Factoring And Invoice Discounting

Both involve a third party company advancing money against outstanding debtor balances.

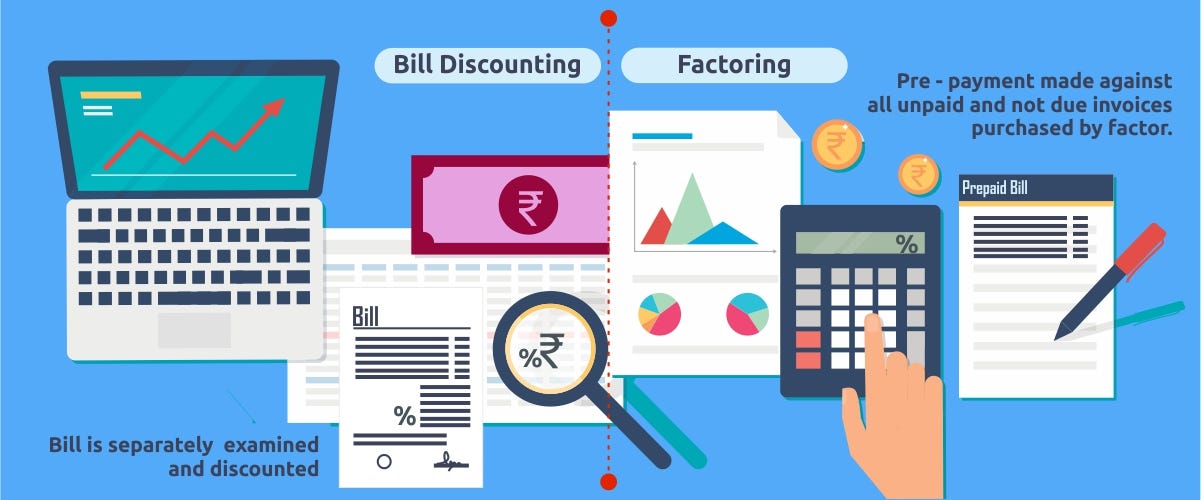

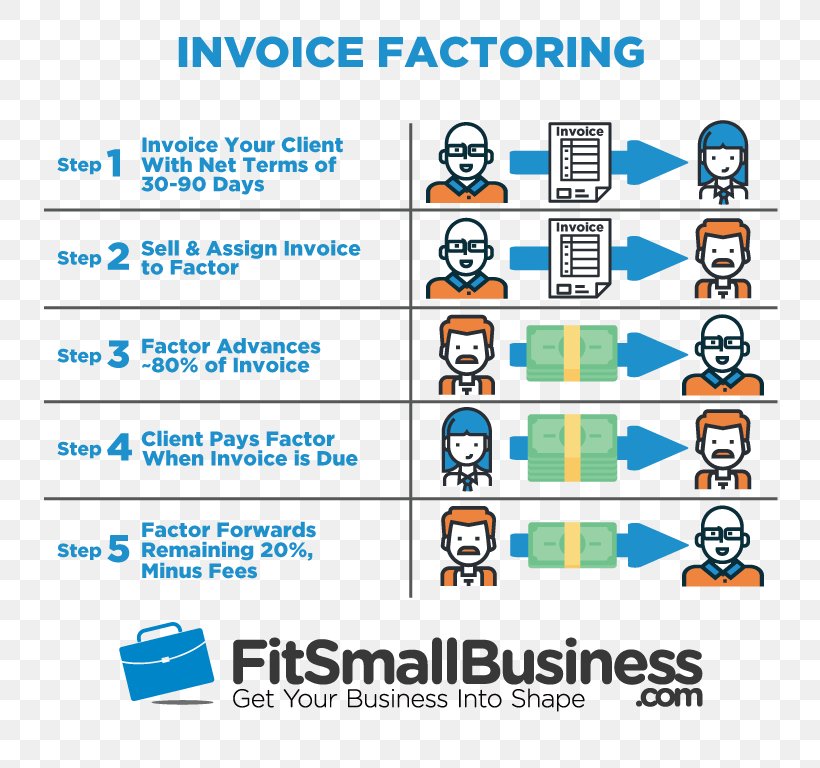

Factoring and invoice discounting. Factoring is when a business sells its invoices to a third party and then the factoring company control the sales ledger and collects the debts. The key differences between invoice finance from marketfinance and factoring can be broadly categorised into four areas. However the business retains control over the. There are many differences between discounting and factoring but the main difference is credit control.

