How A Business Loan Works

This is a type of secured loan backed by a business asset.

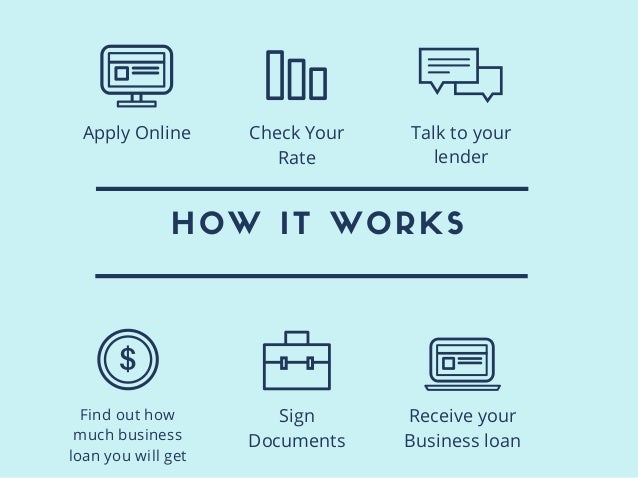

How a business loan works. Therefore the way a small business loan works depends on the type of loan in question. If you work with an equity partner or co owner you may give up some control of your business and will likely forfeit some of the business profits or gains made if you ever sell the business. Usually business loans require regular payments on a set schedule but repayment terms and interest rates can vary quite a bit. The sba does not make direct loans to small businesses.

In exchange for this money lenders require repayment of the principal with interest and fees added to it. The answer to how do business loans work could be as diverse as the expenses of the business owner. Business loans are capital offered by lenders to businesses. Term loans tend to be appropriate for companies that are going to use those funds now says alozie.

