for the financial responsibility of homeownership. A pre approval usually specifies a term interest rate and mortgage amount. Getting pre approved for a mortgage is truly the first step that you should take if you re serious about buying a home. Pre approval letters will provide various details for the specific amount of money needed for conventional loan programs.

A pre approval is typically valid for a brief period of time and usually has a number of conditions that must be met. To get pre approved for a mortgage you ll need five things proof of assets and income good credit employment verification and other types of documentation your lender may require. With a pre approval you can. Given the fact that studies show 40 of mortgage shoppers consider the home.

Know the maximum amount of a mortgage you could qualify for. A preapproval tells buyers that you can get financed for the amount you ve offered. There are reasons both buyers and sellers may need to get to closing fast. Estimate your mortgage payments.

It gives you time to sort out issues. How to get preapproved for a mortgage first of all understand that because of the large amount of money involved in a real estate transaction you ll need documentation proving your income and. If you want to take the stress out of getting a home mortgage getting pre approved for a mortgage is the way to go. Work to improve your credit score.

A pre approval is when a potential mortgage lender looks at your finances to find out the maximum amount they will lend you and what interest rate they will charge you. Getting preapproved means you re getting the bulk of the mortgage process done upfront. Some programs may allow the seller to pay up to 6 percent of a buyer s.

:max_bytes(150000):strip_icc()/PREAPPROVEDMORTGAGEJPEG-e4fb5ba8d0164c7699b4b376a1492293.jpg)

.png)

/PreQualification.folger-5c19152c46e0fb0001719e6b.jpg)