Employers Liability Insurance Policy

It s a key policy since almost one in five small businesses will face employee litigation according to hiscox.

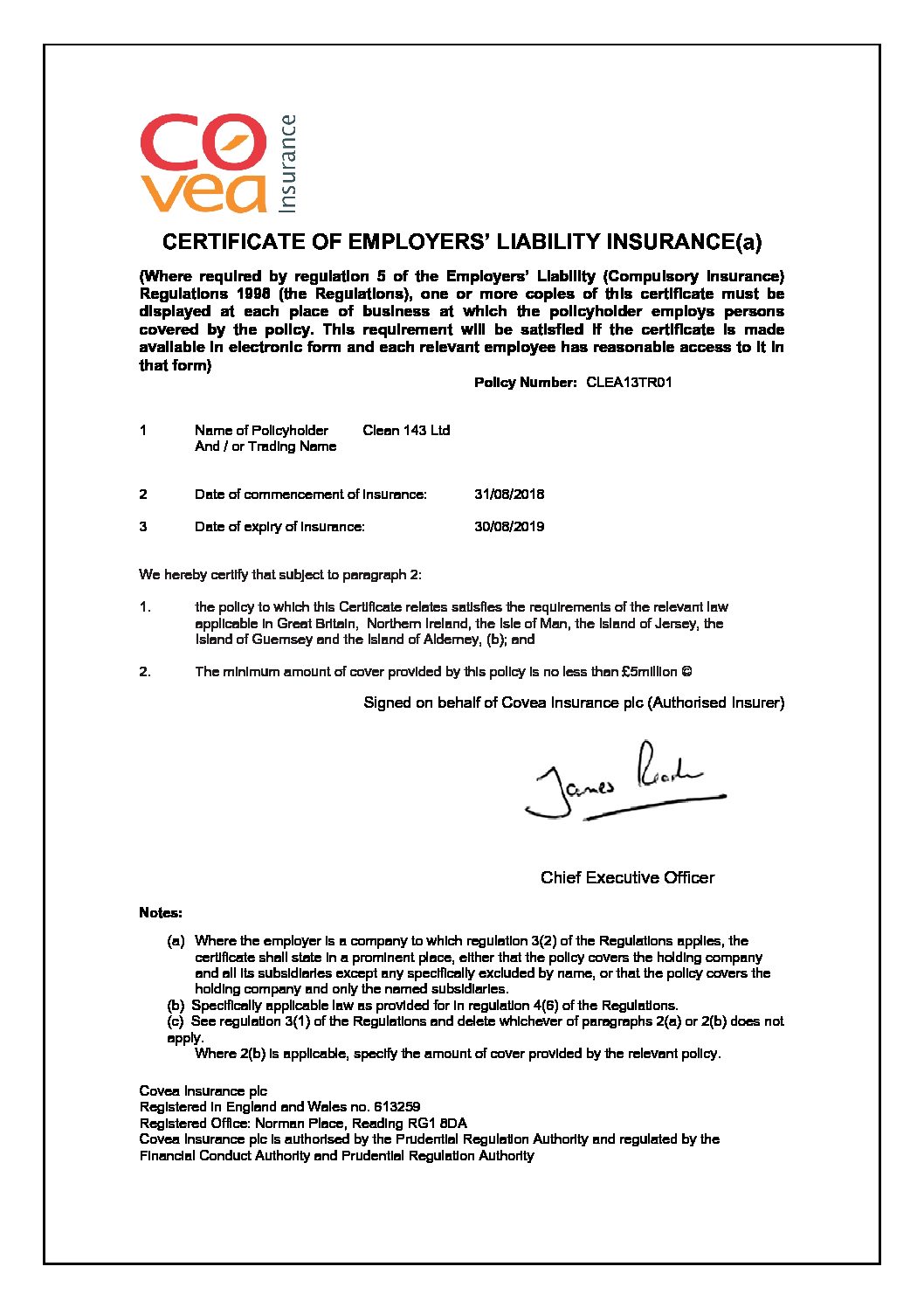

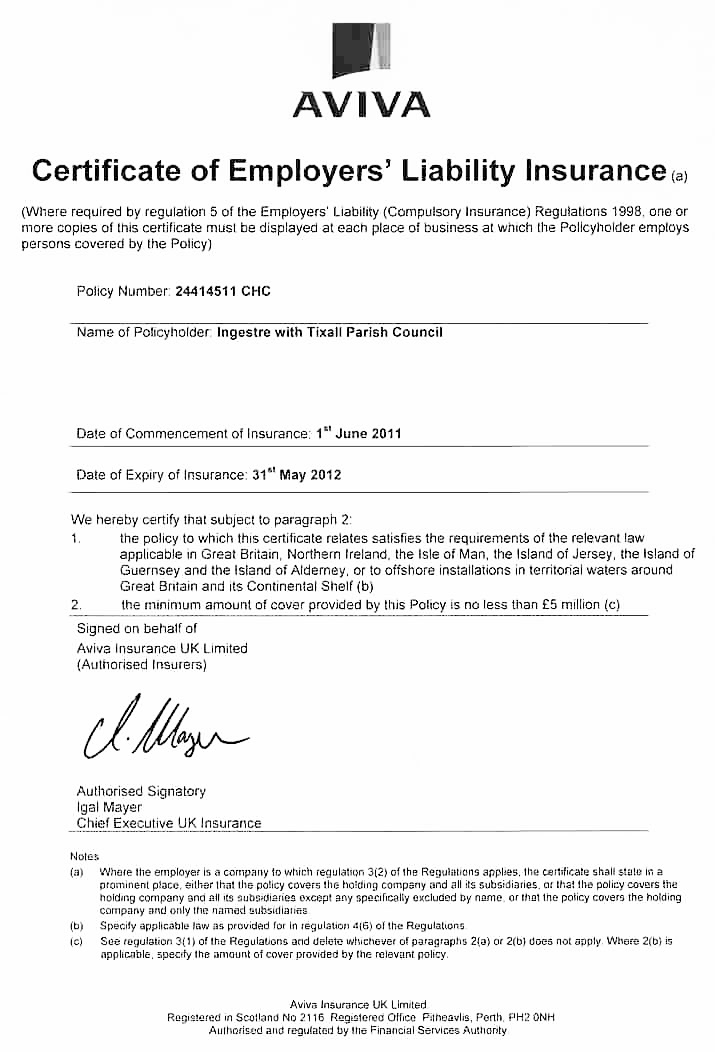

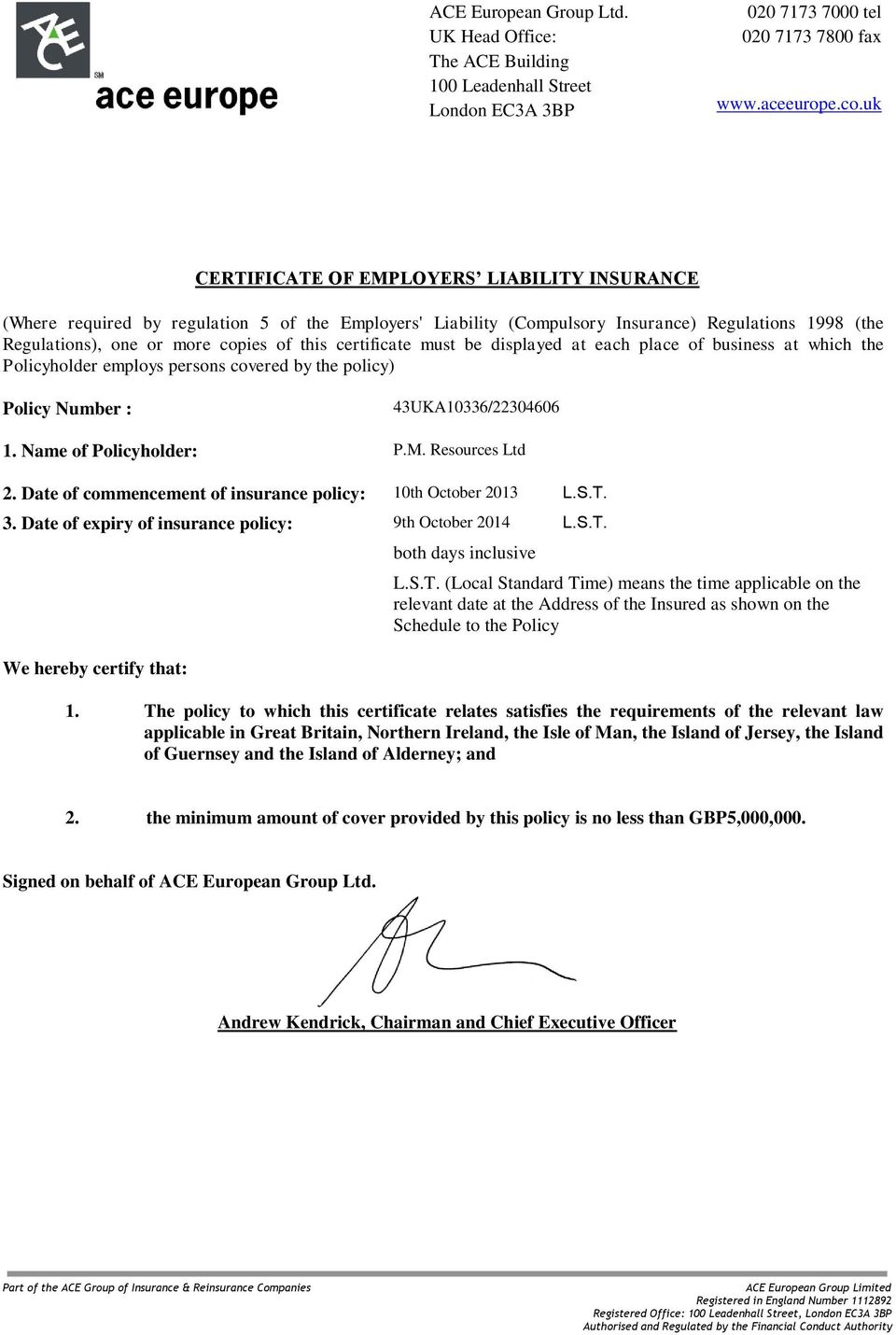

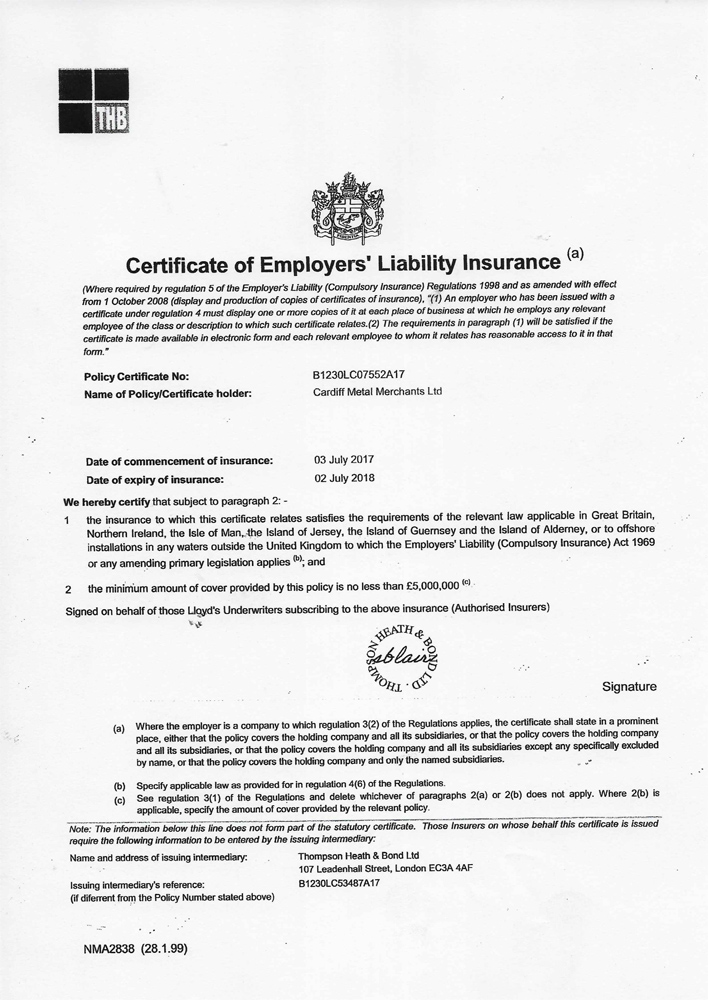

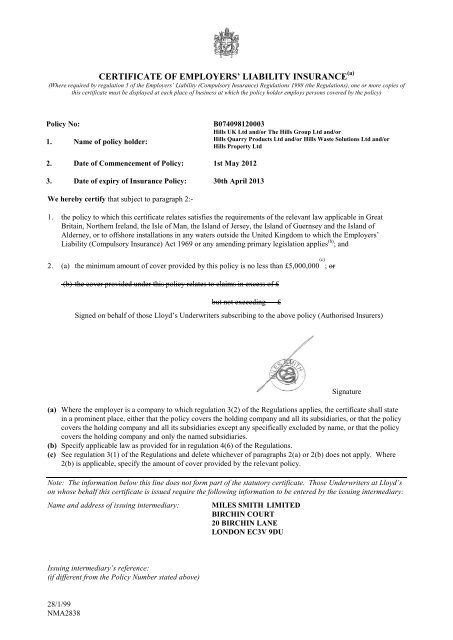

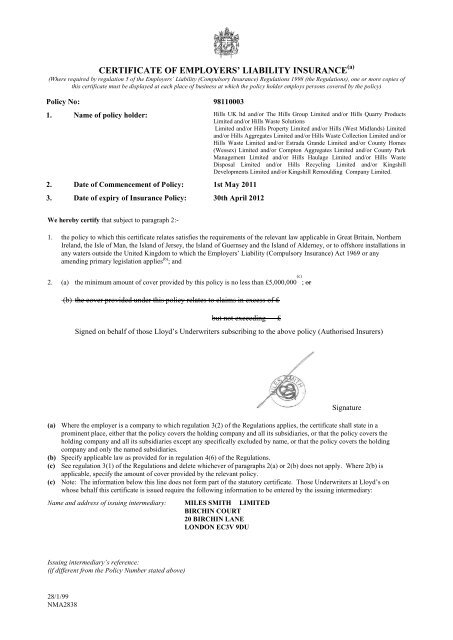

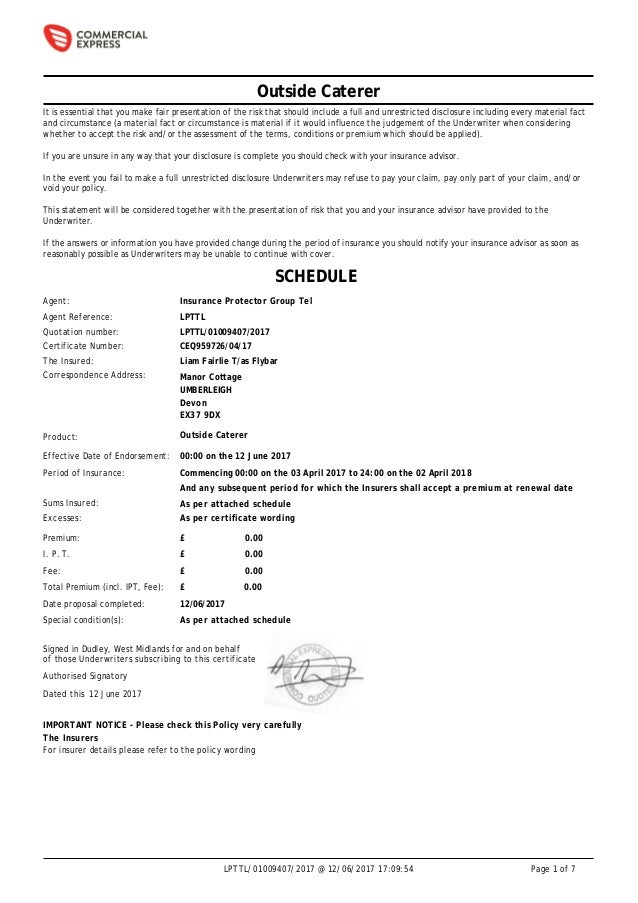

Employers liability insurance policy. Employers liability compulsory insurance act 1969 ensures that you have at least a minimum level of insurance cover against any such claims. Employers liability insurance covers you and