Full Life Insurance Quotes

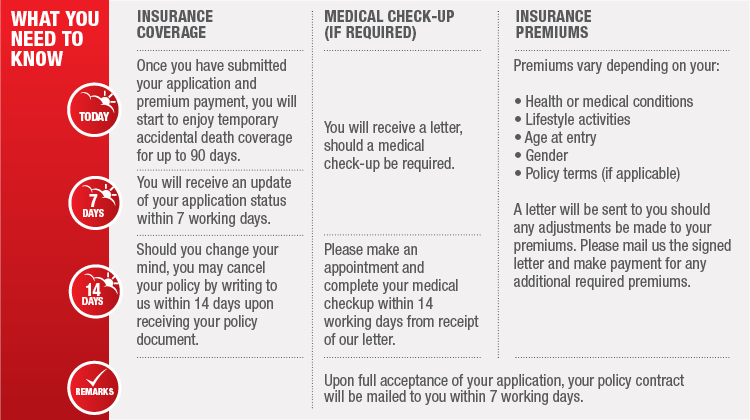

It provides a lump sum payment subject to conditions if the life insured dies or is diagnosed with a terminal illness where death is likely to occur within 24 months 10 the funds can be used for any purpose you choose such as cover mortgage payments school fees bills groceries other living expenses and funeral costs.

