How Do I Get Preapproved For A Mortgage Loan

A preapproval letter usually includes an estimate of your loan amount interest rate and monthly mortgage payment.

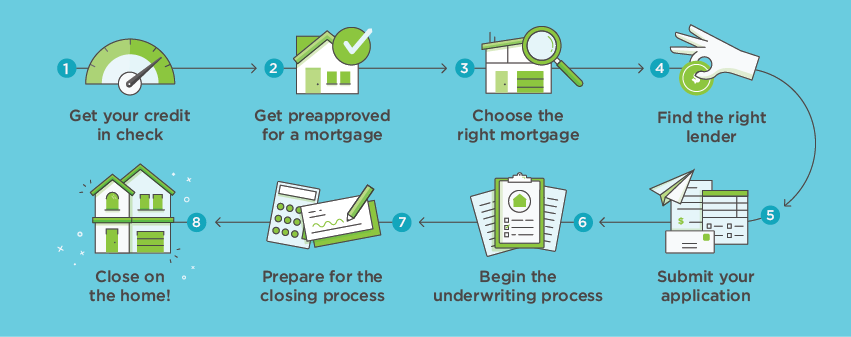

How do i get preapproved for a mortgage loan. In general a debt to income ratio of 36 percent or less is preferable. When refinancing a loan preapproval lets you know that you can get a. A loan preapproval is different than a prequalification says david hosterman regional manager at citywide home loans in centerial colo. Our prequalified approval is the fastest way to get approved with rocket mortgage.

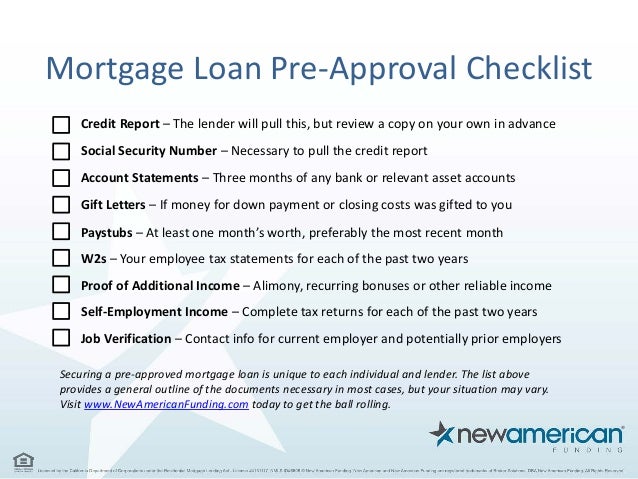

Preapproval requires furnishing documents hosterman says that prove your income to a lender. As mentioned employment history is required but so is proving future income. 43 percent is the maximum ratio allowed. You may need the time to get your household finances in order so you can qualify for a mortgage pre approval.

Make sure you do some credit. For preapproval for a va loan borrowers need to provide evidence of income. You won t be required to provide any documents but you should come prepared with information about your income and assets. Note as long as you confine your mortgage lender activity including completing an.

Even if you are deemed to have bad credit there are ways to still get pre approved for a mortgage. Part time full time self employed or military income are commonly accepted types of income. Rocket mortgage offers a couple of different approval options. Estimate your mortgage payments.

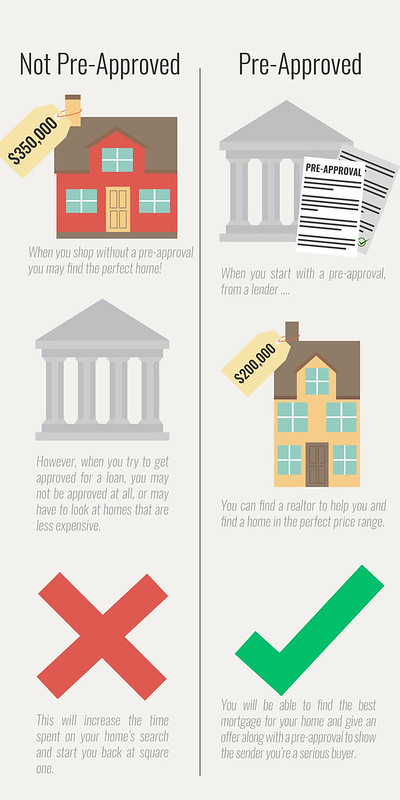

Know the maximum amount of a mortgage you could qualify for. Decrease your overall debt and improve your debt to income ratio. A prequalification happens by answering questions over the phone. A loan preapproval shows a seller that your income and assets meet a lender s preliminary in depth review and requirements.

The steps for getting preapproved for a home loan include sharing detailed financial information about your income and debt and undergoing a credit check. You can use this letter to compare lenders. Once you re approved though you ll have. To get pre approved for a mortgage you ll need five things proof of assets and income good credit employment verification and other types of documentation your lender may require.

:max_bytes(150000):strip_icc()/PREAPPROVEDMORTGAGEJPEG-e4fb5ba8d0164c7699b4b376a1492293.jpg)

/PreQualification.folger-5c19152c46e0fb0001719e6b.jpg)