Delaware Corporation Franchise Tax

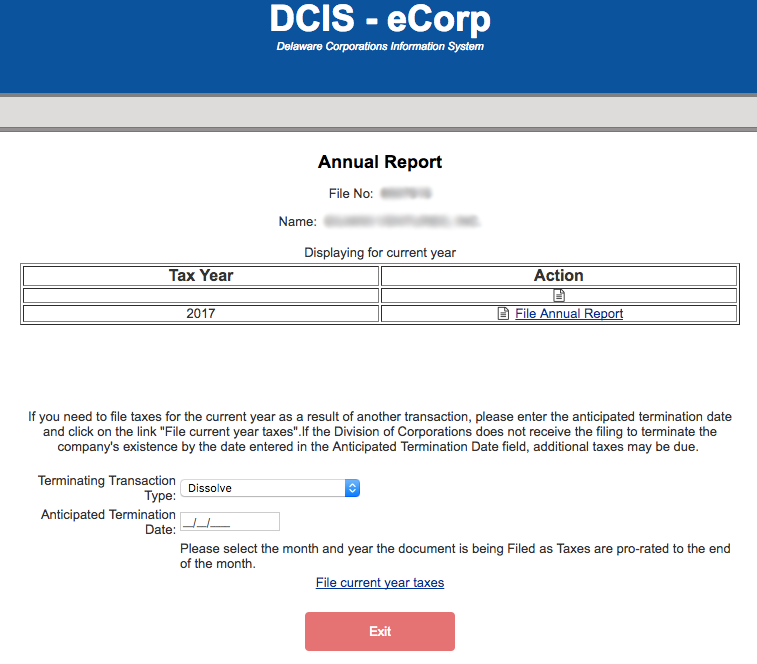

Any delaware corporation that is ending its existence or reinstating their status to good standing is required by law to file an annual report and pay any and all tax due.