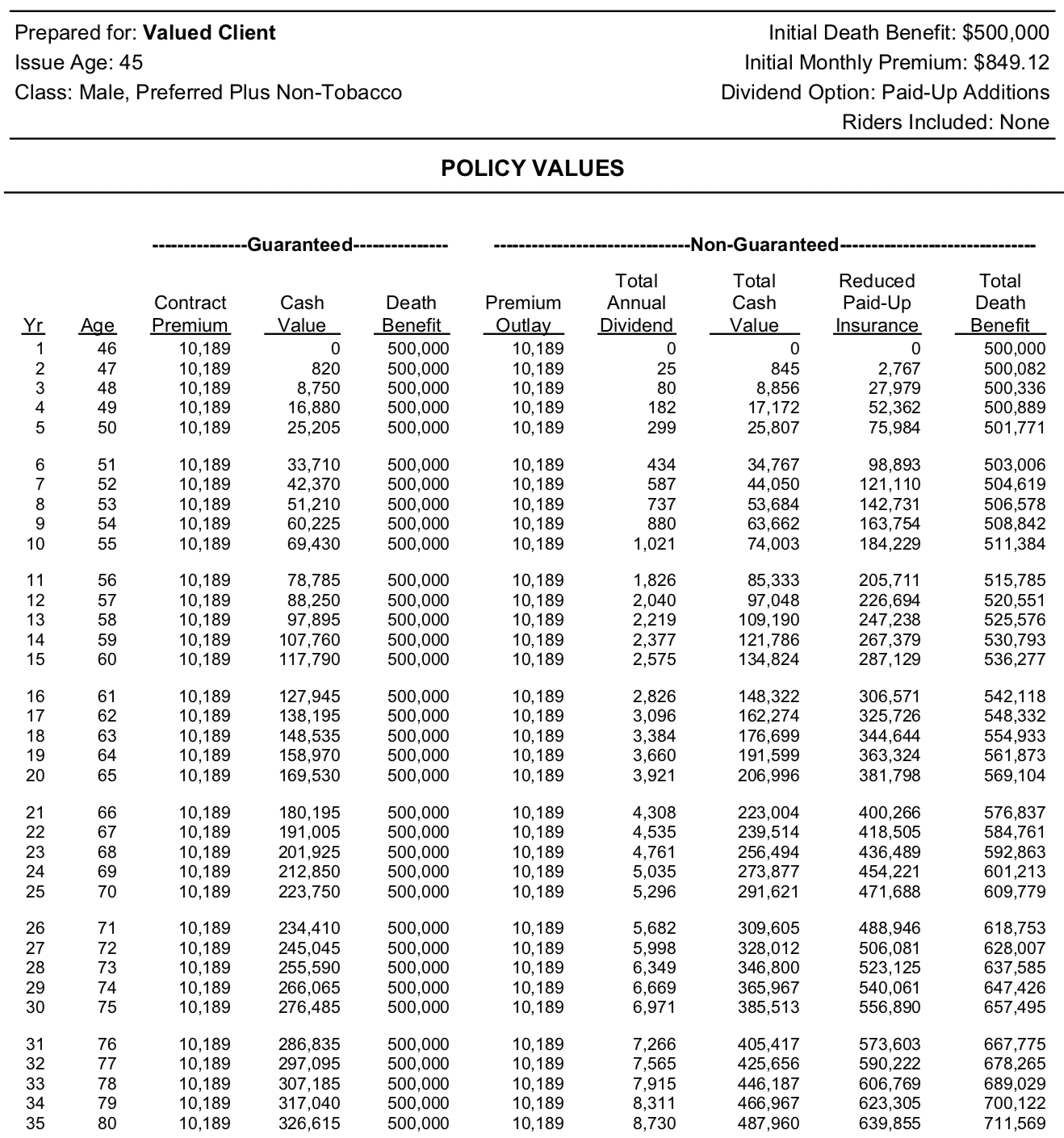

Full life insurance quotes. The amount of cash value available will generally depend on the type of permanent policy purchased the amount of coverage purchased the length of time the policy has been in force and any outstanding. Policy loans accrue interest and unpaid policy loans and interest will reduce the death benefit and cash value of the policy. It s a good idea to get as many whole life insurance quotes as possible to find the cheapest monthly premiums. Once you ve decided how much cover you want you need to do a life insurance comparison to get whole life insurance quotes.

Click on get quotes at the top of this page and fill out the details to get your life insurance. Whole life insurance is a life insurance policy that lasts your entire life even though you only have to pay premiums until a certain age or for a certain number of years. You might be looking for predictability a policy you keep permanently premiums that never change and a guaranteed death benefit 1 maybe you like the idea of a policy that builds cash value you can access 2 to help you with financial obligations. In a 2020 survey conducted by life happens more than half of all respondents overestimated the cost of term life insurance by at least 3x.

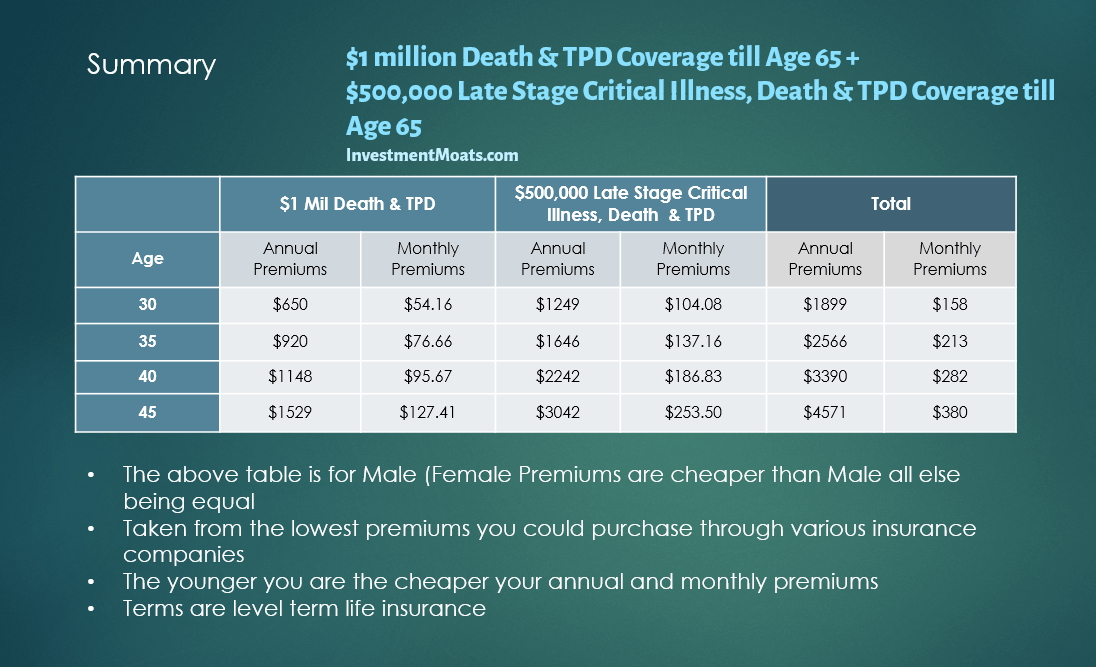

It can be more expensive than a fixed term policy so make sure it s the right policy for you. Whole life insurance is more expensive than term life insurance because in addition to paying premiums for the death benefit policyholders also contribute to the cash value of their policy. Starting at around 30 years old you can expect to pay an average of 100 a month for 100 000 of whole life coverage. Know where to buy whole life insurance and how to find the best policy.

The policy is permanent and its premiums are typically more expensive than term life insurance which is a policy that only lasts until a set expiration date. Disclosure life insurance rate quotes referenced in our materials are based on a composite of participating carriers best published monthly premium rates for 10 year term life policies with face amounts of 250 000 as of 1 10 2020. 1 permanent life insurance develops cash value that can be borrowed. Unless noted otherwise the comparison rates are made for male.

You can compare life insurance quotes online for free to get an estimate of how much you ll pay for your policy. What do you want from your life insurance. Whole life insurance covers you for a lifetime with steady premiums and a guaranteed return on the policy s cash value. Perhaps you want to help protect your family s financial future with higher.