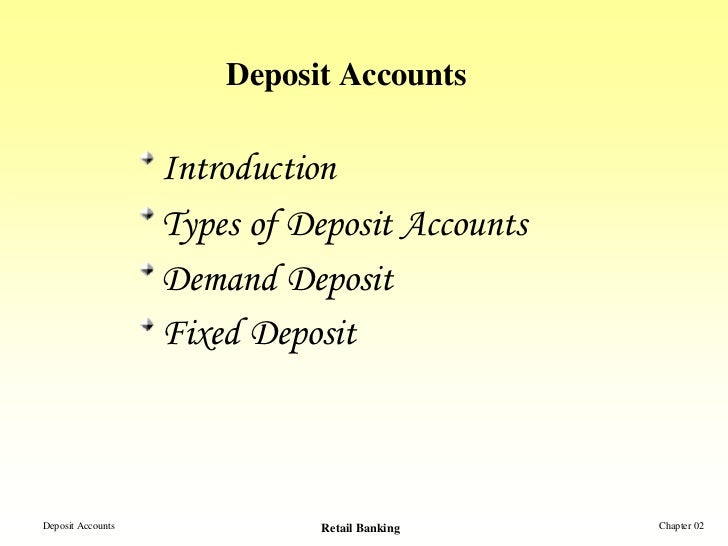

Demand Accounts

:max_bytes(150000):strip_icc()/GettyImages-1126878582-6d25dc6732dc464da74e99e037039238.jpg)

Because money is available on demand they are also sometimes known as demand accounts or demand deposit accounts.

