Does Homeowners Insurance Cover Water Damage From Leaking Pipes

Homeowners insurance protects your home and personal property against destructive weather theft and elemental perils like fire or ice.

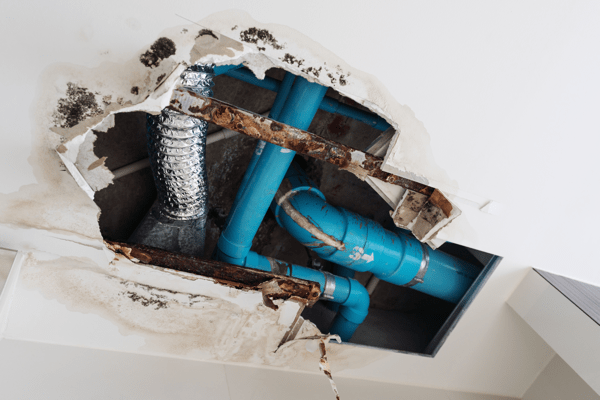

Does homeowners insurance cover water damage from leaking pipes. For example your homeowners insurance will likely not cover water damage that is the result of a faulty sink that has been leaking for several months. Your homeowners insurance policy should cover any sudden and unexpected water damage due to a plumbing malfunction or broken pipe. Water damage that occurs gradually due to a leaky or rusty pipe however is generally. Does homeowners insurance cover pipes that burst.

Most standard homeowners policies help cover water damage if the cause is sudden and accidental but there may be situations that your policy does not cover. From burst pipes to leaking plumbing learn what homeowners insurance may and may not help cover. Even a policy that covers leaks of any kind will significantly limit or exclude any related mold damage. However most home insurance policies exclude damage to your home that occurred gradually such as a slow constant leak as well as damage due to regional flooding.

While this type of policy will not cover floods from the outside many other types of water damage would be covered. For most perils your coverage is fairly easy to understand and doesn t require much reading in between the lines but water damage to your home is a different story. Repair or replacement of the actual source of the water damage. Homeowners insurance generally covers damage due to broken pipes if their collapse is sudden and unforeseen.

If you have state farm homeowners insurance it will protect you from a number of different types of water damage. Does homeowners insurance cover. But if that pipe didn t burst but slowly leaked for several weeks and was hidden from view your policy won t cover you because this is considered a maintenance issue rather than an accidental loss unless you have hidden water coverage.

:max_bytes(150000):strip_icc()/how-to-handle-water-damage-claims-3860314-FINAL-5ba50164c9e77c0082224c9c.png)

/Woman-with-Water-from-leaking-plumbing-580e5ce23df78c2c73718d85.jpeg)