Debt Tax Shield Formula

Thus the adjusted present value is 115 000 or 100 000 15 000.

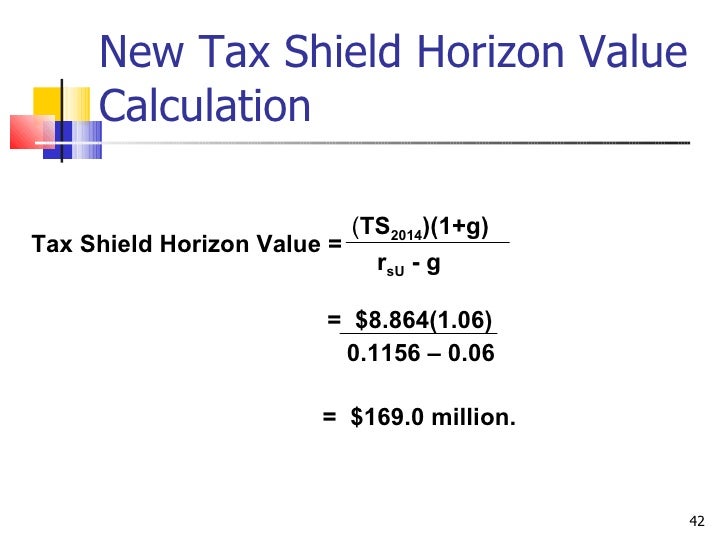

Debt tax shield formula. The impact of adding removing a tax shield is highly impacted by the company s optimal capital structure which is a mix of debt and equity funding moreover the interest expense on the debt is tax deductible which makes the debt funding cheaper. Thus if the tax rate is 21 and the business has 1 000 of interest expense the tax shield value of the interest expense is 210. The difference between apv and. The tax shield also has deterministic nature in the first period and in other periods it is stochastic.

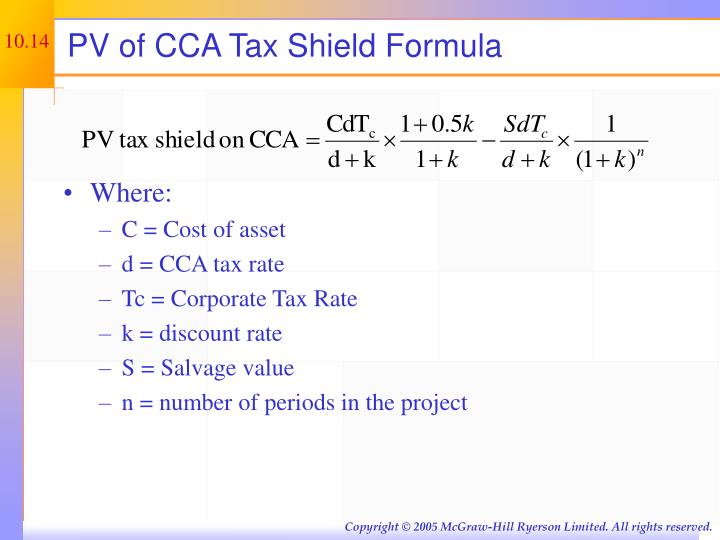

Tax shield is the reduction in the taxable income by way of claiming the deduction allowed for the certain expense such as depreciation on the assets interest on the debts etc and is calculated by multiplying the deductible expense for the current year with the rate of taxation as applicable to the concerned person. Tax shield t d. A company carries a debt balance of 8 000 000 with a 10 cost of debt cost of debt the cost of debt is the return that a company provides to its debtholders and creditors. The discount rate used to calculate the tax shield is assumed to be equal to the cost of debt capital thus the tax shield has the same risk as debt.

Assuming no adverse effects from debt no personal tax consequences and a single corporate tax rate it s easy to calculate the value of a debt tax shield. This and the constant debt assumption in 1 imply that the tax shield is proportionate to the market value of debt. In this hypothetical situation you can use the formula l u td where l is the market value of the levered firm u is the market value of the unlevered firm t is the tax value of a dollar of debt and d is the market value of the debt. The tax shield can be specifically represented as per tax deductible expenses.

Although tax shield can be claimed for a charitable contribution medical expenditure etc it is primarily used for interest expense and depreciation expense in the case of a company. Cost of debt is used in wacc calculations for valuation analysis. What is tax shield. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest medical expenses charitable.

The calculation of interest tax shield can be obtained by multiplying average debt cost of debt and tax rate as shown below. In other periods the value of debt is unknown so the key component debt is stochastic. An appropriate discount rate for interest tax shield is cost of debt in the first year it is the unlevered cost of capital in the following years. Its 50 000 debt load has an interest tax shield of 15 000 or 50 000 30 7 7.

And a 35 tax rate.