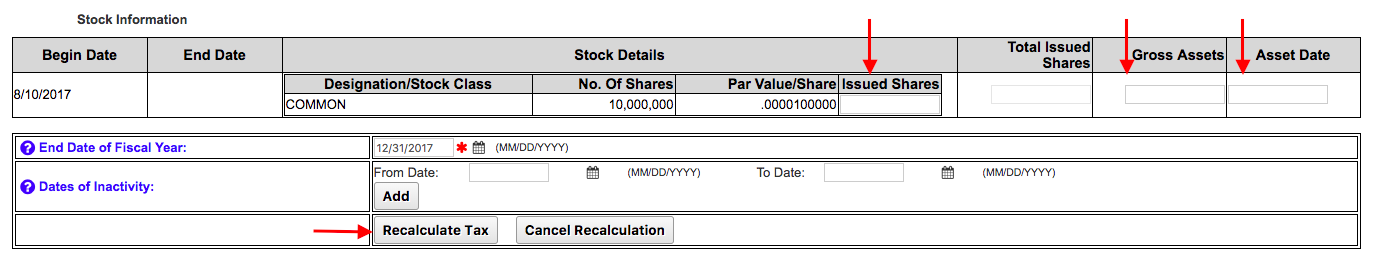

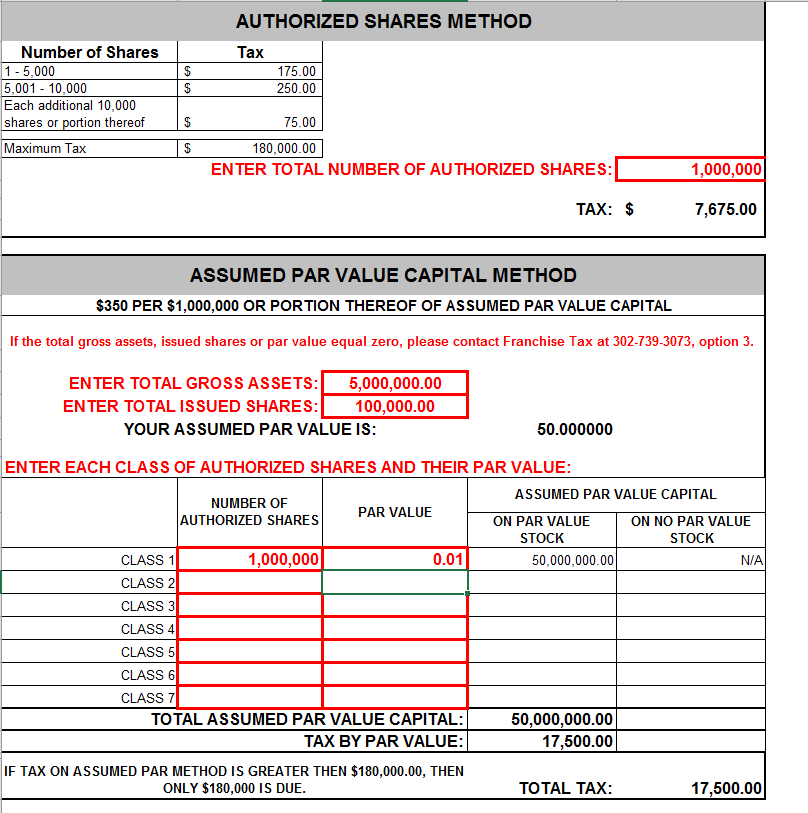

Delaware corporation franchise tax. The delaware franchise tax for a corporation is slightly more complicated. So there is a minimum delaware franchise tax and annual report payment total of 225 a year for delaware domestic corporations. Corporations incorporated in delaware but not conducting business in delaware are not subject to corporate income tax 30 del c section 1902 b 6 but do have to pay franchise tax administered by the delaware department of state. The franchise tax for a corporation is based on your corporation type and the number of authorized shares your company has.

