How Many Years To Keep Tax Records For Audit

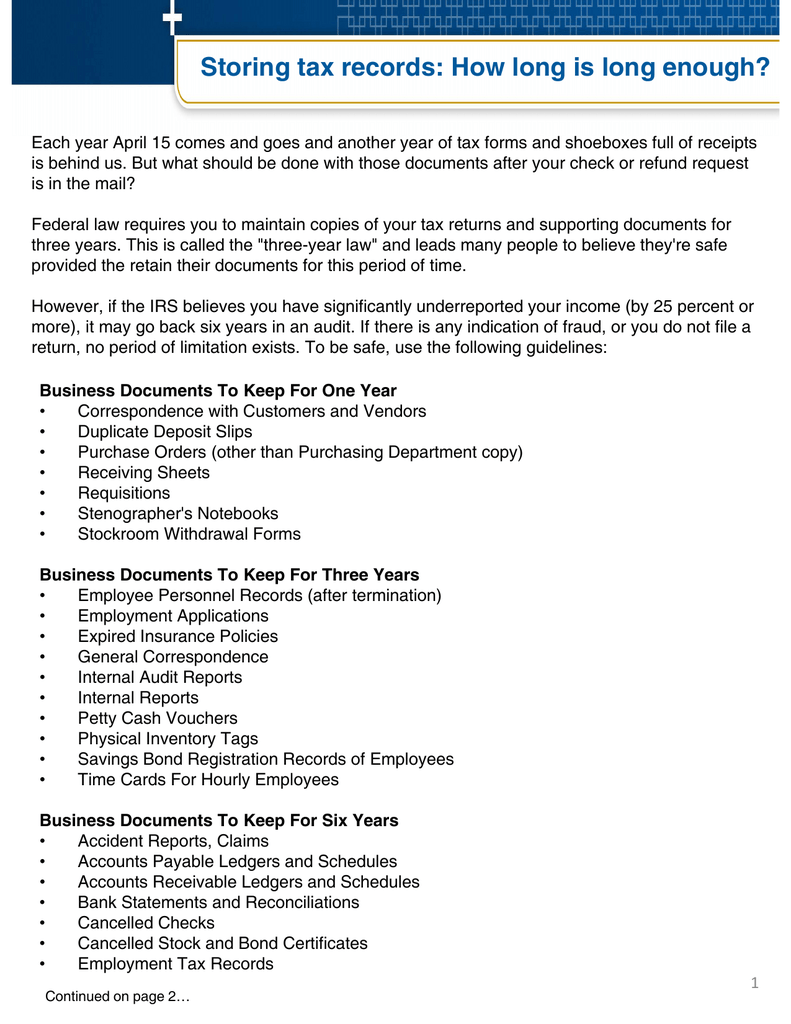

