Financing Receivable Definition

The term financing receivables is used to describe an arrangement whereby a business uses its receivables to gain immediate access to cash.

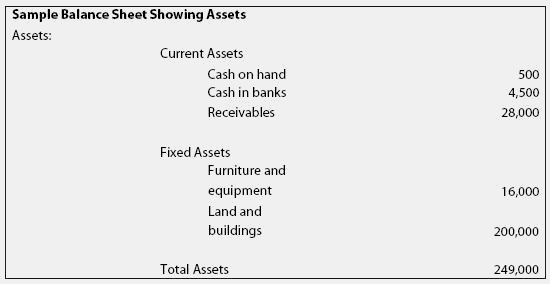

Financing receivable definition. Money that a customer owes a company for a good or service purchased on credit. These are generally in the form of invoices raised by a business and delivered to the customer for payment within an agreed time frame. Accounts receivable a r are amounts owed by customers for goods and services a company has sold to those customers. How does accounts receivable financing work.

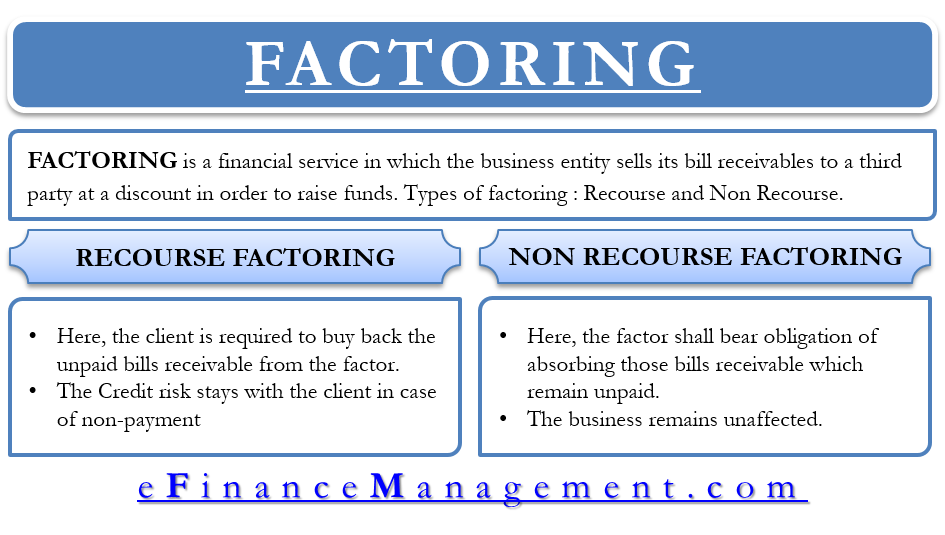

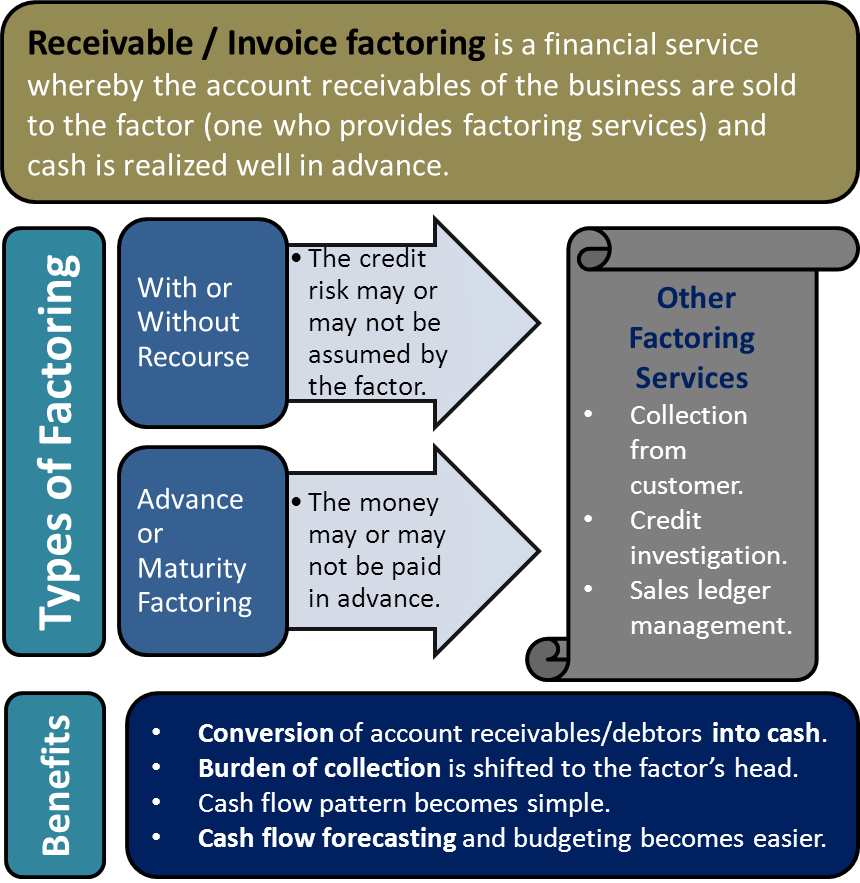

Accounts receivable financing allows companies to receive early payment on their outstanding invoices. Accounts receivable ar financing is a type of financing arrangement in which a company receives financing capital related to a portion of its accounts receivable. What is accounts receivable ar financing. Accounts receivable financing also called factoring is a method of selling receivables in order to obtain cash for company operations.

Accounts receivable are current assets for a company and are expected to be paid within a short amount of time often 10 30 or 90 days. Accounts receivable financing involves a business selling its receivables to a third party financial company also known as a factor. Financing receivables usually fall into two broad categories which involve either the sale of receivables or a secured loan. Accounts receivable are legally enforceable claims for payment held by a business for goods supplied and or services rendered that customers clients have ordered but not paid for.

Financing receivables better known as accounts receivable financing is a way to quickly convert receivables into cash. Accounts receivable financing refers to an arrangement where a corporate gets access to capital by selling their outstanding receivable invoices to the bank wherein the risk of uncollected receivables may lie with the corporate or with the bank depending on the agreement. A company using accounts receivable financing commits some or all of its outstanding invoices to a funder for early payment in return for a fee.

/open-book-with-figures-and-paper-with-words--accounts-receivable--613785056-c6a530e62e164acf899fc612ab80b528.jpg)