your business for compensation costs if an employee becomes ill or injured as a result of the work they do for you. Employers liability insurance policies also place limits on what they must pay out per employee per injury and per illness. To protect your business from costs resulting from employee claims that are not covered by workers compensation benefits.

All employees doing non manual work earning a salary of 2 100 or less a month excluding any overtime payment bonus payment annual wage supplement productivity incentive payment and any allowance. Who needs employers liability insurance. Employers liability insurance will enable you to. All employees doing manual work regardless of salary level.

Employer s liability insurance is part of workers compensation insurance. Employers liability insurance is required by law for most businesses. Liability insurance also called third party insurance is a part of the general insurance system of risk financing to protect the purchaser the insured from the risks of liabilities imposed by lawsuits and similar claims and protects the insured if the purchaser is sued for claims that come within the coverage of the insurance policy. It protects employers from employee related litigation arising from employer negligence.

Employer s liability insurance the policy covers statutory liability of an employer for the death of or bodily injuries or occupational diseases sustained by the workmen arising out of and in course of employment. If you are an employer you are required to buy work injury compensation insurance for. It covers the gap between your company s bottom line and lawsuits stemming from employee activities. Employer s liability insurance protects your business when an employee sues over a work injury or illness.

These limits might be as low as 100 000 per employee 100 000 per. It s legally required of all businesses with one or more employees. Employers liability insurance is purchased with the same thought in mind.