Endorsing Checks

You don t always have to endorse checks.

Endorsing checks. You endorse a check on the back of the check. We found that the banks that accept checks without an endorsement do so at a limited amount. Most checks give you a space on the back for your endorsement. Do i always have to endorse a check truth be told some banks will accept a check without an endorsement.

Why endorse a check. Understanding how to properly endorse a check will create a smoother and more positive experience when signing over a check to someone else. If you lose the check after you endorse it someone may steal the check and alter the endorsement. Usually the bank will then ask for an identification card to be sure that you are the person on the payee line.

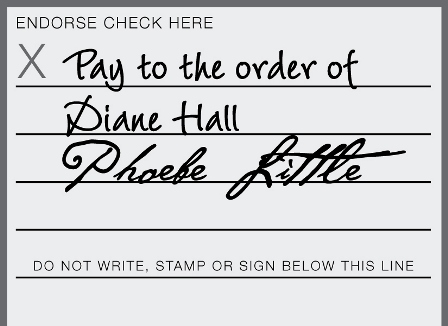

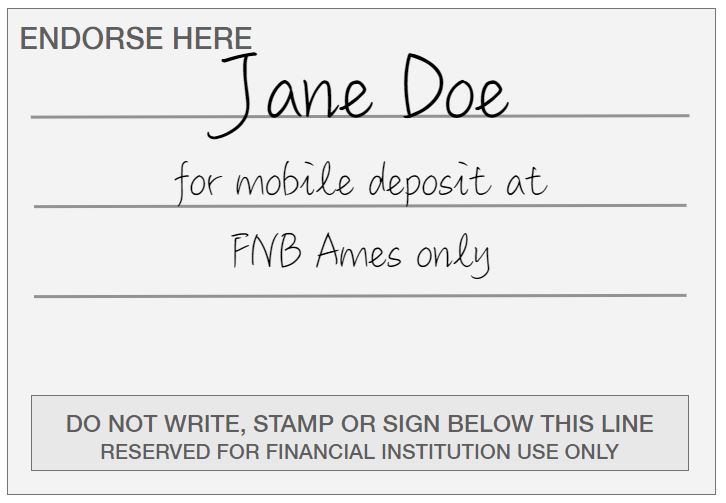

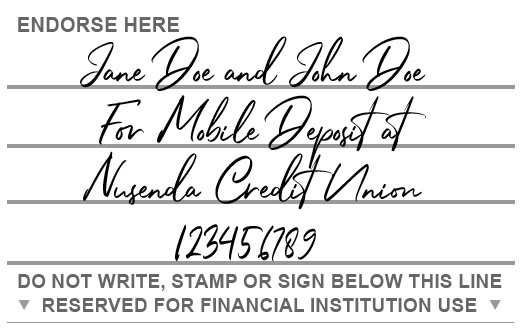

There may be a simple line or a box that reads. Endorse the check at the bank before getting in line or during a mobile deposit. You ll see a few blank lines and an x that indicates. Checkwriters can often view images online of processed checks including the endorsement area after checks are paid.

You typically use this type of endorsement to cash or deposit the check yourself or to give it to someone else to cash or deposit. To endorse a check you simply turn it over and sign your name on the back. To endorse the check go to the endorsement area on the back of the check. This is the short section at the top where it says endorse here using a pen complete the endorsement.

If someone gives you a check you must endorse it before you can cash it or deposit it in your bank account. Every check has an area on the back that reads endorse check here this is where you will sign your name as it appears on the front of the check. To endorse a check means to sign the back of a check to give your bank the right to cash it or deposit into a bank account. Some banks allow you to deposit checks without a signature account number or anything else on the back.

Through your endorsement you give the bank the legal right to process the check. Write the business name which should match the payee on the front of the check. This is the legal way to confirm that the recipient of a check is the rightful owner of the money and it provides documentation of when and where the money was deposited or cashed.

/SeeHowtoEndorseChecks.WhenandHowtoSign-edit-c213a1e53f794813a7e327935ec0e63a.png)

/back-of-a-check-315354-v3-5b8814724cedfd002522df54.png)

/endorse-checks-payable-to-multiple-people-315299-v2-5bbdffc846e0fb0026eccaf4.png)