Home Quity Loans

:max_bytes(150000):strip_icc()/home-equity-loans-315556_final3-23fa1237c577475f811fe9fc06eedec2.png)

Common reasons to take out a home equity loan are.

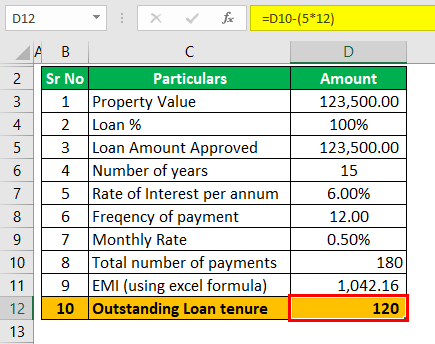

Home quity loans. More how the loan to value ltv ratio works. A home equity loan is a second mortgage that borrows against the equity in your home and uses your house as collateral to secure the loan. A home equity loan is a type of loan in which the borrower uses the equity of his or her home as collateral the loan amount is determined by the value of the property and the value of the property is determined by an appraiser from the lending institution. A home equity loan is an installment loan based on the equity of the borrower s home.

Why you might want a home equity loan. Lenders are required by law to verify your finances and you ll have to provide proof of income access to tax records and more. Home equity loans usually have fixed interest rates and are available in terms of five to 15 years. The interest rates are competitive with other types of loans and the terms.

All mortgage loans typically require extensive documentation and home equity loans are only approved if you can demonstrate an ability to repay. A home equity loan hel is a second mortgage that allows you to tap a portion of your home s value in a lump sum payment. A home equity loan is a consumer loan secured by a second mortgage allowing homeowners to borrow against their equity in the home. Most home equity lenders allow you to borrow a certain percentage of your home equity typically up to 85 percent.

Tapping home equity accesses the portion of the home you ve paid for to get one lump sum payment without having to sell your home or refinance your first mortgage. If you haven t already paid off your first mortgage a home equity loan or second mortgage is paid every month on top of the mortgage you already pay hence the name second mortgage. Make major improvements to your.