Does It Cost To Get Pre Approved For A Mortgage

If you re looking to get preapproved for a mortgage rocket mortgage can help.

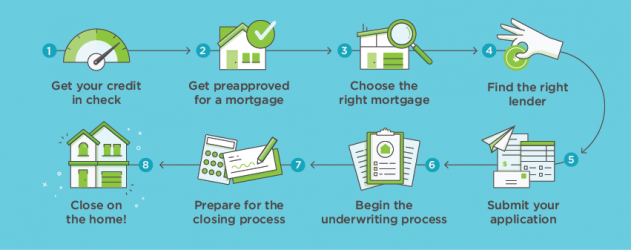

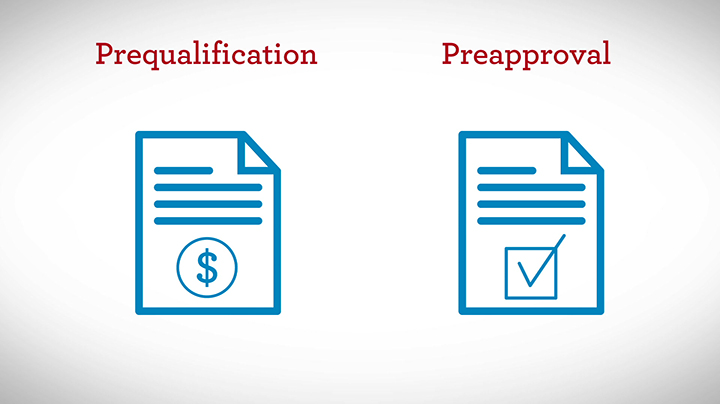

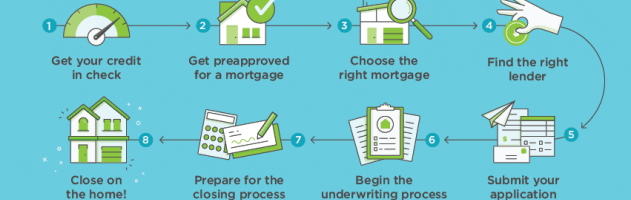

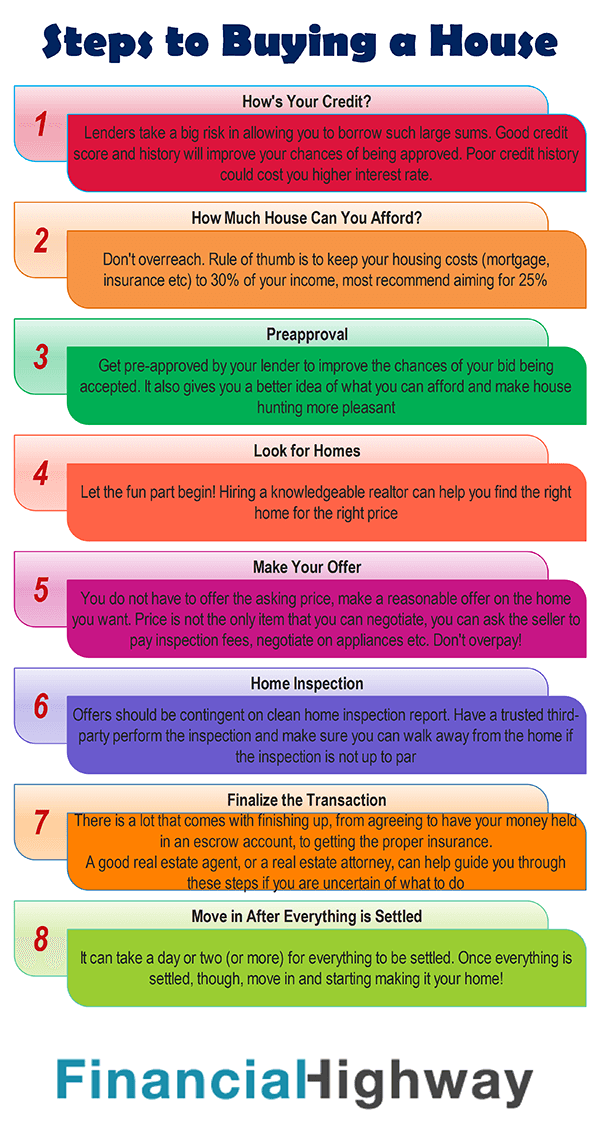

Does it cost to get pre approved for a mortgage. To get pre approved for a mortgage you ll need five things proof of assets and income good credit employment verification and other types of documentation. All mortgage pre approval letters have an expiration date. It s also important to note that if you re getting a conventional mortgage you usually need a credit score of at least 620 to qualify for a mortgage. Our prequalified approval is the fastest way to get approved with rocket mortgage simply apply online and allow us to check your credit.

Click to check your home buying eligibility. Rocket mortgage offers a couple of different approval options. The pre approval amount is the maximum you may get. You won t be required to provide any documents but you should come prepared with information about.

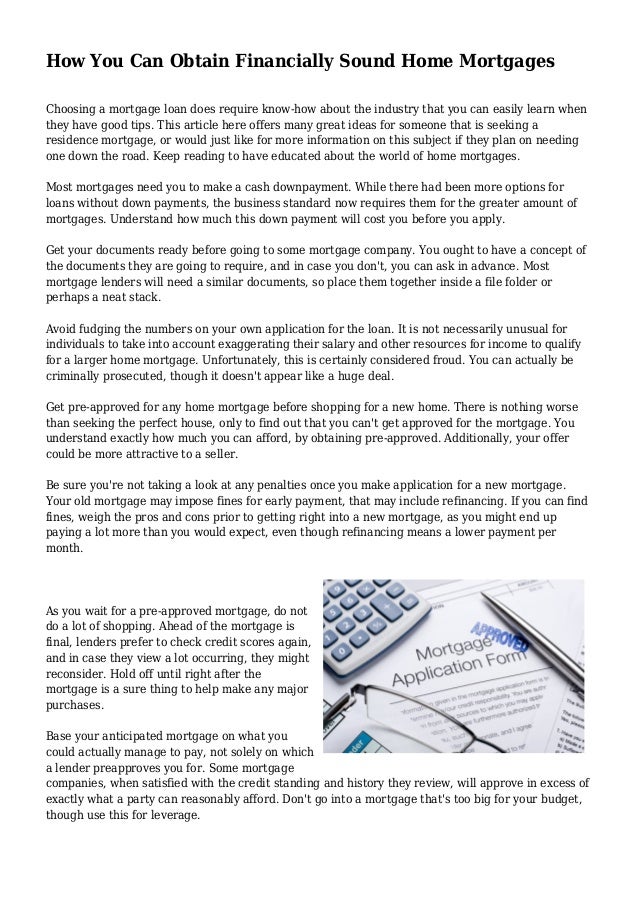

Does it cost anything to get a pre approval letter. In general a debt to income ratio of 36 percent or less is preferable. Lock in an interest rate for 60 to 120 days depending on the lender. Does the pre approval expire.

With a pre approval you can. It lets a mortgage lender know you meet the minimum. Sometimes lenders can help you with getting you on the right track credit wise to get the best interest rate and loan. It does not guarantee that you ll get a mortgage loan for that amount.

Decrease your overall debt and improve your debt to income ratio. Even if you are deemed to have bad credit there are ways to still get pre approved for a mortgage. Armed with a pre approval a home buyer can confidently approach a real estate agent or a home seller as a qualified prospect. A pre qualification is much more informal than a pre approval.

Estimate your mortgage payments. Mortgage lenders generally provide a no cost. The only thing a lender can collect for is the cost of pulling your credit report which is usually 50 or less bogan explains. A mortgage pre approval is not the same as being pre qualified for a mortgage.

Know the maximum amount of a mortgage you could qualify for. 43 percent is the maximum ratio allowed. Nor does getting a preapproval guarantee that a lender will approve you for a mortgage especially if your financial employment and income status change during the time between preapproval and.

/PREAPPROVEDMORTGAGEJPEG-e4fb5ba8d0164c7699b4b376a1492293.jpg)

/PreQualification.folger-5c19152c46e0fb0001719e6b.jpg)