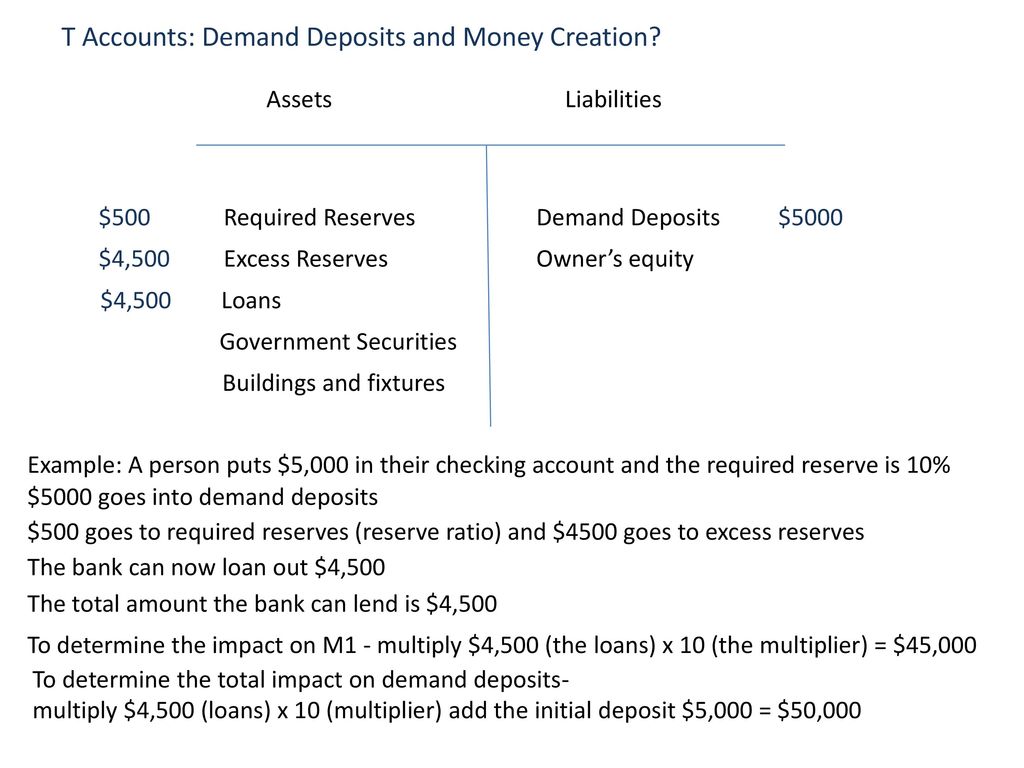

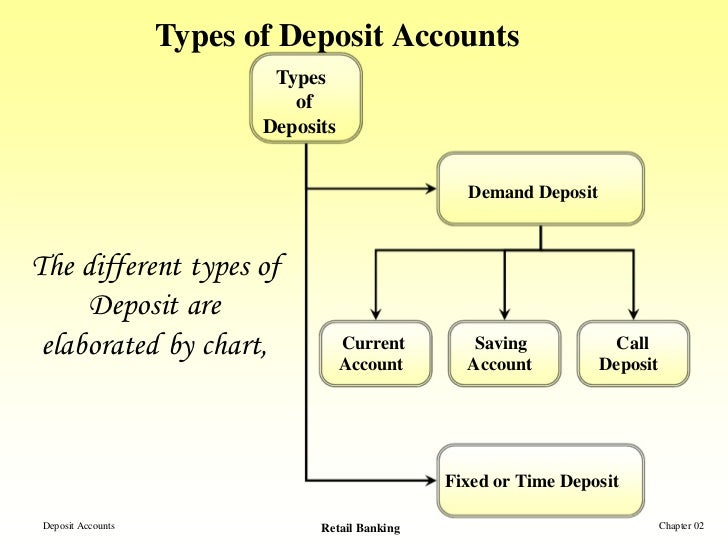

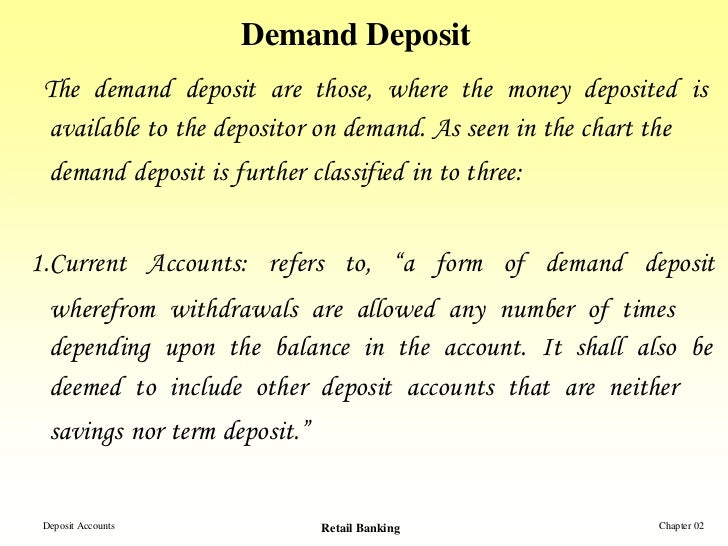

Demand accounts. Depending on the country and local demand economics earning from interest rates varies. Simply put these would be funds like those held in a checking account. A demand account or demand deposit is a deposit account held at a bank or other financial institution the funds deposited in which are payable on demand. Demand deposits are a key component of the m1 money supply calculated by the federal reserve.

A demand deposit is an account with a bank or other financial institution that allows the depositor to withdraw his or her funds from the account without warning or with less than seven days notice. What is demand accounts demand accounts is an exciting new service brought about by the faster payments initiative of the us federal reserve providing payments that are instant final irrevocable good funds and secure. In the united states now accounts operate as transaction accounts. Demand deposits or non confidential money are funds held in demand accounts in commercial banks.

These account balances are usually considered money and form the greater part of the narrowly defined money supply of a country. Dda accounts can pay interest on a. What is a demand deposit.

:max_bytes(150000):strip_icc()/money_market__currency_chart_-5bfc2efa46e0fb00517c8ac0.jpg)