Estimate Mortgage Loan Approval Amount

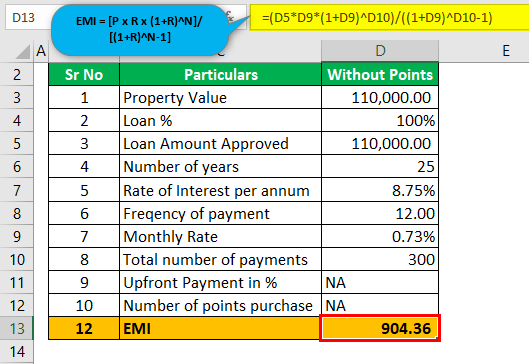

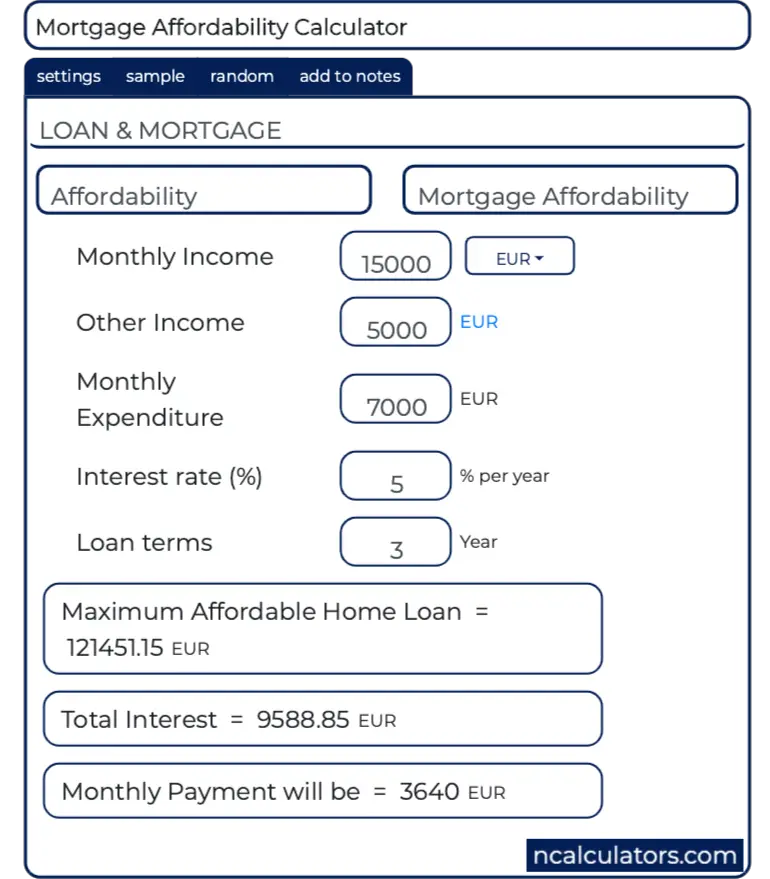

To estimate mortgage affordability.

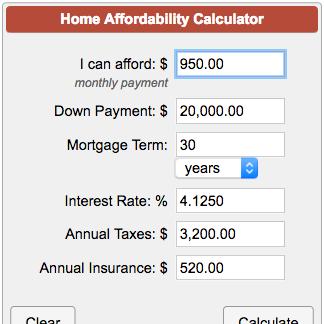

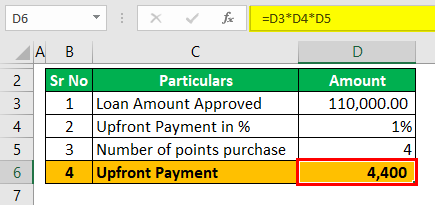

Estimate mortgage loan approval amount. A higher loan amount will mean a higher monthly mortgage payment. If you have queries on home loans and interest rates call a mortgage specialist at. Any application is subject to credit approval. The down payment amount is expressed in the loan to value ratio and the higher the ltv the bigger the risk you are.

You selected an adjustable rate mortgage or arm. The guide is available on the websites of abs and the monetary authority of singapore in the four official languages. The first step in researching how to qualify for a home loan or any loan is to take a long hard look at your finances. How to estimate affordability.

Look for estimate mortgage approval amount canfin homes loan account login 5 point credit union home loans 30y mortgage rate chart 5 3 bank home loan 30 home loan 2nd. The association of banks in singapore abs has published a consumer guide on home loans. This assumes that your total costs for your loan payments principal and interest taxes and insurance should not be higher than 45. Figuring out how to qualify for a home loan auto loan etc.

You are encouraged to read the guide before committing to any home loan. How to estimate mortgage pre approval amount by craig berman in a preapproval a lender. This computation is not an offer or approval of any loan by the bank. The maximum loan amount is the most the lender is willing to loan you not what makes sense for your budget.

When a lender preapproves your mortgage it means she s reviewed your financial information and is willing to approve a mortgage up to a certain amount even. Based on the amount of your mortgage loan debt payments and other expenses this is the amount you have left over each month. If you re prepared to pay 20 000 down on a 100 000 home.

:max_bytes(150000):strip_icc()/PREAPPROVEDMORTGAGEJPEG-e4fb5ba8d0164c7699b4b376a1492293.jpg)

:max_bytes(150000):strip_icc()/annual-percentage-rate-apr-315533_byexcel_FINAL-4e3f58ac2743412cbcb0b3aadf2107f2.png)