How Does A Mortgage Refinance Work

What is mortgage refinancing.

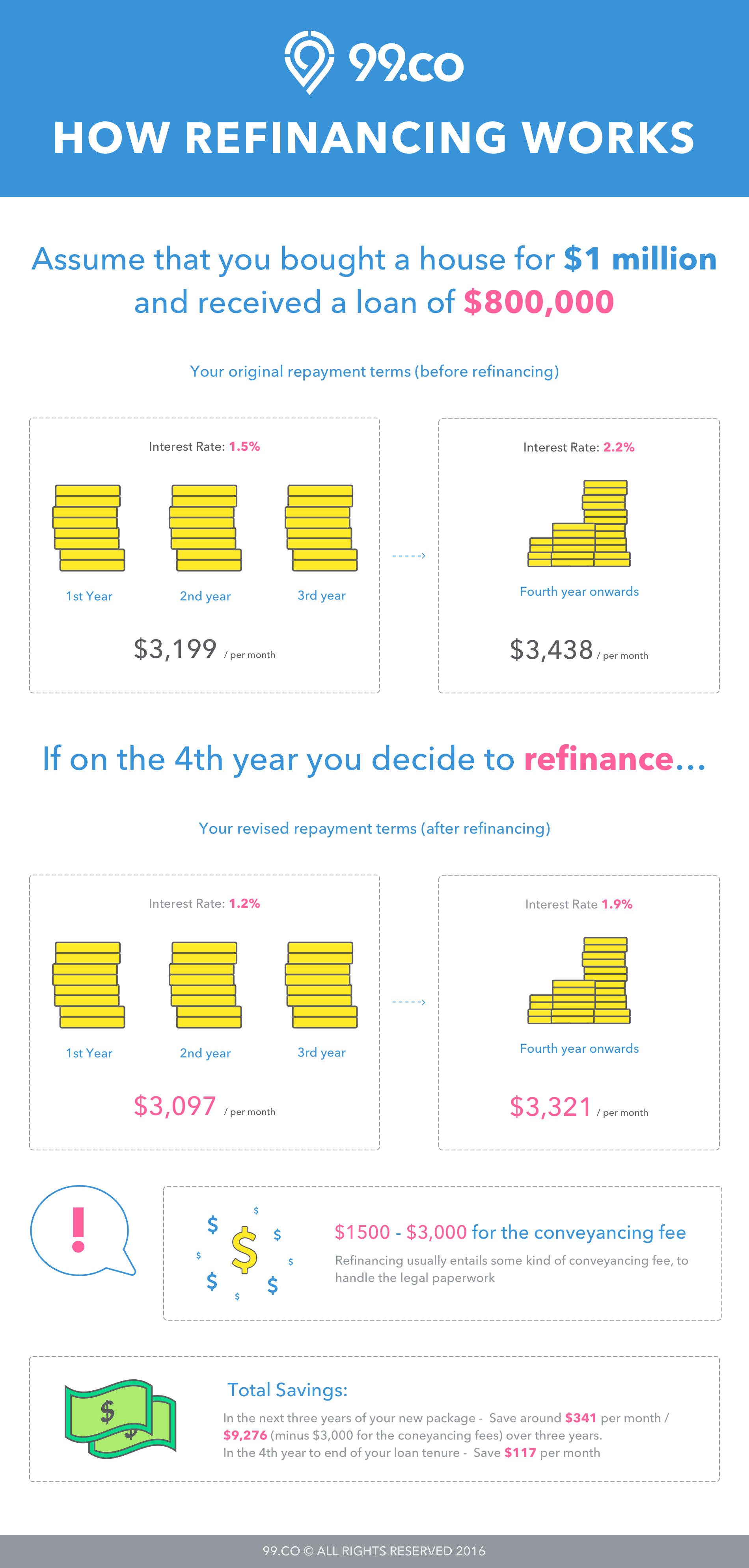

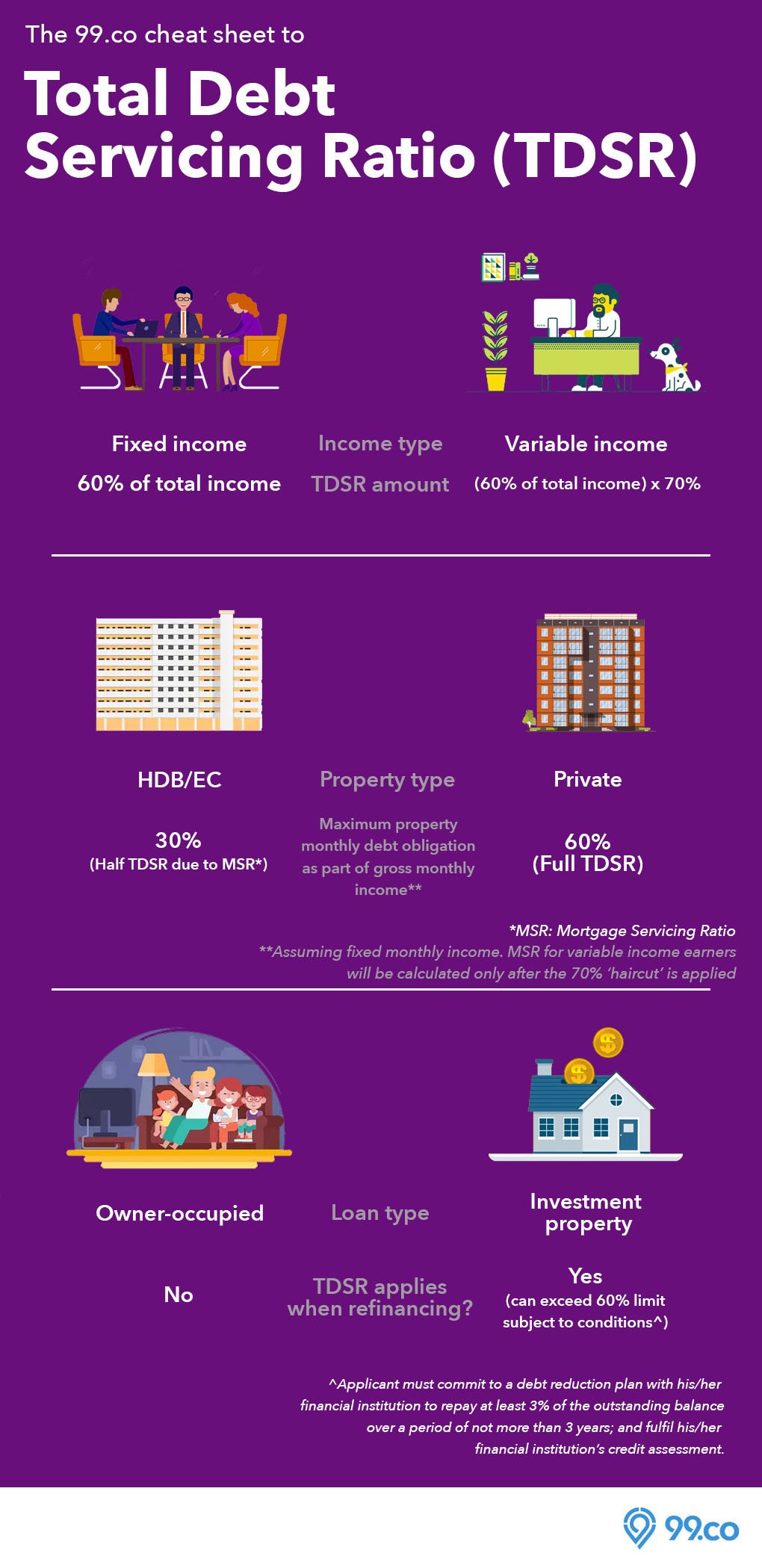

How does a mortgage refinance work. The new loan will have a different interest rate terms and conditions than the old loan. When you refinance you take out a new mortgage loan to pay off your old mortgage loan. The application process and submission requirements are generally the same as with a standard mortgage. When you refinance your mortgage your lender will pay off your previous home loan completely so that you are only left with the refinanced mortgage.

In many cases homeowners refinance to take advantage of lower market interest rates cash out a portion of their equity or to reduce their monthly payment with a longer repayment term. How does refinancing a mortgage work. When you refinance your mortgage you essentially trade in your old loan for a fresh one with a new interest rate and mortgage term. The process of refinancing a mortgage works in a similar way to obtaining a mortgage to purchase a home with the obvious difference being that you already own.

Refinancing a mortgage involves taking out a new loan to pay off your original mortgage loan. The details of the new mortgage loan can be customized by the homeowner include the new. Mortgage refinancing in a nutshell means paying off your current mortgage so as to get a new mortgage with lower interest rates a shorter repayment term or changing from an adjustable rate mortgage arm to a fixed rate mortgage. And possibly even a new loan balance.

You may also have. Mortgage refinancing also allows the opportunity to cash in to your home s equity or even to consolidate your debts. You may elect to receive this new mortgage from the same bank that held your old loan previously or you may refinance your home loan with an entirely different lender.

:max_bytes(150000):strip_icc()/GettyImages-155420417-0636da199f484064a9ac1e7af2b84012.jpg)

/what-is-refinancing-315633-final-5c94f0874cedfd0001f16988.png)

:max_bytes(150000):strip_icc()/approved-mortgage-refinance-application-form-with-pen-calculato-183784889-577c07775f9b585875ca5323.jpg)

/close-up-of-female-accountant-or-banker-making-calculations--savings--finances-and-economy-concept-1006671124-fe0a396be99740e699238edc273e4311.jpg)