Does Credit Monitoring Hurt Your Score

And by regularly checking your credit scores and monitoring your credit history you re actively maintaining your financial health and ensuring that your credit rating remains in good standing.

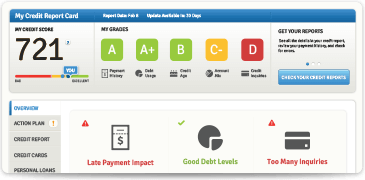

Does credit monitoring hurt your score. And to many people it is unclear if credit monitoring will hurt your score in any way. If you do choose to pay or settle your collections it is a good idea to see how it impacts your credit scores. Checking your credit score with creditwise is completely free and won t hurt your score. But nothing is an exact science and you can t rely solely on their scores to determine how likely you are to get approved for a loan.

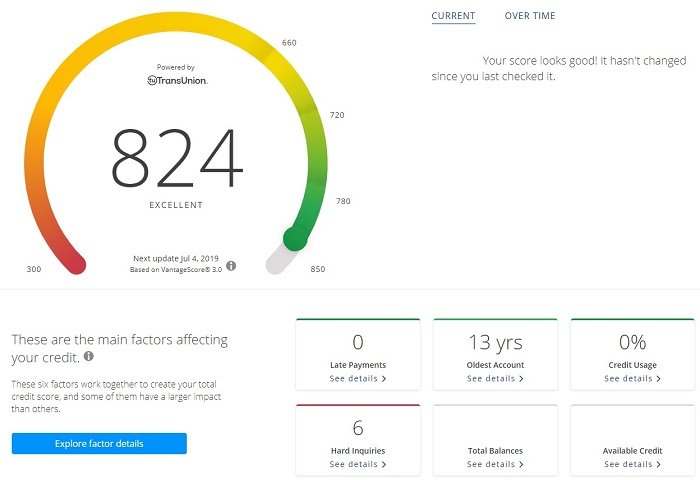

After bankruptcy your credit score can plummet. The short answer is no. But according to top scoring model fico filing for bankruptcy can send a good credit score of 700 or above plummeting by at least 200 points. Here s what you need to know about soft and hard inquiries and why checking your credit score regularly is a good idea.

Ask for your credit score. Those occur after you have applied for a loan or a credit card and the potential lender reviews your credit history. Don t worry soft inquiries do not hurt your credit score. Bankruptcy will have a devastating impact on your credit health.

Checking your own credit score is considered a soft inquiry and won t affect your credit. Continuous monitoring of your credit score will allow you to notice any errors immediately and dispute them in a timely manner. But at the same time you wouldn t want to do anything to hurt your credit score. There are other types of soft inquiries that also don t affect your credit score and several types of hard inquiries that might.

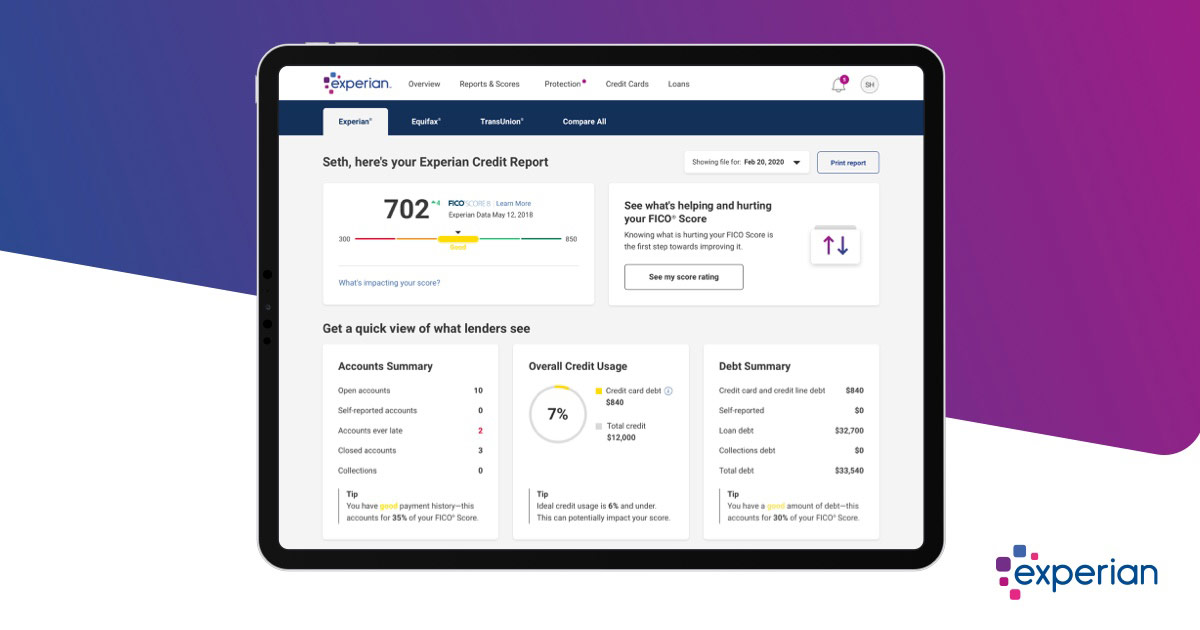

Credit monitoring does not hurt your credit score. The exact effects will vary. If so you may want to use a credit monitoring service to keep track of changes to your credit report and credit score. So carefully consider your credit rating before you file for bankruptcy.

If consumers access their own credit reports it does not have any effect on their credit scores. It won t hurt and can only help. Checking your credit scores and reports doesn t affect your credit. Learn about managing your credit and receive updates when your transunion or experian score changes.

Reviewing a credit report results in what is called a soft pull or soft inquiry meaning it will only be seen on a personal credit report. This means despite it being a good idea to pay or settle your collections a higher credit score may not be the result. For people looking for a free reliable way to monitor their credit scores credit karma provides real time updates and personalized advice to help you raise your score.