File Delaware Llc

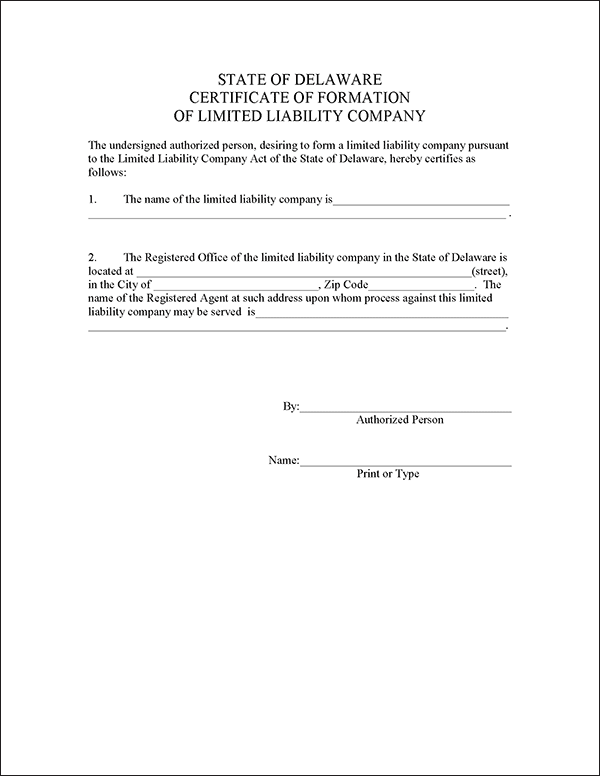

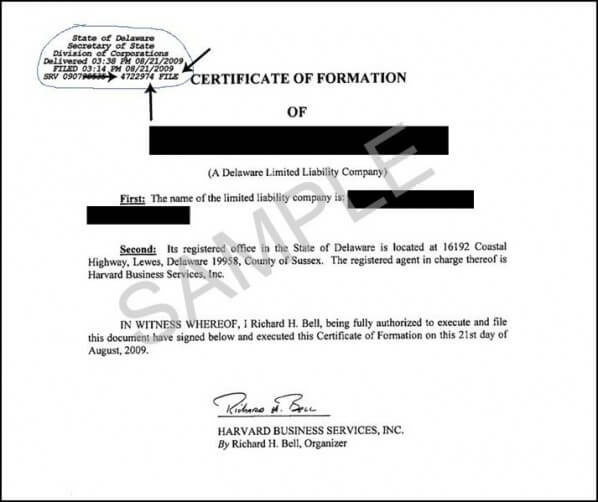

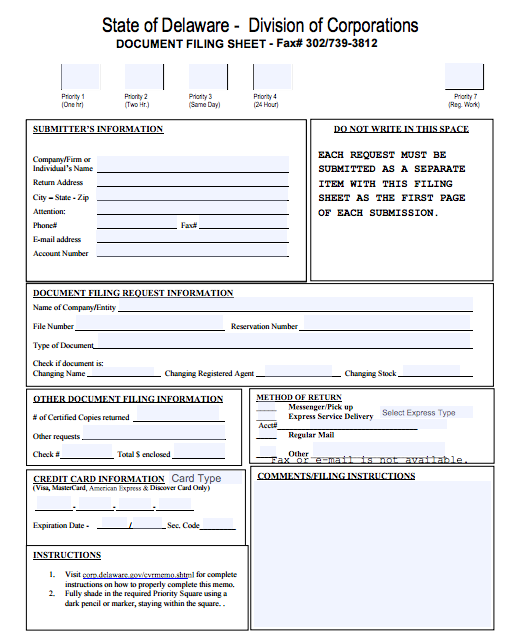

A delaware llc is created by filing by mail or fax a certificate of formation of limited liability company with the delaware division of corporations.