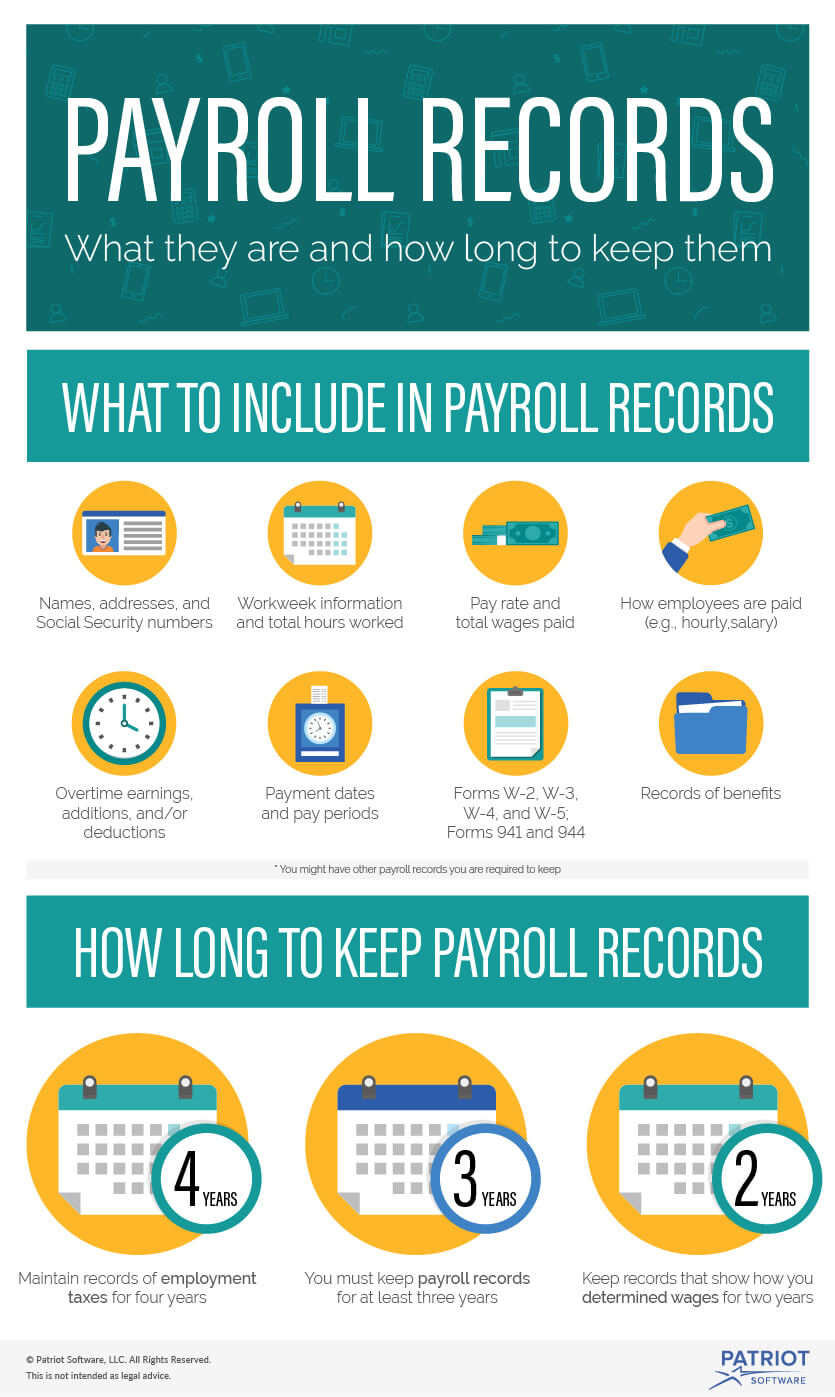

Keep for at least four years after the tax is paid or is due.

