Employer Disability Insurance

If you can t work because you get sick or injured disability insurance will pay part of your income.

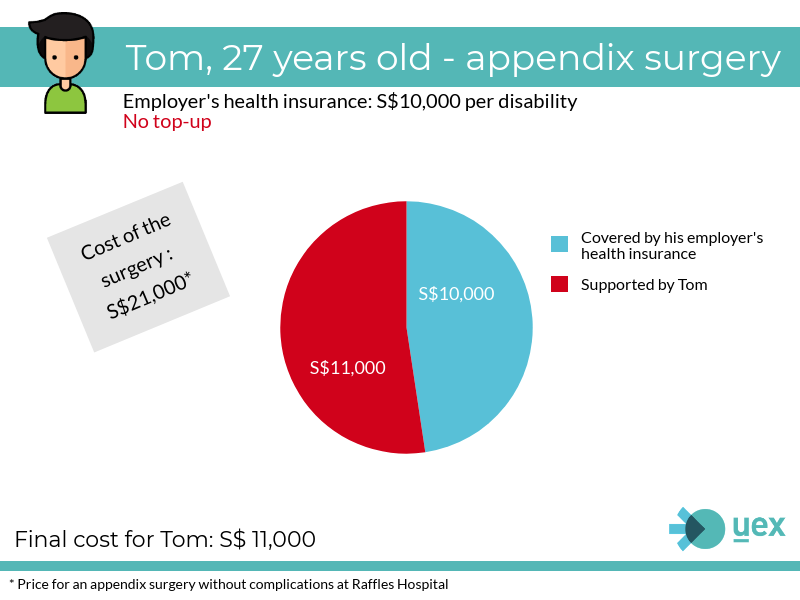

Employer disability insurance. Long term disability insurance benefits generally begin when the following benefits end. As mentioned above disability insurance short term or long term is an additional benefit you can offer to your employees as part of a competitive benefits package. Disability insurance often called di or disability income insurance or income protection is a form of insurance that insures the beneficiary s earned income against the risk that a disability creates a barrier for a worker to complete the core functions of their work. These are group disability insurance policies that cover employees of a company.

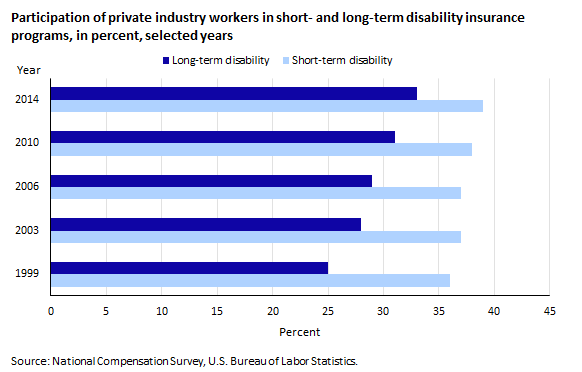

Most people get their disability insurance from work. Sick leave benefits from your employer. Disability insurance protects employees paycheck by replacing a portion of their income during their disability. When you choose disability coverage consider how long you can manage without a paycheck.

The employee retirement income security act erisa is the law that applies to most group disability policies. Employer or group disability insurance dabdoub law firm working to protect disabled employees. Types of disability policies. Usually group long term disability insurance is fully paid for by employers with no contribution expected from employees.

Most long term disability plans will replace 60 to 70 of your normal income. One in four workers will be disabled before retirement according to the social security administration. If you have significant savings you may be willing to choose a longer elimination period. Most group long term disability plans have an elimination period of 90 days or 180 days.

Each disability plan is different. Justworks offers access to all kinds of employer benefits including disability insurance through metlife. These benefits usually start when short term benefits are exhausted and continue from five years to life. For example the worker may suffer from an inability to maintain composure in the case of psychological disorders or an.

Under most group plans generally the employer selects the elimination period. It s a good idea to supplement that coverage if your salary far exceeds the cap or you. Short term and long term disability insurance. You can also buy your own policy.

Employer sponsored disability insurance usually pays only a portion of your base salary up to a cap. Our three long term and three short term plan options coordinate to provide maximum protection. There are two types of disability policies.

/short-term-disability-basics-1177839_V2-5bbd0f8146e0fb0051d0c4cf.png)