Fafsa Bank Account

I am a dependent and using my fathers tax information.

Fafsa bank account. One of the things the fafsa requires on question 90 of the application is the total current balance of cash savings and checking accounts that your parents own. Click to share on facebook opens in new window. Depending on your school you may receive your financial aid in the form of a check or direct deposit to your bank account after all other college expenses have been paid. Fafsa doesn t check anything because it s a form.

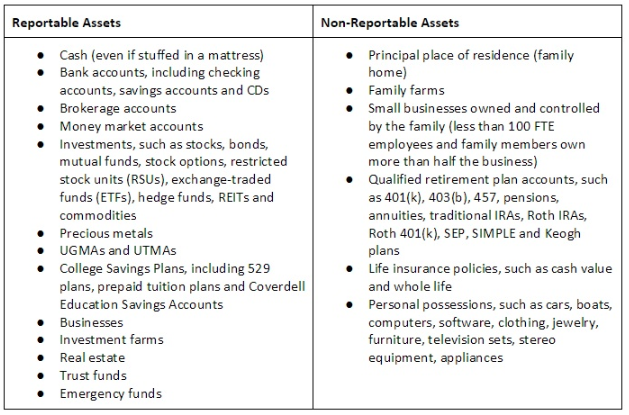

However the form does require you to complete some information about your assets including checking and savings accounts. The fafsa asks for the amount of your assets on the day you file and the amount used in the calculation is based off of this amount not the amount of savings you might have when school starts. Examples of income that may appear on your tax return includes wages from your job or self employment distributions from retirement accounts taxable work study or scholarship money and investment income from savings accounts or stock sales. Whether or not you have a lot of assets can reflect on your ability to pay for college without financial aid.

Fafsa applications use tax return information as a primary source of income information. This doesn t just mean the total in your bank accounts but also any cash or cash assets on hand regardless of whether they re in a bank account in a safe at home or in a safe deposit box earmarked for your inheritance. This means that should you mindlessly blow your savings after filing the fafsa you may still be expected to pay the 20 percent yourself. If i put this down on the fafsa form will i be denied any grants.

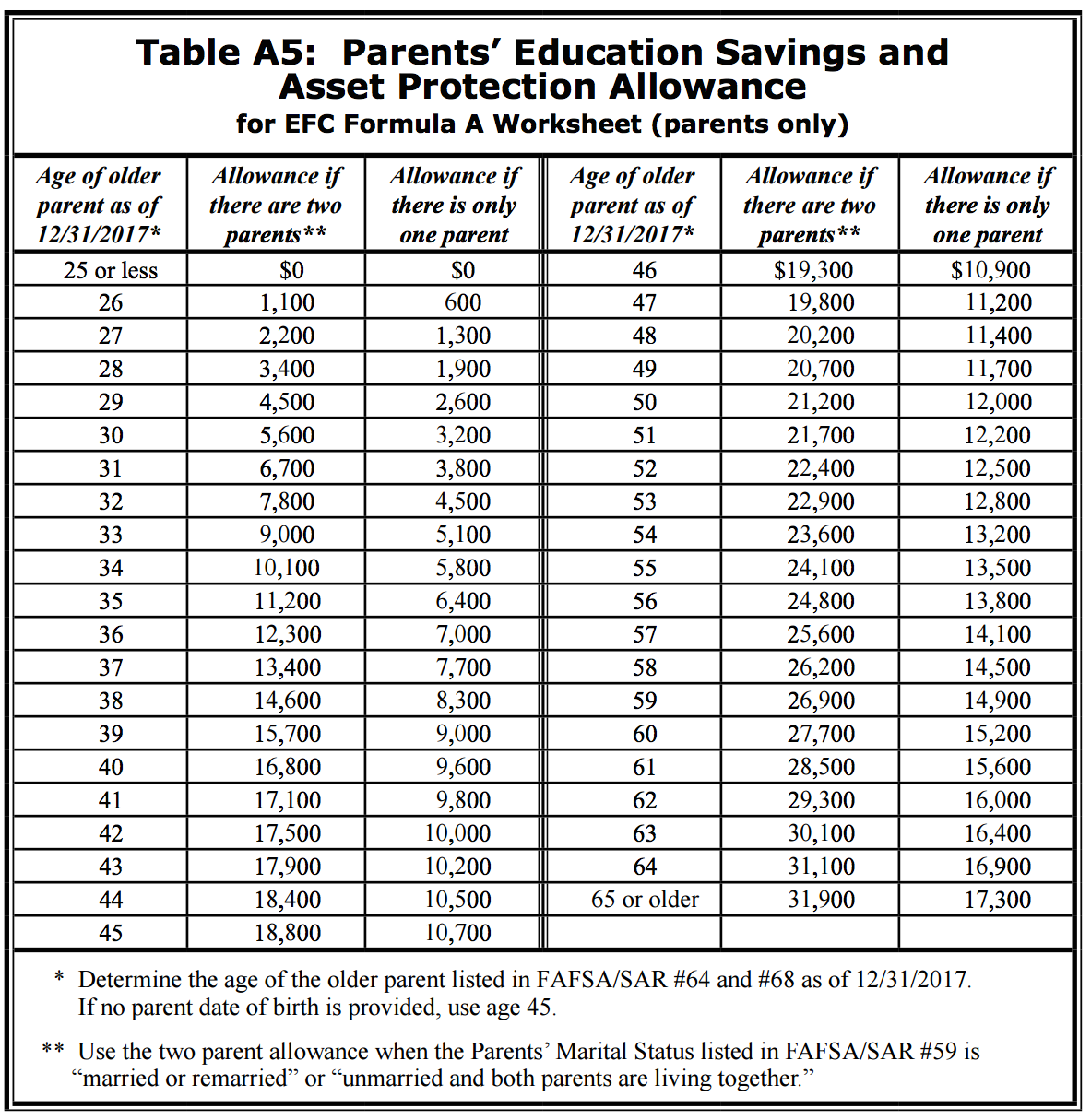

Based upon federal standards retirement accounts such as 401 k s or iras whether they are owned by the parent or the student are not considered when figuring the efc. Bankmobile disbursements provides refund management an industry leading service that processes and disburses financial aid credit balances to students on behalf of college and university administrations and offers an optional checking account for students. Does fafsa check your bank accounts. Financial information for you and or your parents including savings accounts current bank statements investments assets and business details.

The information entered into the fafsa however including money in bank accounts will determine what aid the student is eligible to receive.