Home Insurance Pennsylvania

Customize your homeowners coverage.

Home insurance pennsylvania. Zip code zip code. Even if you don t own a home but rather rent an apartment you can purchase renters insurance to cover your personal belongings. Erie insurance state farm amica mutual and chubb are all among the best pennsylvania homeowners insurance companies. Take a closer look at how you can protect the place you call home with a house home.

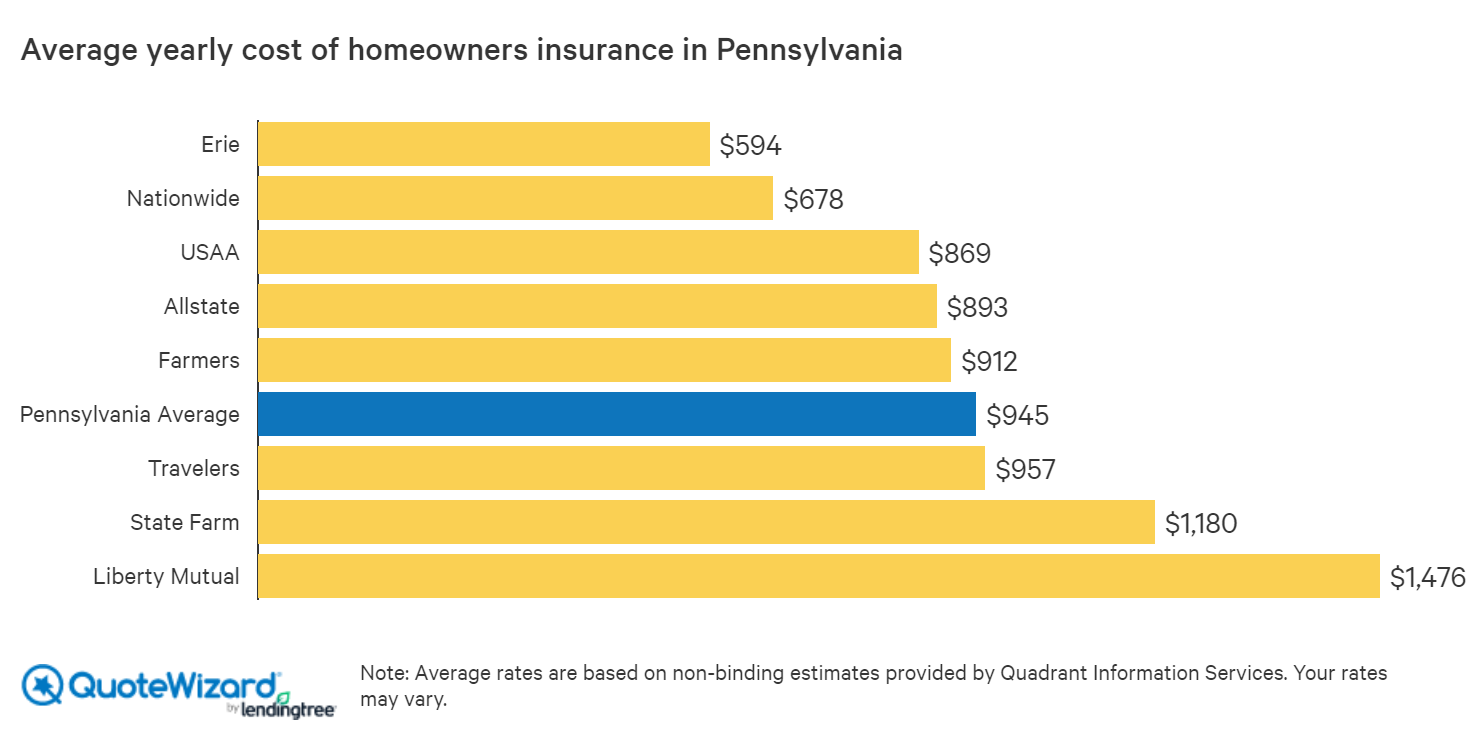

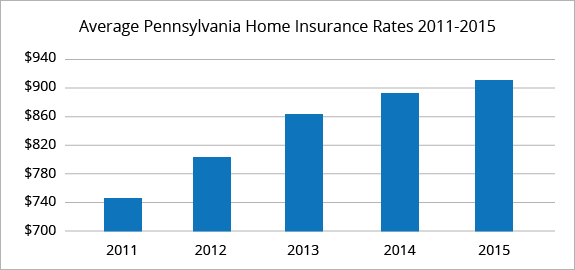

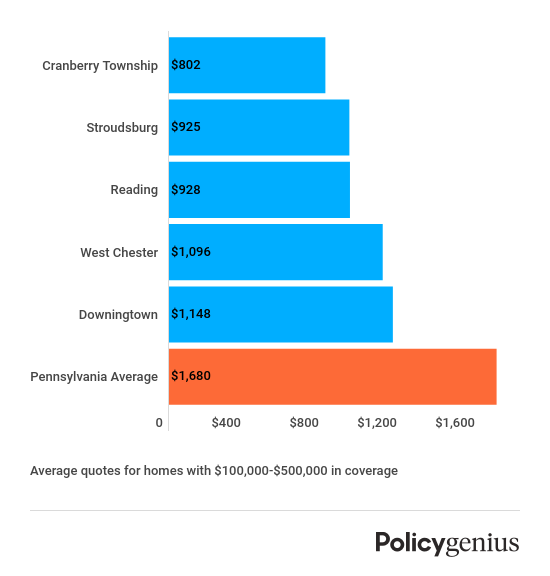

According to the insurance information institute iii the average cost of a homeowner s insurance premium in pennsylvania is 913 making pa the 38th most expensive state in the country for home insurance. Pennsylvania homeowners insurance rates by zip code pennsylvania has some of the cheapest home insurance in the country but that doesn t mean you ll pay little for your policy. Your area home claims history coverage level and deductible all play a role in the cost of a home insurance policy. Though not mandatory under pennsylvania law a mortgage lender may require you to purchase homeowners insurance as a condition of your mortgage agreement.

Pennsylvania home insurance includes several categories of critical protection. Enter your zip code to start your quote. Their average annual premium is affordable for pennsylvania residents and the company offers many options for additional coverage such as identity theft loss assessment personal umbrella policy and personal injury. Pennsylvania homeowners face many challenges throughout the year.

Low cost philadelphia pa home insurance packages fast online pa home insurance quotations. Nationwide s pennsylvania home insurance can cover you in the event of theft certain natural disasters water backup damage and more. Pennsylvania national mutual casualty insurance company or penn national specializes in pennsylvania home and auto insurance and offers its products in 11 states. And with our home insurance discounts members can save even more on our affordable rates.

Get coverage that fits your home. From philadelphia to pittsburgh your home in pennsylvania deserves the best protection there is. Most insurers in this state provide coverage for your dwelling also called your home structure other structures on the property such as a shed or stand alone garage and personal property which may include furniture bicycles and stereos.