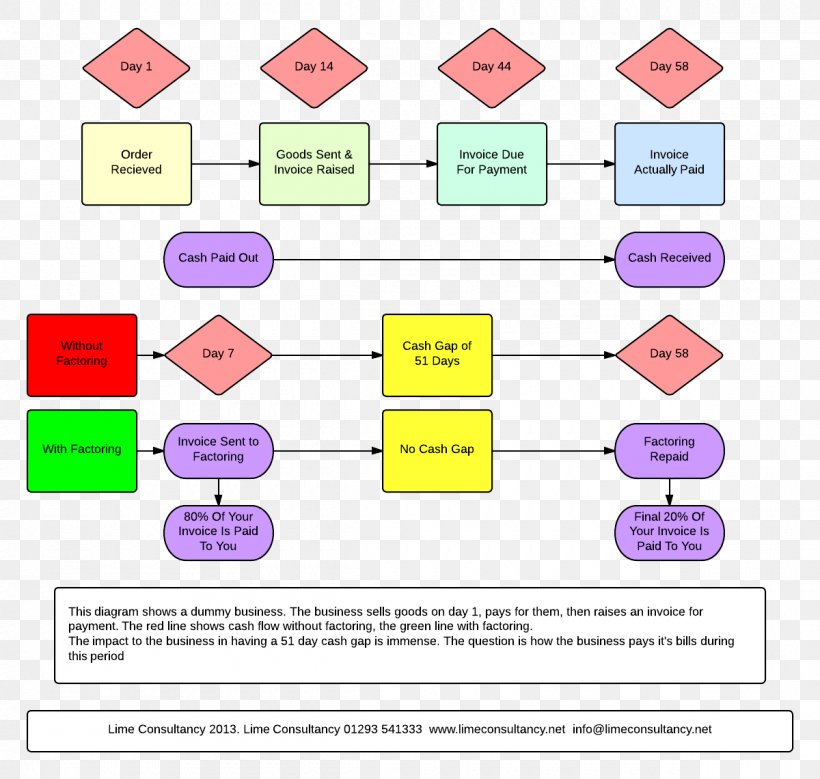

The added flexibility for the business and lack of predictable volume and monthly minimums for factoring providers means that spot factoring transactions usually carry a cost premium. Spot factoring or single invoice discounting is an alternative to whole ledger and allows a company to factor a single invoice. As a result invoice discounting is mostly used by big companies with a steady and reliable customer base. With factoring the third party company takes control of the sales ledger chasing customers for.

