How Long Can Your Checking Account Be Overdrawn

Be sure to check your balance regularly.

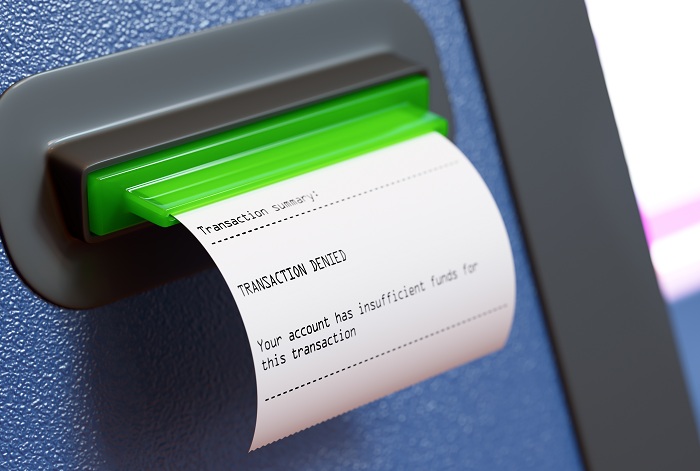

How long can your checking account be overdrawn. Once your account is closed additional. Overdraft fees continue to accumulate and if you do not pay the bank will eventually act. Because fees can add up quickly you should try to stop using your checking account until you have sorted everything out. Your bank has the right to close your account after you become overdrawn but most banks wait before taking that step.

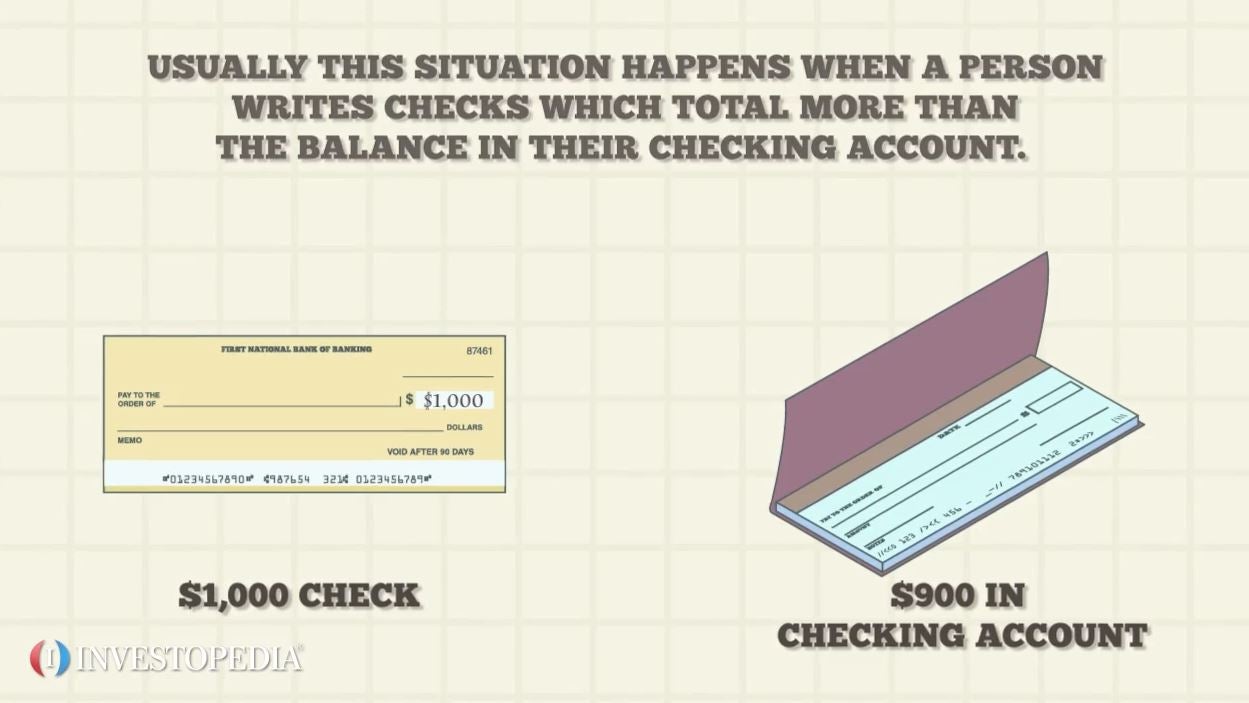

An overdraft occurs when there s not enough money in your personal checking account to cover a payment purchase or check you write. Whether an overdrawn account is closed by you or the institution it doesn t end your obligation to rectify your negative balance. Understanding overdraft protection and fees. Your bank can also close your account if it s negative for too long or if you repeatedly go negative.

Mishandling your bank account can result in serious ramifications. With a chase checking account you have options specifically when it comes to how we handle overdrafts. Ask your bank about the terms of their overdraft policy to find out the exact length of time your account can remain overdrawn. Banks report overdrawn and unpaid accounts to consumer data services like chexsystems which give customers a score in terms of banking reliability much like the three major credit bureaus do for credit worthiness.