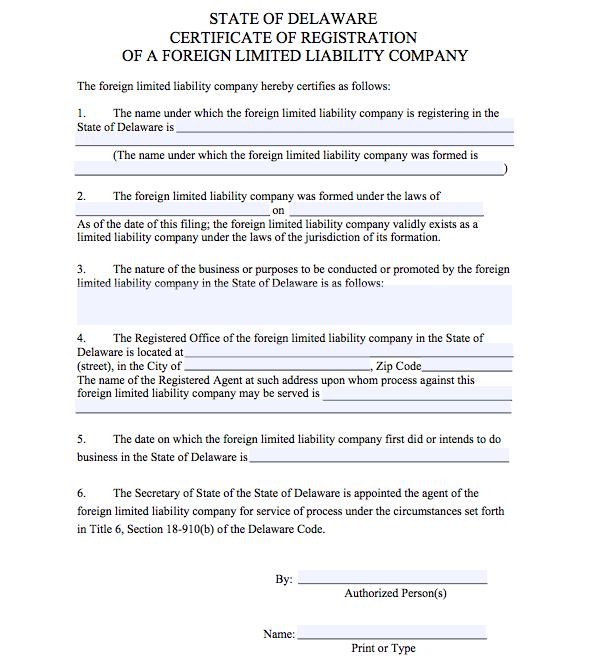

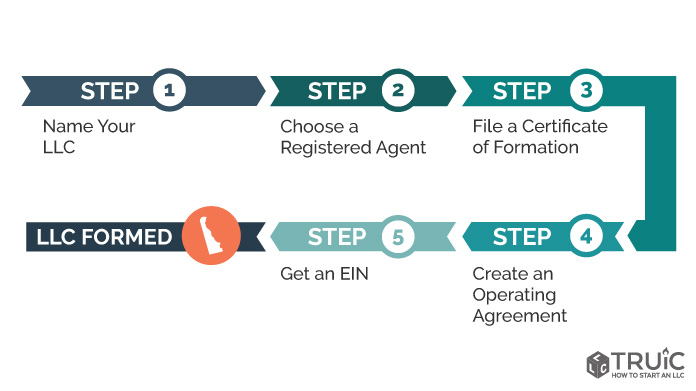

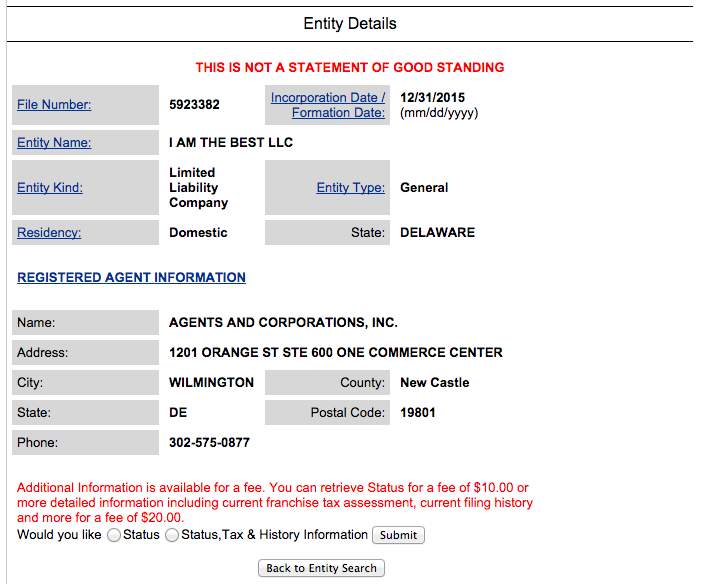

File delaware llc. The name and address of the llc s registered agent signature of an authorized person the organizer or person authorized by the organizer. To form an llc in delaware you will need to file a certificate of formation with the delaware department of state which costs 90 you can apply by mail or in person. The entity information provided on this website free of charge consists of the entity name file number incorporation formation date registered agent name address phone number and residency. Search for an entity name.

The certificate must include. Limited liability companies classified as corporations must file either delaware form 1100 or form 1100s. The certificate of formation is the legal document that officially creates your delaware limited liability company. There is no delaware tax return to file for llcs that are formed in delaware provided they conduct no business in delaware.

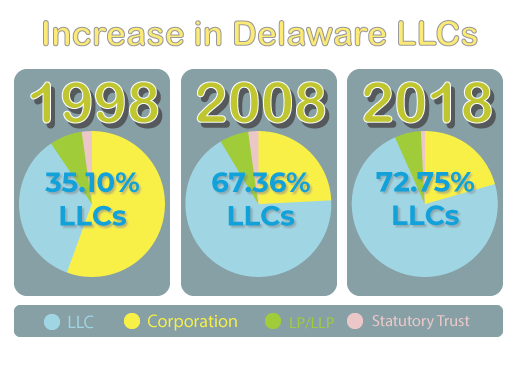

Always pay a fair price the simplest way to start your u s. Corporations public benefit corporations effective august 1 2013 limited liability companies llc limited partnerships lp statutory trusts and many general partnerships gp are required to file with the delaware division of corporations. Forming an llc in delaware is easy. Searching or reserving an entity name.