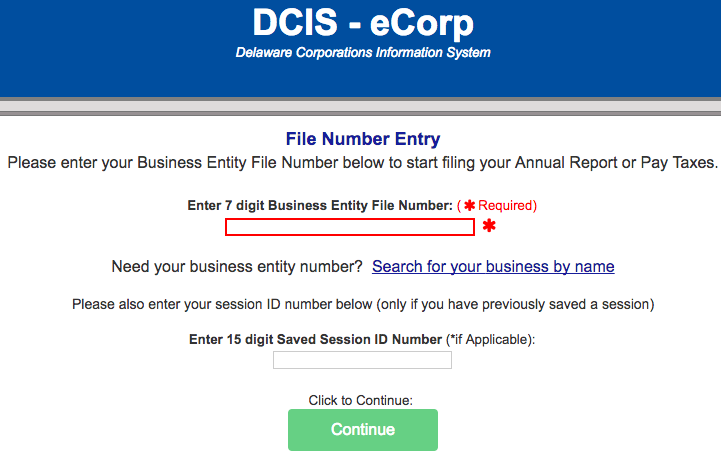

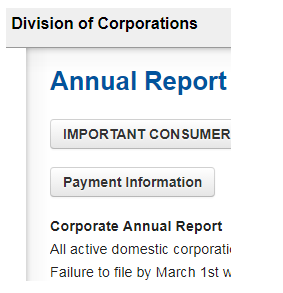

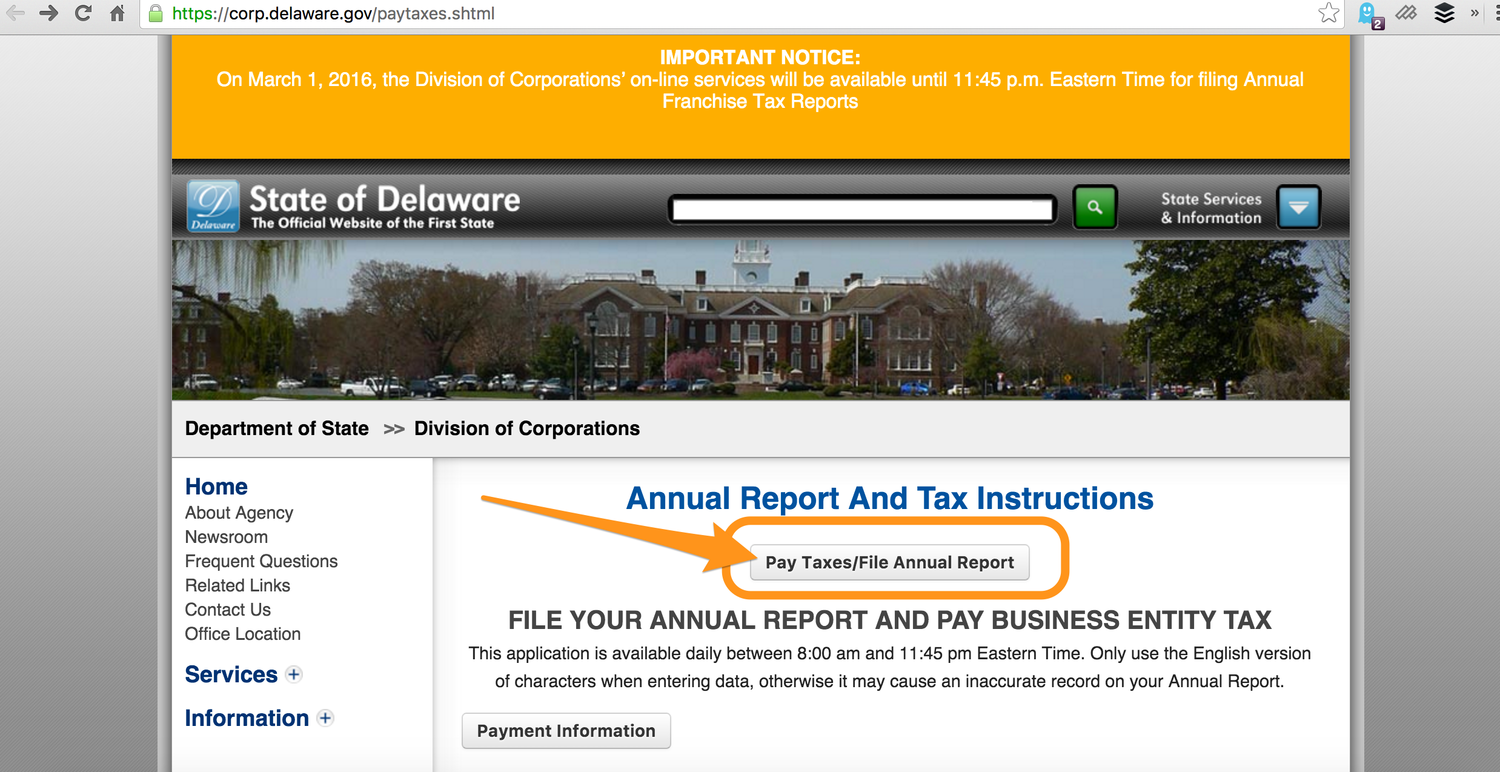

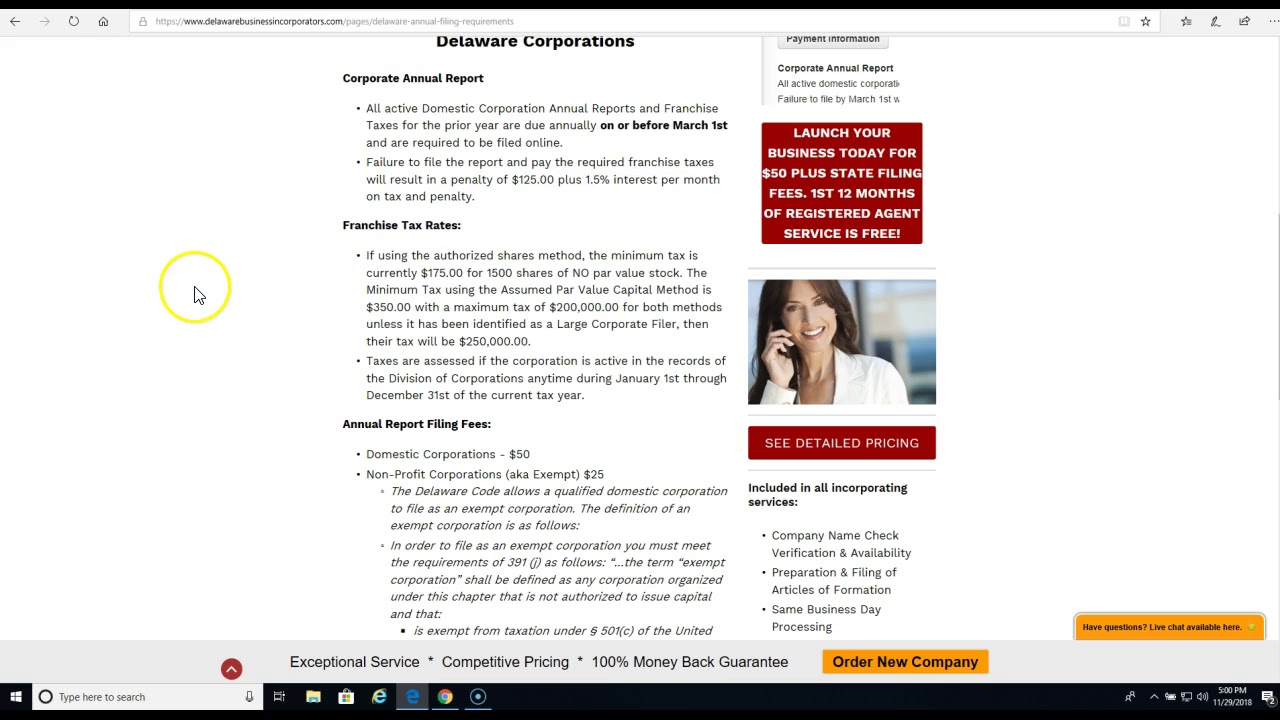

The franchise tax for a delaware llc or delaware lp is a flat annual rate of 300. It is a flat fee of 30 due on june 1. It is based on the corporation type and the authorized shares. All active domestic corporation annual reports and franchise taxes for the prior year are due annually on or before march 1st and are required to be filed online.

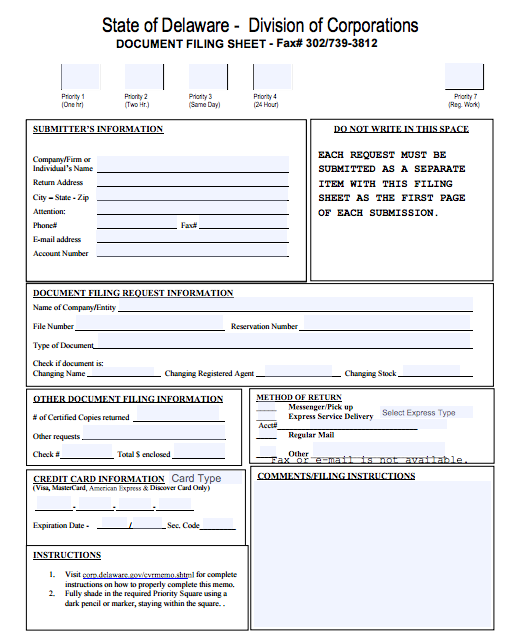

Please contact the franchise tax section at 302 739 3073 and select option 3 and option 1 or by email at dosdoc ftax delaware gov before submitting your renewal merger. The delaware franchise tax for this business is simple. The franchise tax is due even if the business didn t conduct any activity or lost money. The total cost also includes an annual report fee.

Business make a payment pay pay delaware taxes pay division of revenue pay gross receipts tax pay personal income tax pay quarterly estimated tax pay withholding tax payment personal revenue taxes. The franchise tax for corporations is calculated based on the type of corporation the number of authorized shares and other factors. There is a minimum tax of 175 and a minimum filing fee of 50. Domestic corporations must file by march 1 or face a 200 penalty and a 1 5 interest rate on the amount due.

How do i calculate my delaware franchise tax. Failure to file the report and pay the required franchise taxes will result in a penalty of 200 00 plus 1 5 interest per month on tax and penalty. Delaware however offers a flat fee franchise tax of 100.