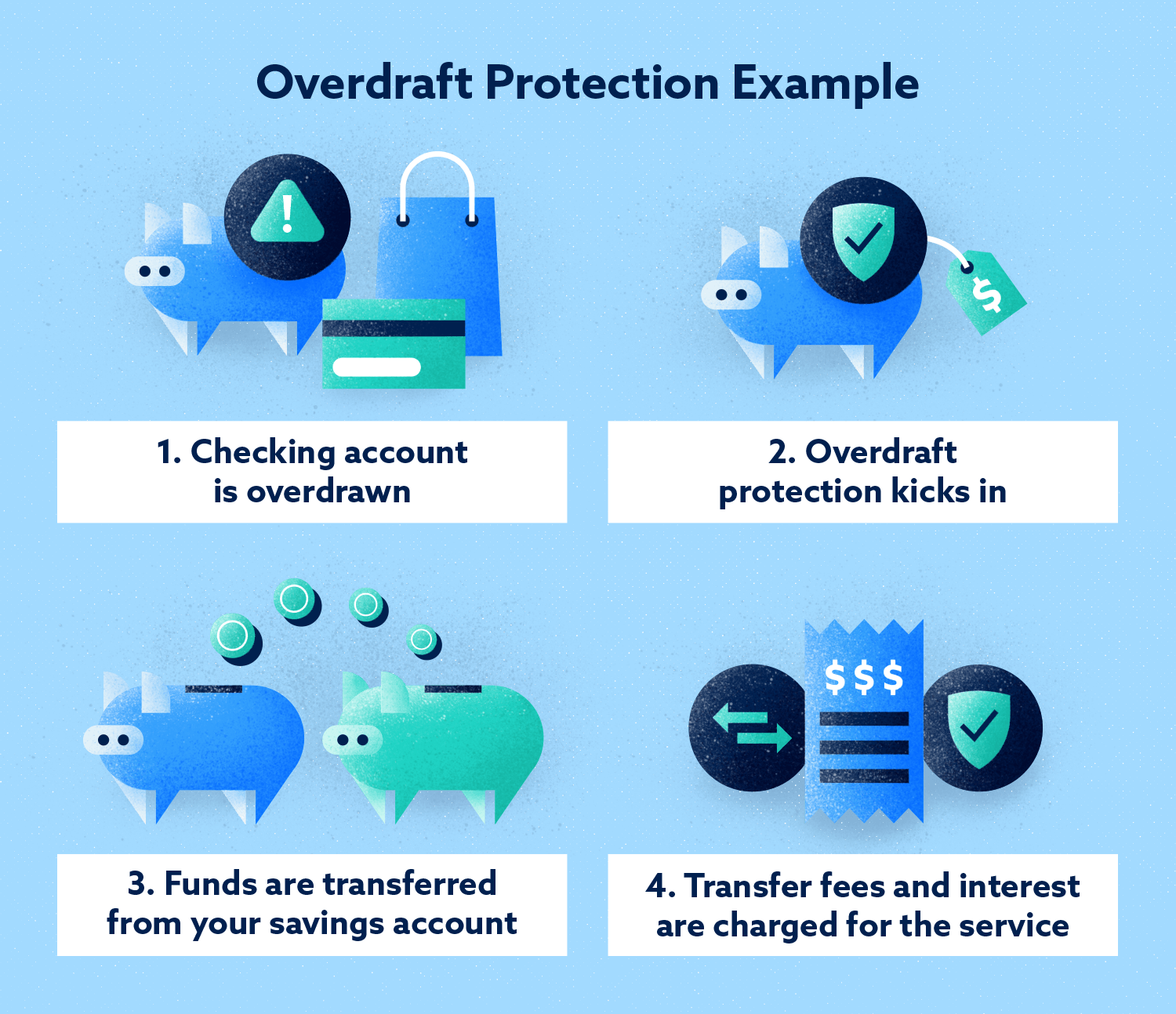

Your bank may offer an overdraft protection program. Can i pay for an item now and add funds later. If an account is left overdrawn anywhere from 3 to 31 days the bank may charge an additional fee. Will there be charges if i go overdrawn for 5 7 days.

If for example you write four checks that exceed your checking account balance and your bank charges 40 per overdraft you will be assessed a 160 penalty. Our overdraft services aren t available for chase secure checking sm. I have just bought an item that will take my account overdrawn until the money arrives from my funds transfer. Stop using the account.

If your account is overdrawn you should discontinue all nonessential spending until it s back in the black. The fees cover the bank s cost for honoring the transactions you made so the checks aren t returned by vendors. In some cases you can link another account to the checking account and if your balance goes. 4 after that the bank can close the account and may send a negative report to credit agencies which may keep you from opening a new checking account for up to five years.

/insufficient-funds-315343-final-89b1ea8eda2f41c7b2fbfeae44426e65.png)

/couple-overdrawn-56a634985f9b58b7d0e06740.jpg)

/does-closing-a-bank-account-affect-credit-score-4159898-V2-45d9935c2796436a873c0ca8dbf3ab43.jpg)

:max_bytes(150000):strip_icc()/help-my-bank-closed-my-account-2385800-FINAL-5b8812c04cedfd0025228a14.png)