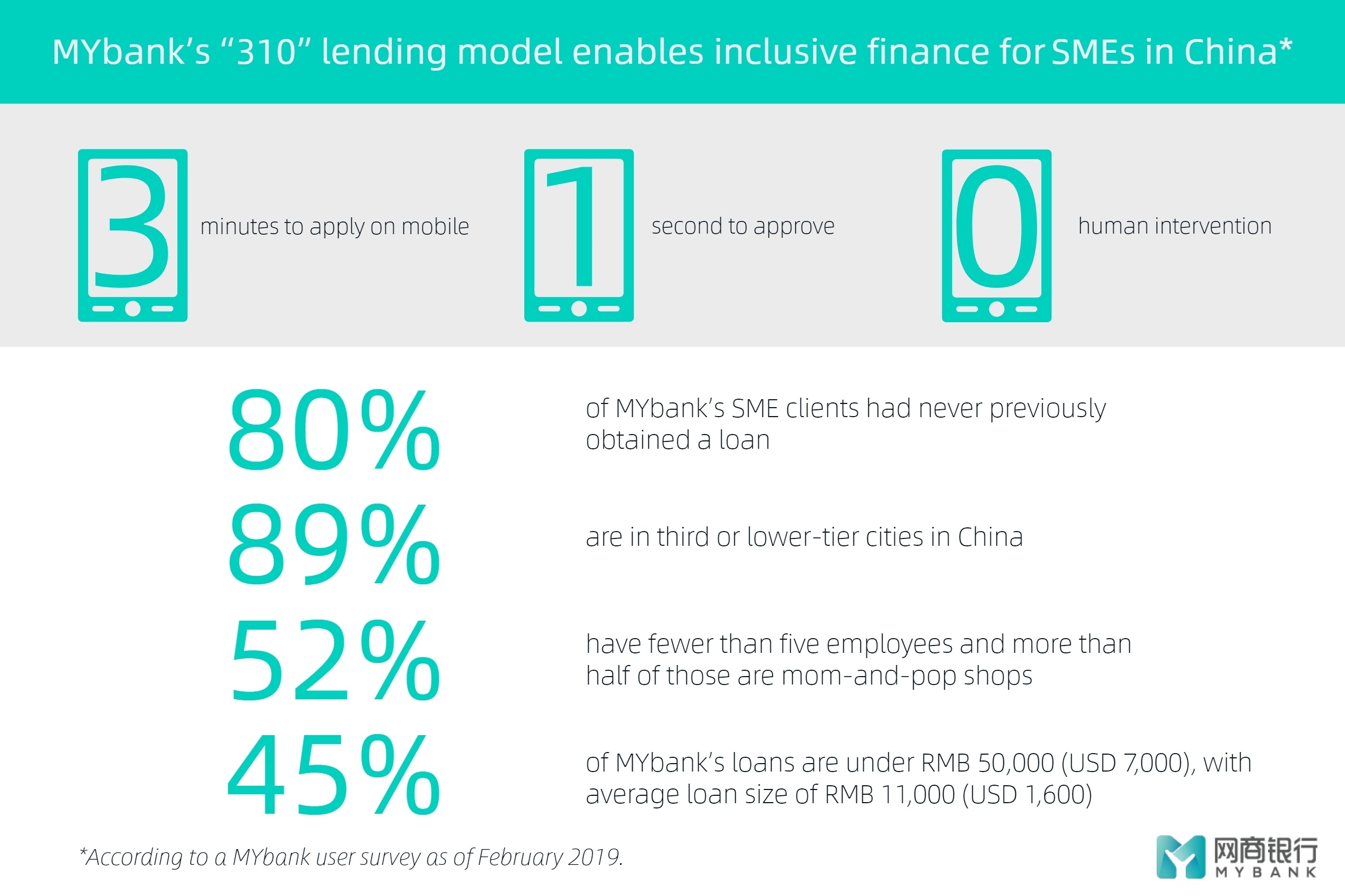

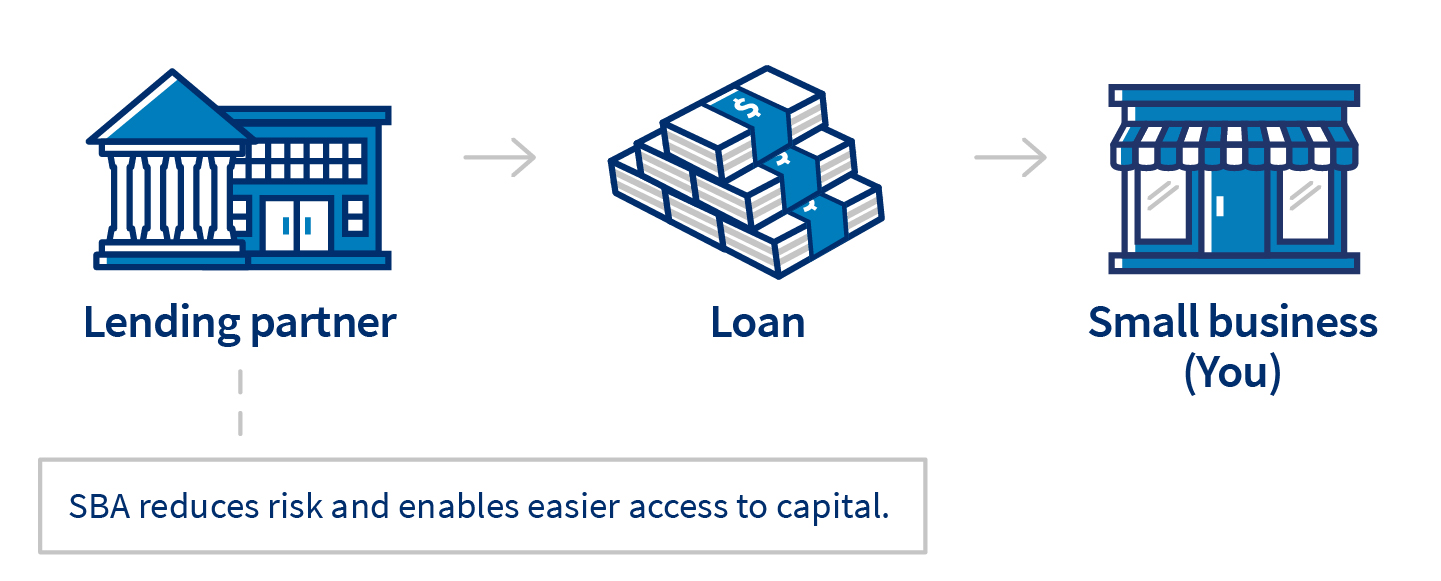

The length of a loan s term will of course vary from one loan to the next and it will obviously make a big difference whether you have to repay the loan within three months or five years. Rather the sba sets the guidelines for loans which are then made by its partners lenders community development organizations and micro lending institutions. The sba express loan part of the sba standard 7 a loan program is one of the most popular va small business loans. Treasury updates on stimulus package.

A small business loan is based on your personal ability to pay so you re liable for making the payments until the loan is paid off no matter what happens to your business. Some short term lenders charge monthly interest rather than an annual rate so double check you know exactly how much it will cost before you apply. They are partially guaranteed by the small business administration and made by financial institutions. The sba loan program is a 350 billion portion of the 2 trillion stimulus package passed by congress last week.

How small business loan repayment works loan repayment is usually pretty straightforward but methods can vary somewhat from lender to lender. Over time several types of small business loans have evolved to help entrepreneurs meet their goals. How will small business loans work. Short term business loans often charge higher interest rates than other types of loan.

The united states small business administration sba offers three types of funding to help small businesses. You may go through all the work to satisfy the bank s requirements only to find out you still don t qualify or the bank may only give you a small portion of the money you need. How do business loans work. Small business loans are types of financing provided to companies for different purposes by various lenders.

Types of small business loans.

/what-are-interest-rates-and-how-do-they-work-3305855-FINAL2-2f4b8e003d8d475fa79182d2a5cd4aa4.png)

/cash-flow-how-it-works-to-keep-your-business-afloat-398180-v3-5b734281c9e77c0057b67a4c.png)