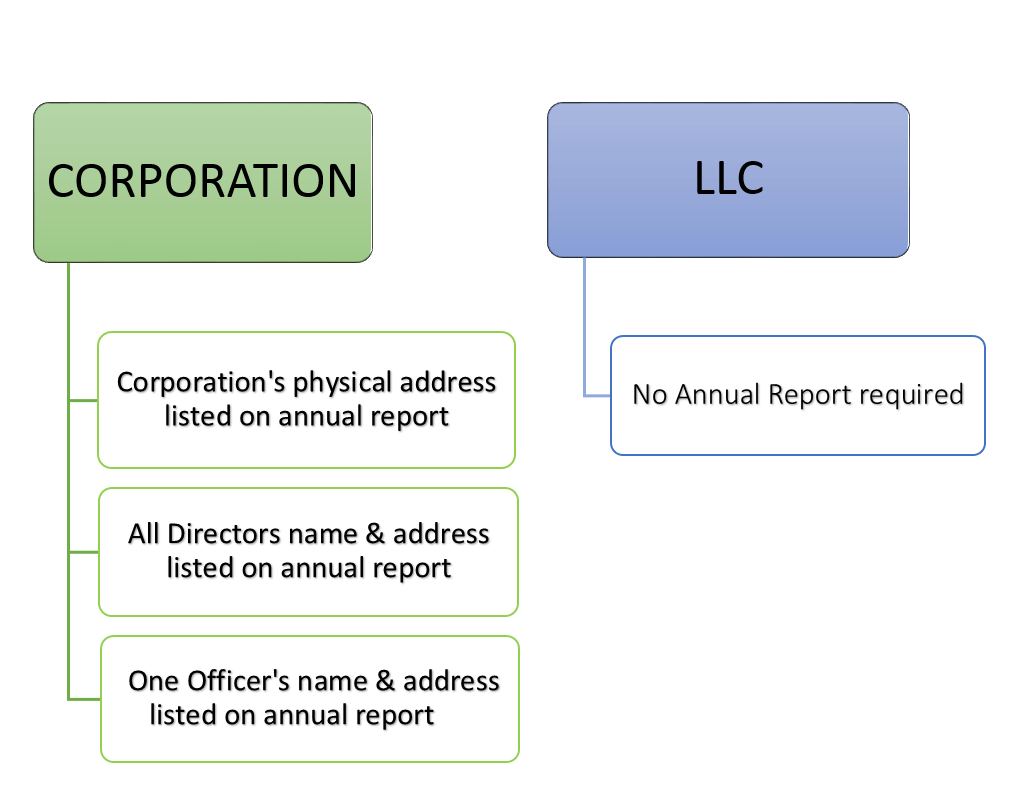

If you don t live in or do business in delaware and you ve heard that you should form an llc in delaware let me save you a lot of money and headaches. Delaware llcs do not pay a franchise tax or file an annual report. 179 one time fee order now all delaware state fees first year free registered agent one complete year. What is a single member limited liability company llc.

The tax is a flat annual fee of 300. Sole proprietorships do not file with the delaware division of corporations. A single member llc can be either a corporation or a single member disregarded entity. An llc is taxed as a sole proprietorship or partnership unless it elects s corporation or c corporation tax status.

The disadvantages of forming an llc in delaware far. How to file a delaware llc annual report annual delaware llc maintenance overview. You should not form an llc in delaware. However additional information can be obtained for a fee.

Enhanced screening of business entities formed in delaware now required. File your annual report or pay lp llc taxes online. Instead llcs in delaware must pay an annual tax sometimes referred to as an alternative entity tax. If you live in delaware or do business in the state then this information does not apply to you.

Company since delaware business formation is so simple there is no need to make this procedure so complicated. Start a company basic optimize your business. Important updates effective august 1 2019.