Factoring Credit

An example of factoring is the credit card.

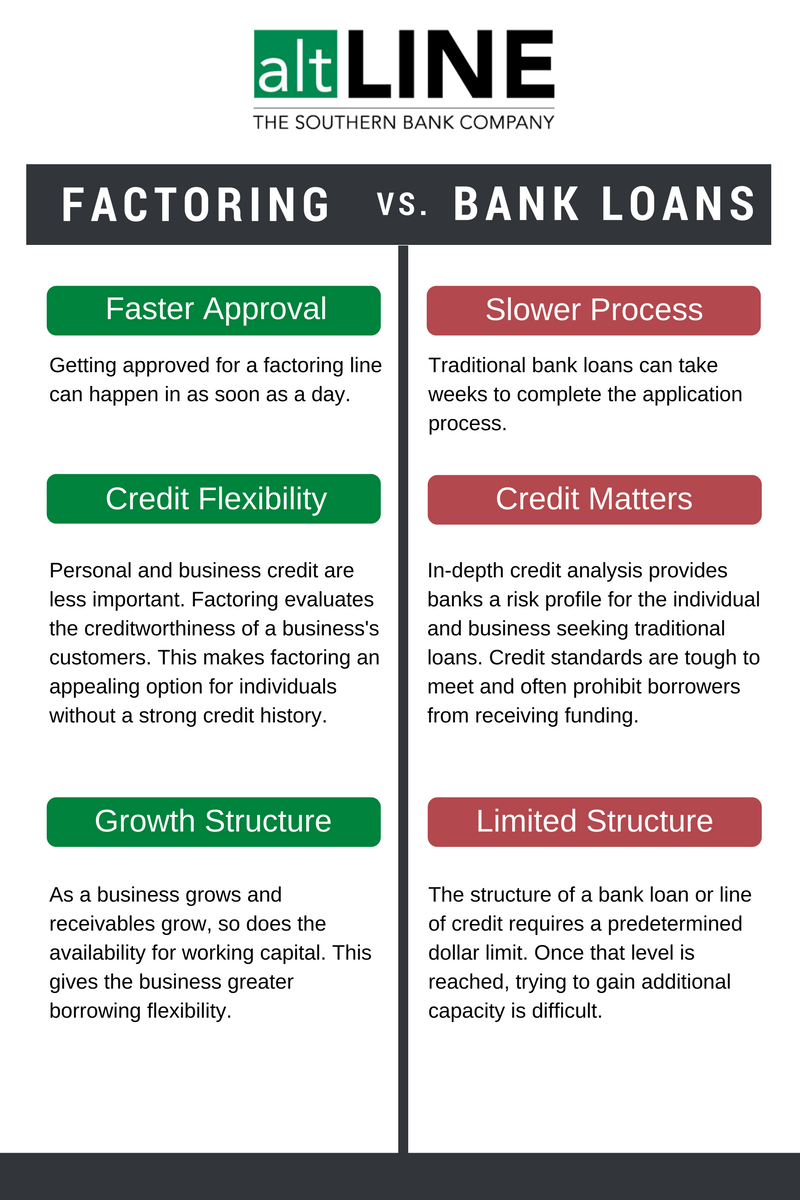

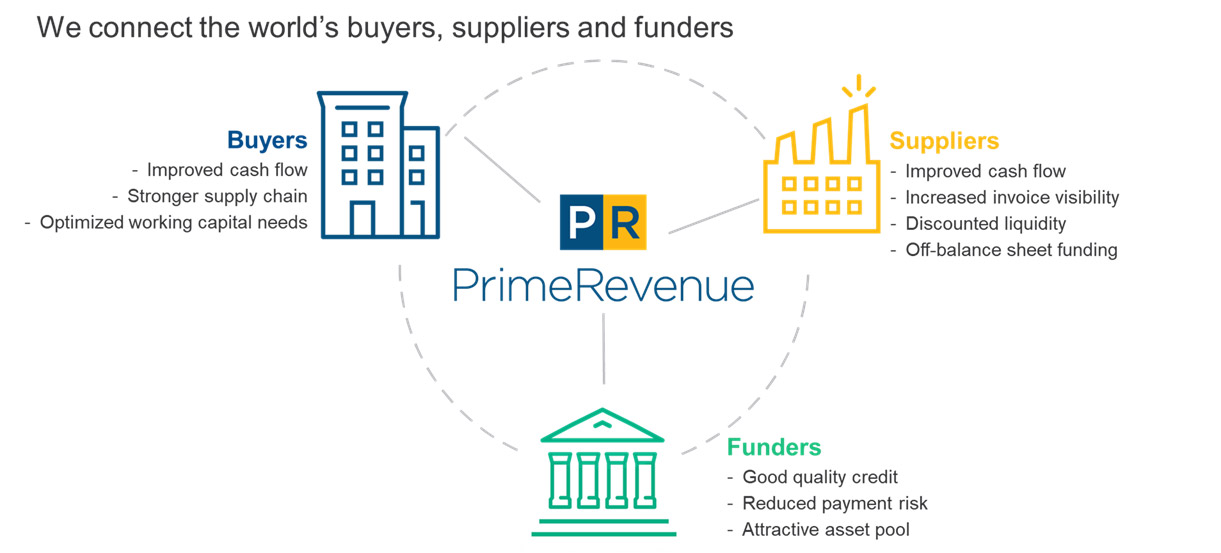

Factoring credit. Companies allow their clients to pay at a reasonable. You can immediately put the liquidity to use in the company increasing your flexibility so that you can utilize current market opportunities or finance investments for growth. Keeps your company connected to your customers. Chez crédit mutuel factoring.

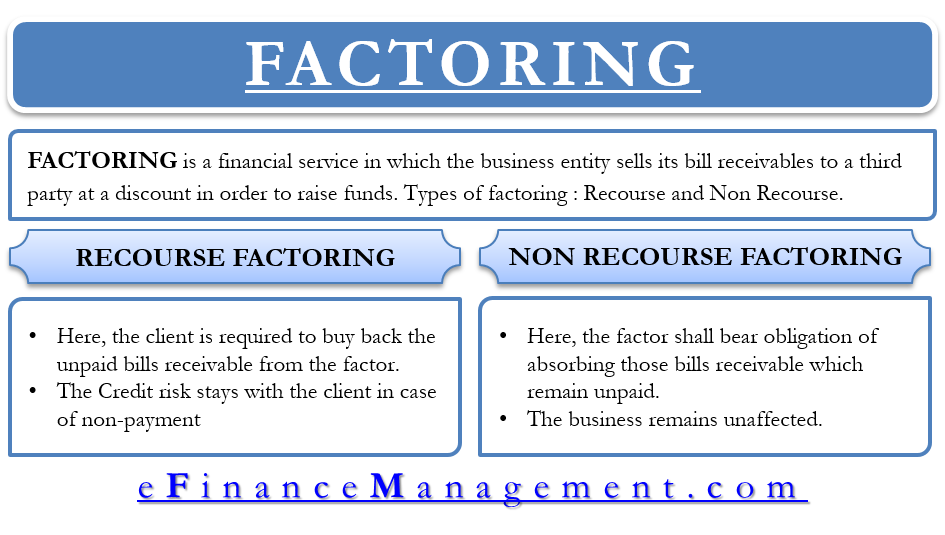

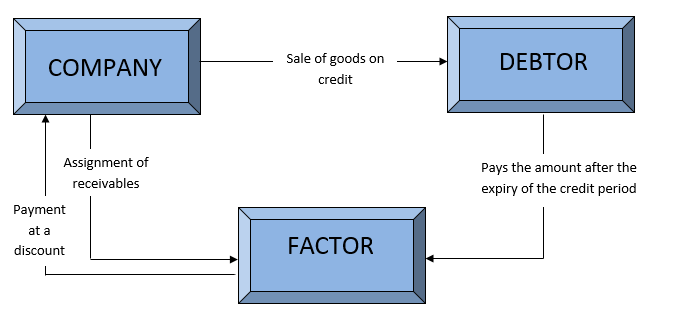

Traditional credit card factoring is a felony. Nous imaginons et créons avec nos clients les solutions de financement de demain pour les accompagner dans leur développement en france et à l international. Credit insurance is a compelling and affordable alternative to accounts receivable factoring. Factoring receivables factoring or debtor financing is when a company buys a debt or invoice from another company factoring is also seen as a form of invoice discounting in many markets and is very similar but just within a different context.

As of last week we have taken all the necessary measures to protect our teams and our operations. The covid 19 health crisis is at the heart of everyone s concerns and crédit agricole leasing factoring is mobilised to give you all the support you need. With this innovative form of financing you sell outstanding trade receivables to the bank. Insuring accounts receivable with credit insurance.

Credit insurance can strengthen both cash flow and strategic decision making. What is accounts receivable factoring. If so factoring with credit suisse is your best option. In this purchase accounts receivable are discounted in order to allow the buyer to make a profit upon the settlement of the debt.

Factoring without recourse is a sale of a financial asset the receivable in which the factor assumes ownership of the asset and all of the risks associated with it and the seller relinquishes any title to the asset sold. Also any financial losses that occur must be compensated.