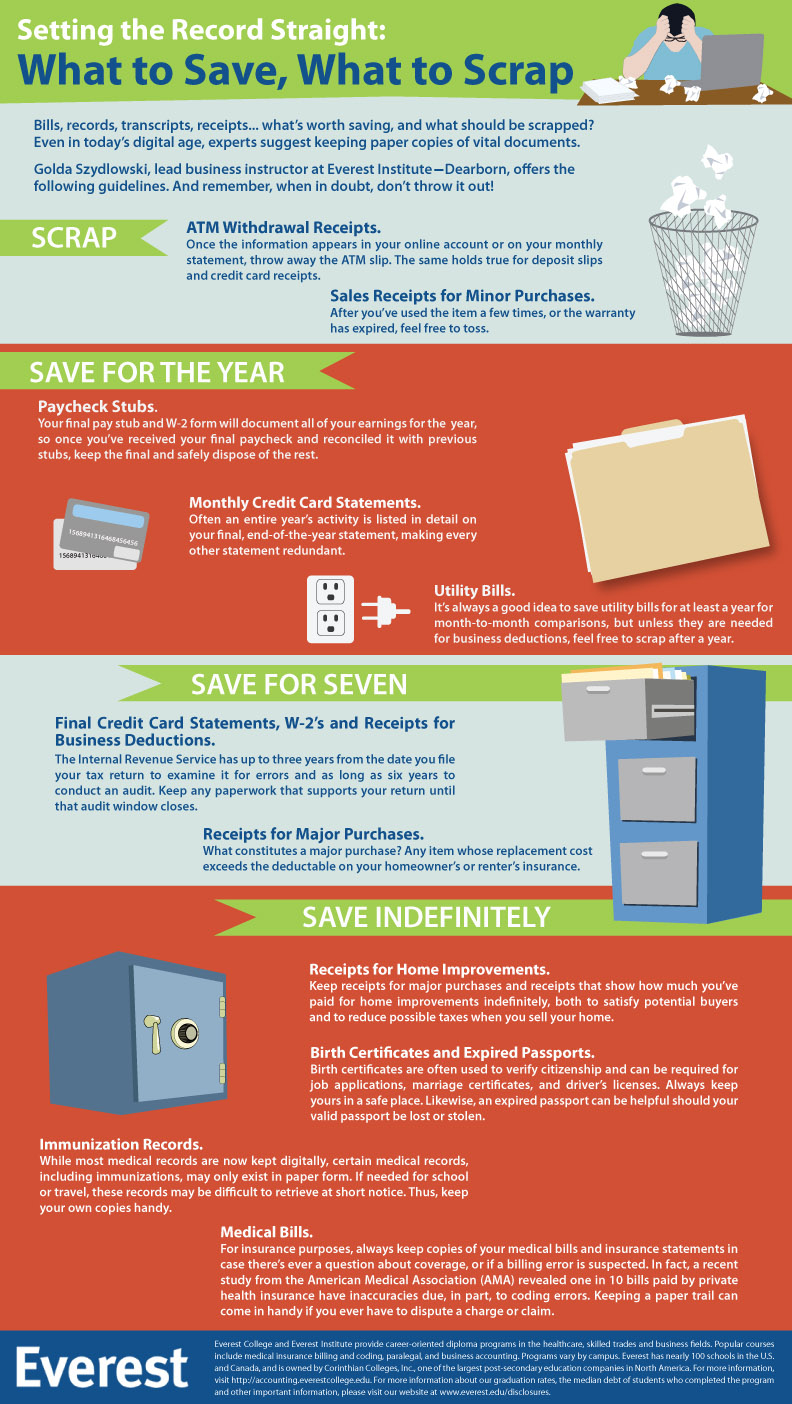

How many years to keep tax records for audit. You need to have the documents they ask for. Keep records for 3 years from the date you filed your original return or 2 years from the date you paid the tax whichever is later if you file a claim for credit or refund after you file your return. 1 oct 2014 to 30 sep 2015. There are some more specific situations.

They could show up at any time. Also keep a copy of your return the related notice of assessment and any notice of reassessment. Generally you must keep your written evidence for five years from the date you lodge your tax return. To keep up to.

Companies with non december financial year end e g. Ps la 2005 2 penalty for failure to keep or retain records. The irs can request six years worth of financial records. Have claimed a deduction for decline in value formerly known as depreciation keep records for the.

According to section 82 of the income tax act 1967 every person that carries on a business in malaysia has the duty to keep proper documentations as well as give receipts. Period of limitations that apply to income tax returns. 1 oct 2018 to 30 sep 2019. How long to keep your records.

The irs usually can audit for three years after you file but there are many exceptions that give the irs six years or longer. For more information see information circular ic78 10r5 books and records retention. The irs has no time limit if you never file a return or file. The irs generally has three years after the due date of your return or the date you file it if later to initiate an audit of your return so you should keep all of your tax records at least.

All businesses in malaysia are required to comply with the record keeping requirements in accordance with malaysian laws and regulations. If however you don t include all your earnings on your 1040 the irs gets a longer window to decide on a potential audit so you need to keep your tax records longer too. For most people this means keeping your tax records for at least three years from the date you file your tax return or the due date of the tax return whichever is later. Keep for three to six years.

/90580763-F-56a938633df78cf772a4e302.jpg)

/man_behind_paperwork-5bfc3707c9e77c00518286bc.jpg)