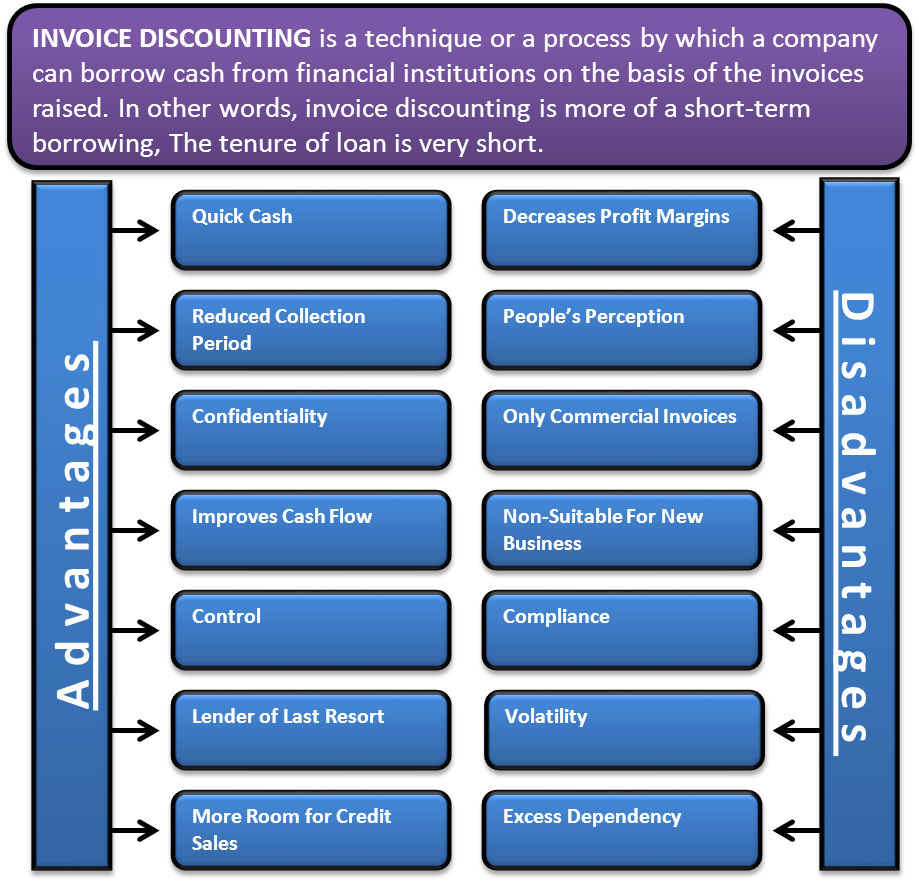

Invoice financing can be structured in a number of ways most commonly via factoring or discounting. Business loans business loans come as secured or unsecured and can cover a wider array of business needs. How much does invoice discounting cost. Factoring vs invoice discounting although on the surface invoice finance and factoring seem fairly similar in reality these solutions are actually very different.

They re the two most common forms of invoice finance but how can you choose between invoice factoring and invoice discounting. This is why factoring is a popular form of finance for businesses that are hard up or threatened with insolvency. Generally speaking invoice discounting is a riskier proposition for lenders than factoring. Differences between discounting and factoring.

There are clear differences between factoring and invoice discounting. With invoice factoring the company sells its outstanding invoices to a lender who might pay. Acceptance is virtually guaranteed. Cost contracts credit control and confidentiality.

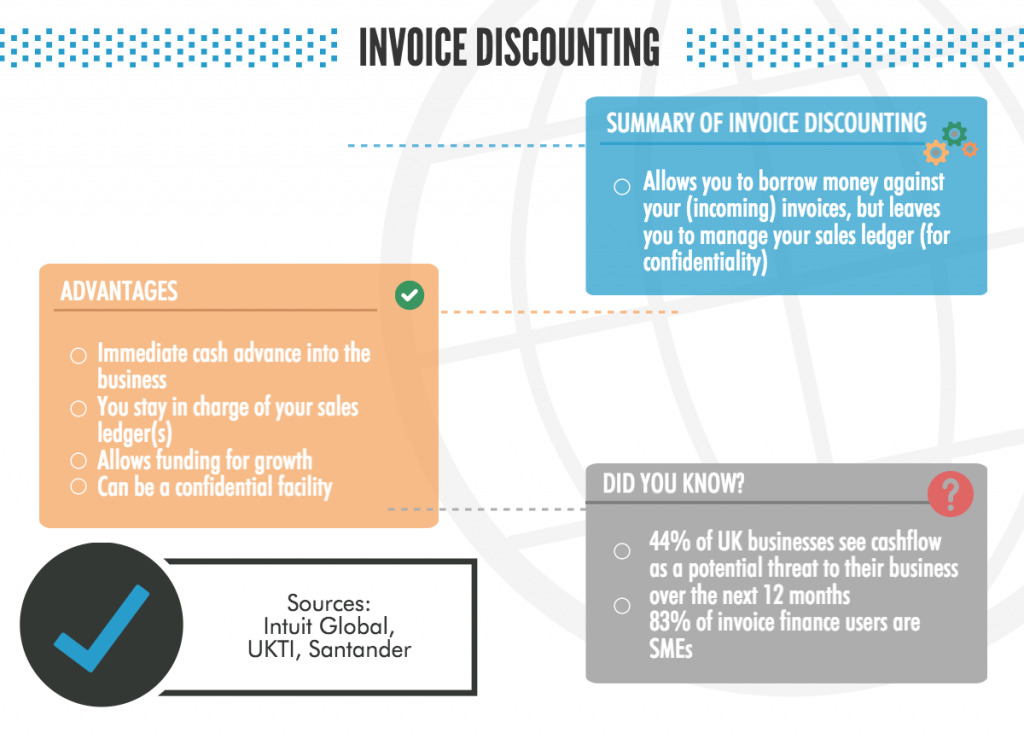

Invoice finance includes invoice factoring invoice discounting spot factoring and chocs facilities. Invoice discounting is an alternative way of drawing money against your invoices. There are generally two costs involved with the first being a service charge or discounting fee and that is highly variable between each individual company and also between each factoring company but the range of 0 25 to 1 of turnover would cover most companies whose sales turnover is in the range of 250 000 to 2m per annum. Risks of factoring vs invoice discounting.

Both factoring and invoice discounting are financial services that enable businesses to release the funds tied up in unpaid invoices. Factoring is less risky for the lender because the factor manages the credit control and collection processes.