Do Small Businesses Have To Provide Health Insurance

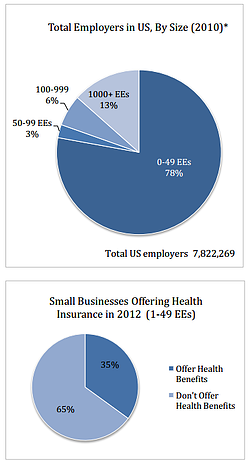

However the affordable care act includes a mandate for certain large employers with over 50 full time equivalent employees to either offer qualified and affordable health benefits or pay a tax penalty.

Do small businesses have to provide health insurance. Given the ongoing decline in employer sponsored health coverage and soaring healthcare costs many cash strapped small business owners ask do small businesses have to provide health insurance read on to learn whether or not you re legally required to provide healthcare coverage for your employees. Many small business owners are confused and have questions about whether or not they have to offer health insurance to their employees. The small business has 25 or less full time equivalent fte employees. Must employers provide small business health insurance in 2020.

Plus why you might want to offer it if you have the. If you do not offer health insurance through your business your employees can buy coverage through the individual marketplace. Larger companies may have faced a fine for failing to offer group coverage and some small businesses could have missed out on a health care tax credit. As a small business owner you may be asking do i have to provide health insurance to employees no business has to offer health insurance.

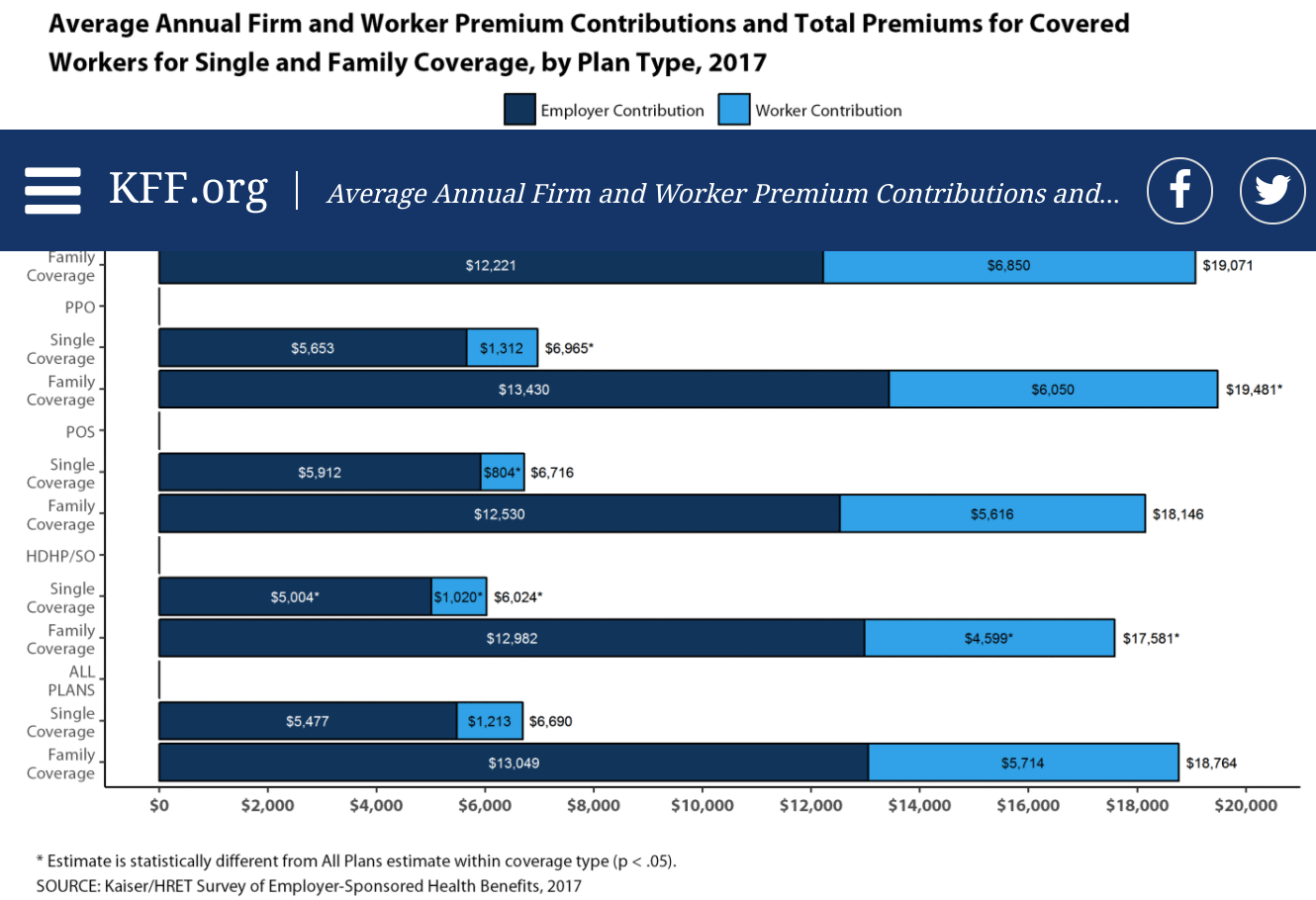

Small businesses that choose to provide health insurance despite not being required to do so may qualify for tax credits. In 2018 small businesses with fewer than fifty full time equivalent employees are not required by law to provide health insurance to their workers. Even with the obamacare individual mandate employers never were forced to offer small business health insurance. A small business can usually qualify for the tax credit if it meets the following insurance requirements.

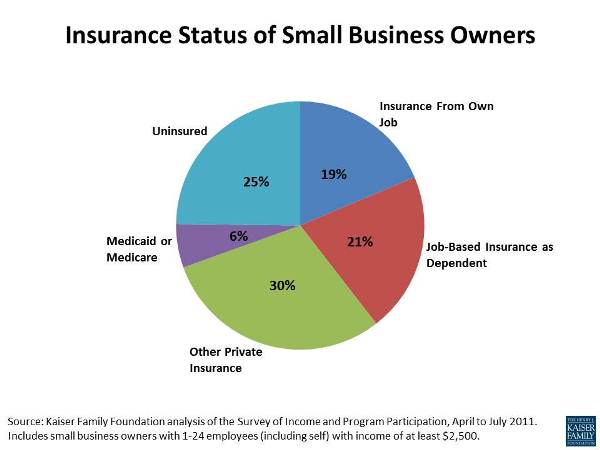

Small businesses are defined as averaging fewer than 50 full time employees annually and are not required to provide employer sponsored health insurance. However if companies meet certain qualifications in terms of employee salary level employer contribution toward insurance premium and buying insurance through the government shop small business health options program which pools small businesses together to provide insurance plans that are more competitive employers may be eligible for up to 50 tax credit on the premiums. Small businesses that have fewer than 50 full time employees or the equivalent in part time workers do not have to provide health insurance under the aca which is sometimes referred to as.