How Does Workers Comp Insurance Work

This is a voluntary agreement between the worker and the employer to close out the case in return for the worker receiving a lump sum payment.

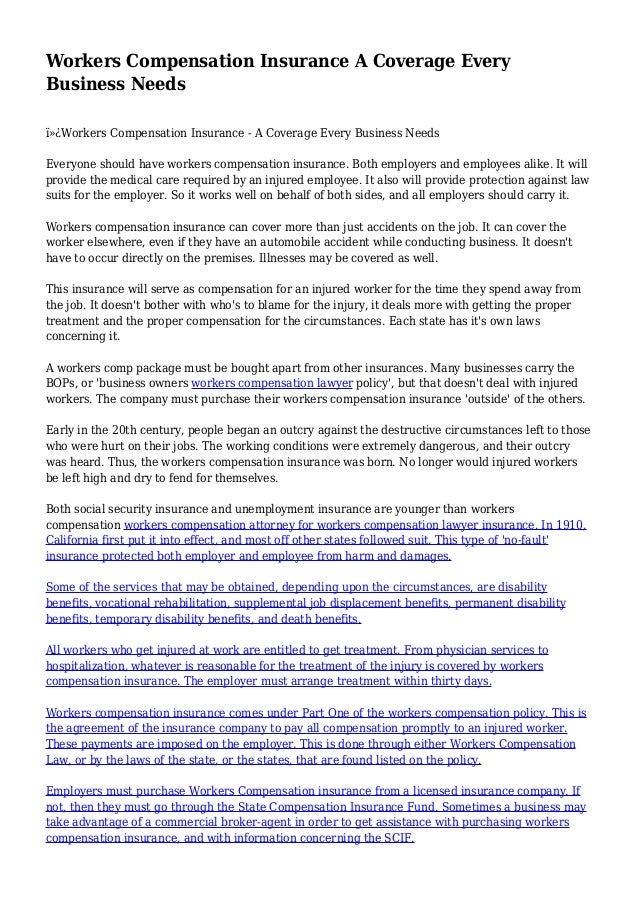

How does workers comp insurance work. Department of labor s website. Medical expenses and rehabilitation. Workers compensation is a form of insurance payment to employees if they are injured at work or become sick due to their work. In other words regardless of the location where the incident occurs if the worker is injured while completing a work task during work hours then their injury or illness is compensable under workers comp insurance.

Workers compensation is insurance paid by companies to provide benefits to employees who become ill or injured on the job through this program workers are provided with benefits and medical care and employers have the assurance that they will not be sued by the employee in most cases. Each state has its own laws and programs for workers compensation. The federal government also has a separate workers comp program mostly for federal employees. Workers compensation or workers comp formerly workmen s compensation until the name was changed to make it gender neutral is a form of insurance providing wage replacement and medical benefits to employees injured in the course of employment in exchange for mandatory relinquishment of the employee s right to sue his or her employer for the tort of negligence.

Wages while they re not fit for work. Workers compensation insurance gives your employees benefits if they have a work related injury or illness also known as workers comp or workman s comp insurance this coverage can help cover your injured or sick employees medical expenses. Employees who get sick or injured on the job can often agree to a workers comp settlement with their employer instead of accepting the insurance company s offer. The federal government does offer its own workers compensation insurance for federal employees but every individual state has its own workers compensation insurance program.

All employees doing non manual work earning a salary of 2 100 or less a month excluding any overtime payment bonus payment annual wage supplement productivity incentive payment and any allowance. These terms all mean the same thing and help protect workers from potentially devastating costs of work related injuries. If you are an employer you are required to buy work injury compensation insurance for. Who needs to be insured.

All employees doing manual work regardless of salary level. Workers compensation is a state mandated insurance program that provides benefits to employees who suffer job related injuries and illnesses.