Factoring Business

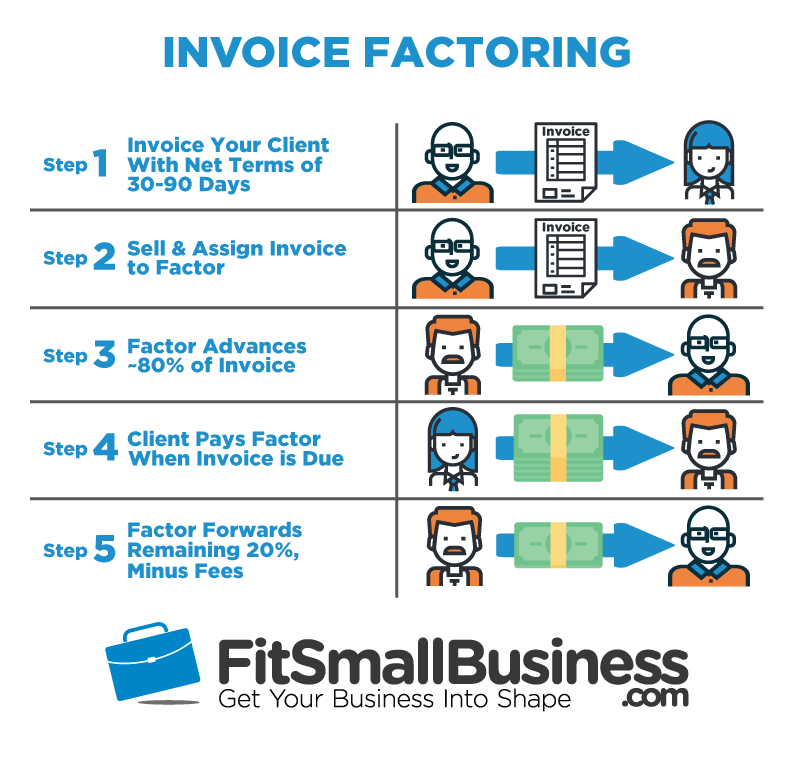

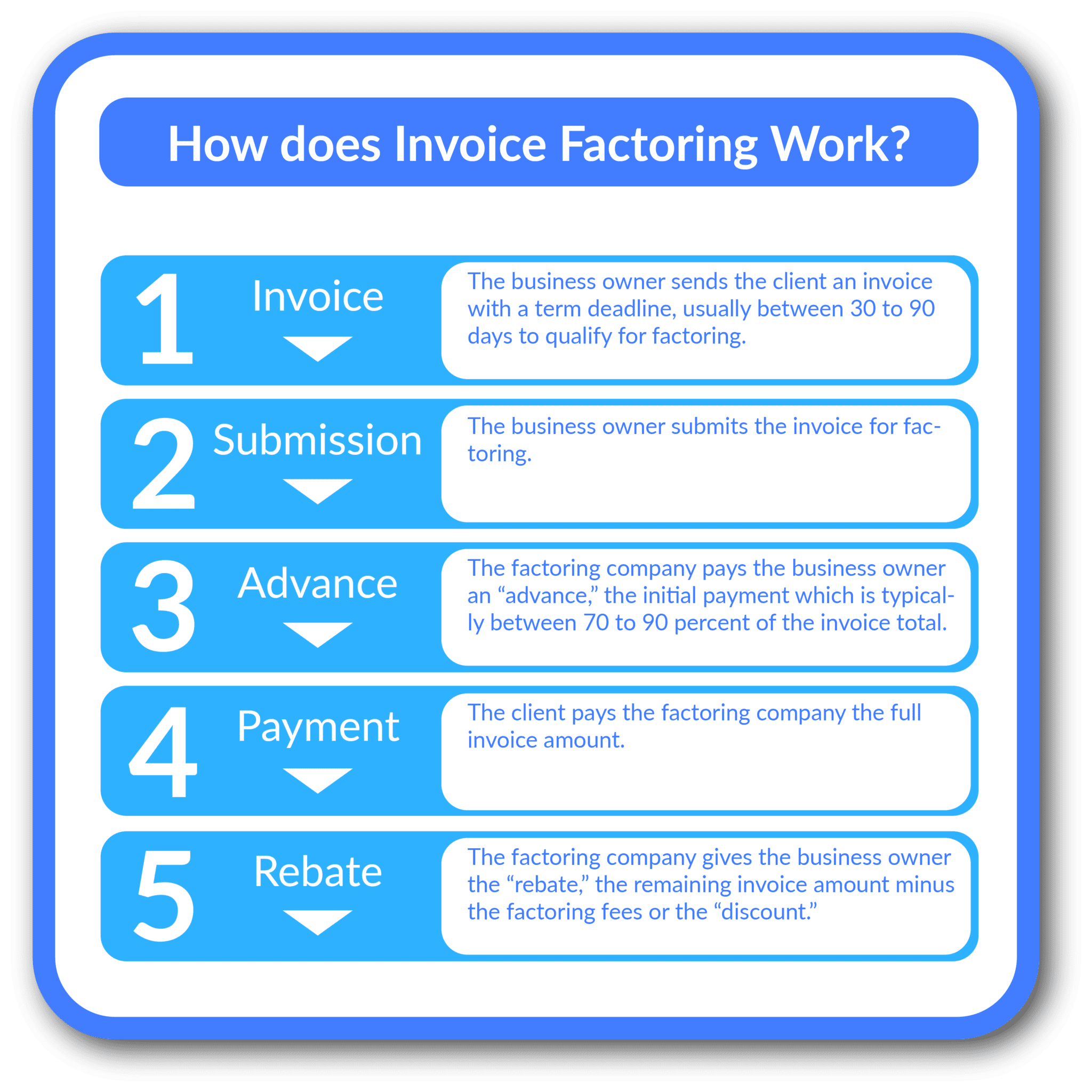

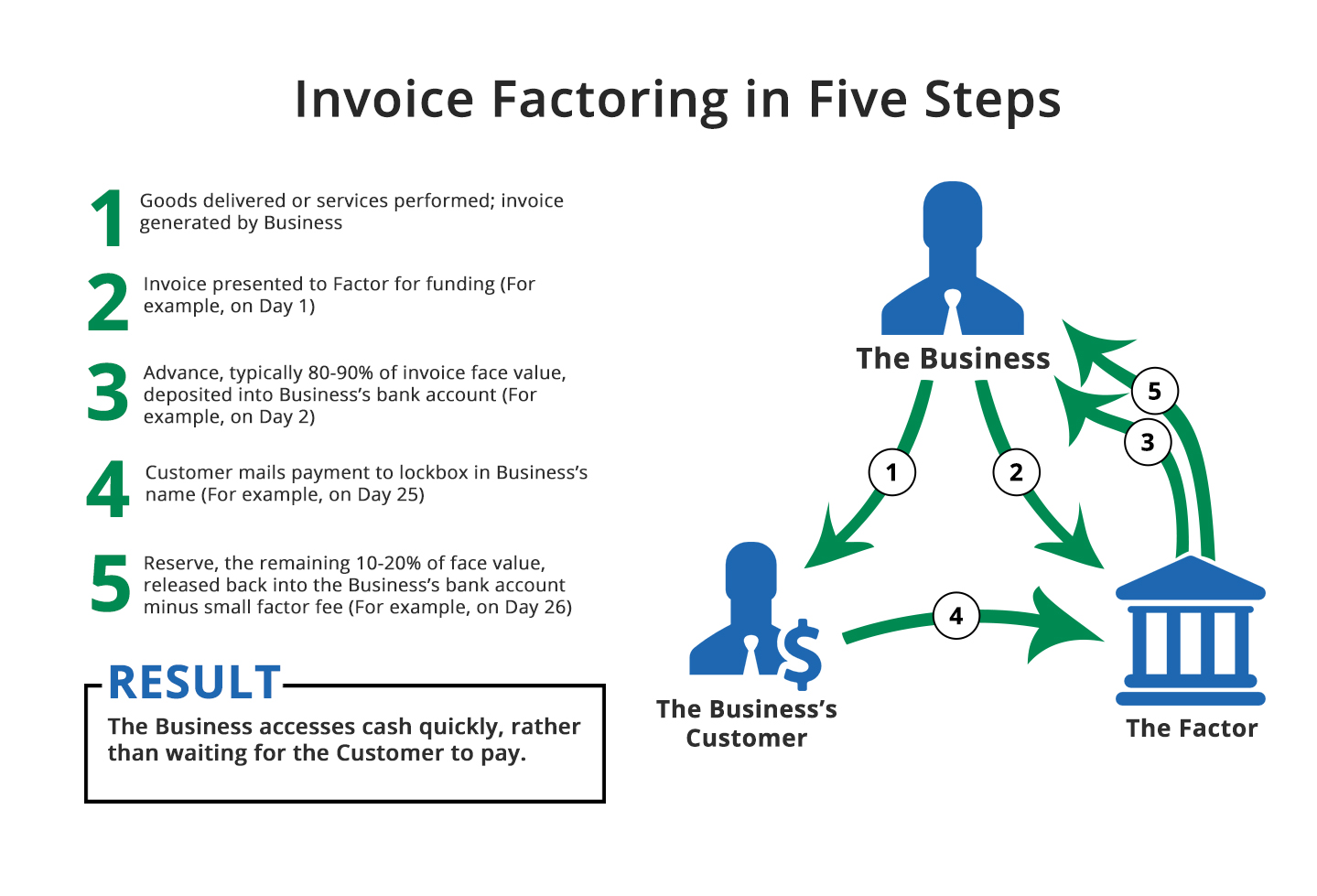

How a factor works.

Factoring business. Factor at discounted prices. Factoring maybank has a number of short term financing solutions to boost your liquidity. Factoring allows a business to obtain immediate capital or money based on the future income attributed to a particular amount due on an account receivable or a business. Factoring is very common in certain industries such as the clothing industry where long receivables are part of the business cycle.

Start slow and learn the ropes. A factoring company also known as invoice factoring or accounts receivable factoring is a service that purchases your open unpaid invoices and advances your business money to cover a portion of those invoices. Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable i e invoices to a third party called a factor at a discount. Forfaiting is a factoring arrangement used in international trade finance by exporters who wish to sell their.

Factoring implies a financial arrangement between the factor and client in which the firm client gets advances in return for receivables from a financial institution factor it is a financing technique in which there is an outright selling of trade debts by a firm to a third party i e. It allows your business to finance invoices which improves your company s working capital. Factoring is a form of financing that helps companies with cash flow problems due to slow paying clients. In a typical factoring arrangement the client you makes a.

If that sounds like a great opportunity then here s how you can turn that into a reality. Maybank can help you transform your book debts into cash by advancing up to 80 of your credit term invoice value. Factoring is commonly used across multiple industries trucking transportation manufacturing government contracting textiles oilfield services health care staffing and more. A business will sometimes factor its receivable assets to meet its present and immediate cash needs.