Does Liability Insurance Cover Other Drivers

This policy will cover you if you happen to lend your boat out providing temporary boat insurance coverage to individuals who may not be on your policy.

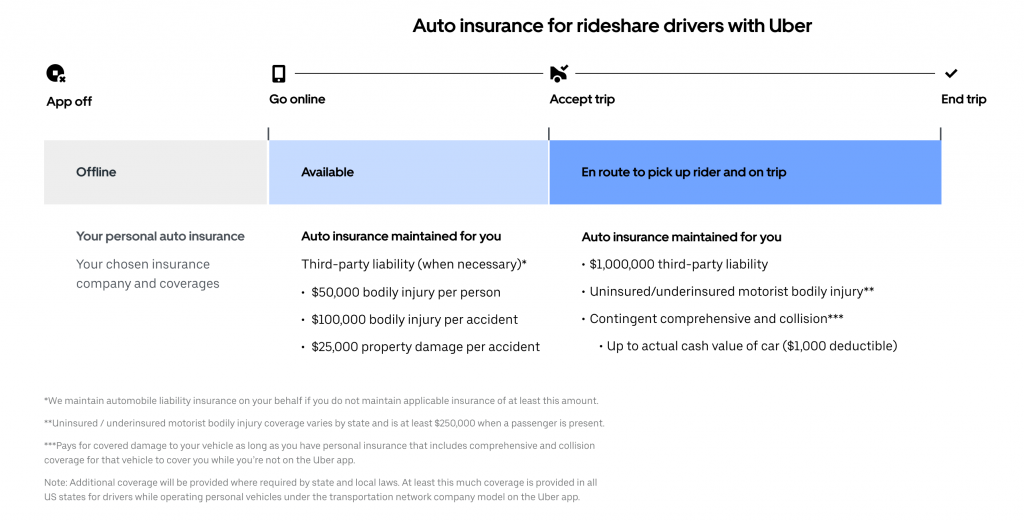

Does liability insurance cover other drivers. Auto liability insurance coverage helps cover the costs of the other driver s property and bodily injuries if you re found at fault in an accident. In most states the insurance company will pay to cover repairs to your vehicle regardless of who is driving. For instance if your friend has an insurance plan with a 25 000 limit on liability coverage and you get in a crash that causes 35 000 of damage to the other driver your friend s plan would cover the first 25 000 and your own plan would cover the remaining 10 000. Liability coverage is what allows a driver to drive a friend s car and still be covered under their own auto insurance policy.

Liability insurance pays for. This means that it covers the other driver in a car accident not you or your friend. It s a critical policy to attach to your standard liability coverage it fills in the gaps left and is not confined to just you making it the most salient feature of the policy. In your car insurance policy your car is covered by the comprehensive and collision coverage and you are covered through your liability and any medical coverage.

Liability car insurance coverage follows a driver no matter what car they are driving. Liability coverage protects the insured i e follows the driver when the insured operates a vehicle owned by. Bodily injury liability coverage sometimes abbreviated as bi if you re at fault for an accident that injures another person bodily injury liability coverage helps pay for their medical expenses. All states except for one new hampshire require at least liability coverage.

Auto liability insurance helps cover another person s medical expenses and property damage via these two types of coverage. 1 but when insurers look at the person behind your wheel and the other car involved in the collision things become less. Most states require at least liability coverage and many states have assistance programs for low income residents who qualify. This means your insurance will likely cover another driver in the event of an accident as long as they had your permission to drive your vehicle.

Liability insurance protects you from legal and financial liability for someone else s injuries. You re at a four way stop a few blocks from your house.

:max_bytes(150000):strip_icc()/200286343-012-56a0f42c3df78cafdaa6ba5b.jpg)

/auto-accident-involving-two-cars-on-a-city-street-970958674-a196dc719c4a464a99c5cf128f2b1aa2.jpg)

/car_accident-e79ae57204b34f5589a2967bff98e89a.jpg)