Do I Need Comprehensive Car Insurance

Fully comprehensive insurance is just another way of saying comprehensive insurance or comprehensive car insurance.

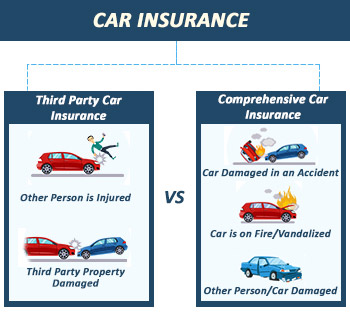

Do i need comprehensive car insurance. Not only are comprehensive insurance policy holders covered against damage to other people s vehicles or property they also enjoy full protection of their own vehicles regardless of who s at fault in the event of an accident. There are two other types of insurance you can choose. If you decide your car faces a lot of risk then it could be worth the costs to add comprehensive coverage to your insurance policy for the peace of mind if nothing else. Comprehensive car insurance is a much higher level of cover and for this reason the most popular.

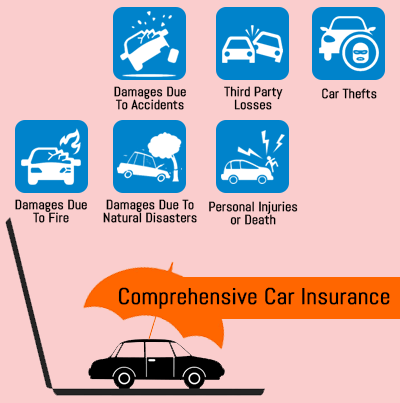

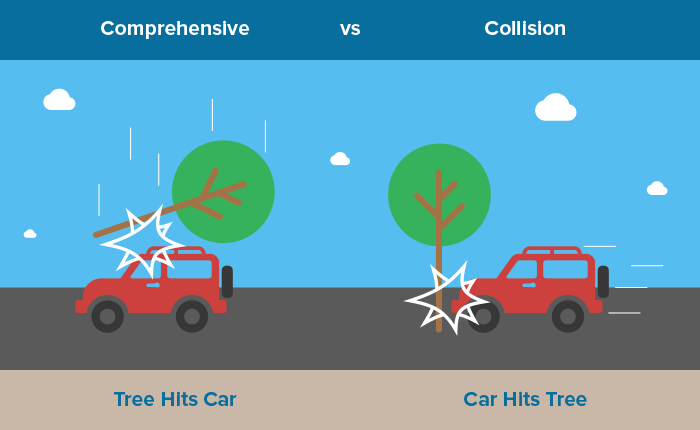

Third party fire and theft tpf t and third party only tpo. Comprehensive car insurance is a type of insurance that helps pay to replace or repair your car if it s stolen or damaged in a non collision incident that is out of your control such as damage. It pays for damage to your vehicle from just about anything except a traffic collision or rollover. On the other hand if you live in a city with mild weather and park in a garage you may feel secure without additional coverage.

If you re shopping for auto insurance you might wonder what type of coverage you need. If you get into a car crash and it was your fault comprehensive will not cover you. Everyone should have some level of additional car insurance on top of their ctp including those who drive old cars. Most car insurance policies include a set of basic coverages that are required by your state and are important for every driver to have.

If you wouldn t repair it for a major mechanical issue you probably shouldn t insure it for comprehensive and collision says gusner. However certain coverages are optional one being comprehensive car insurance. Comprehensive car insurance also known as fully comp is the top level of non business insurance you can get for your car. All of these terms are misnomers for a product that is not comprehensive in the least.