Deductible Insurance Example

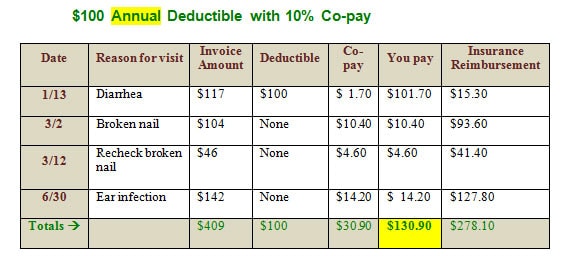

It means many plans have a maximum annual insurance deductible that patient owes.

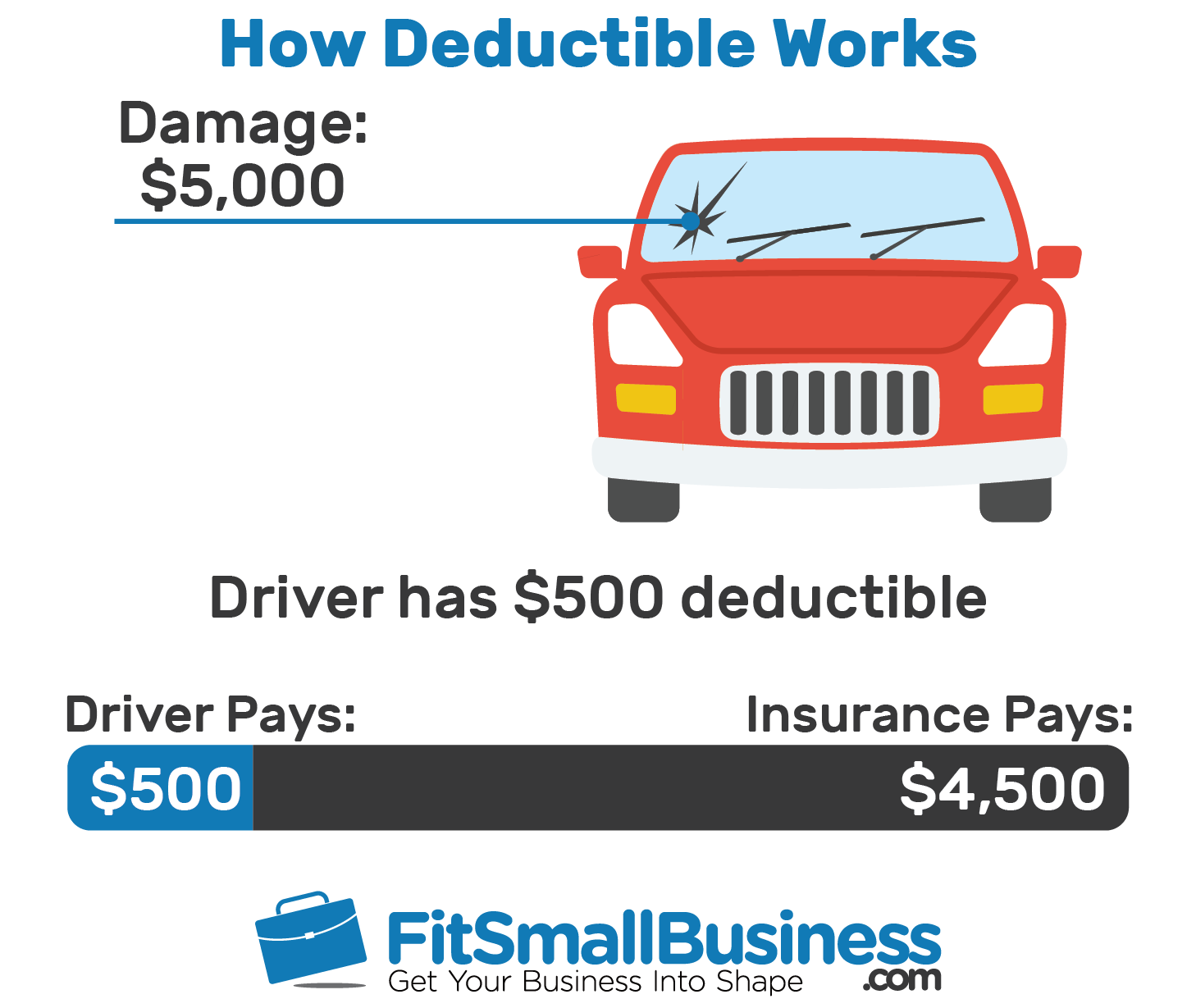

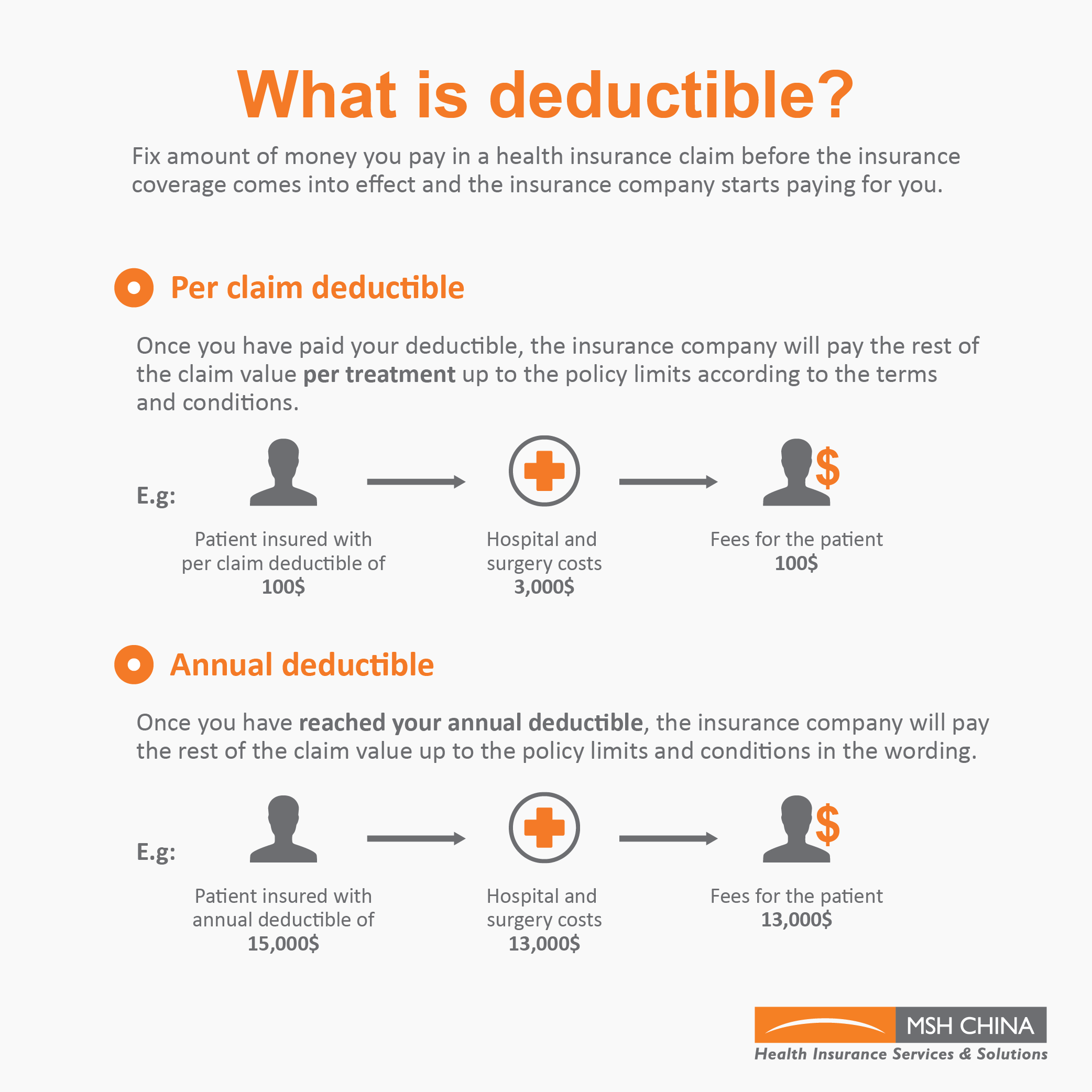

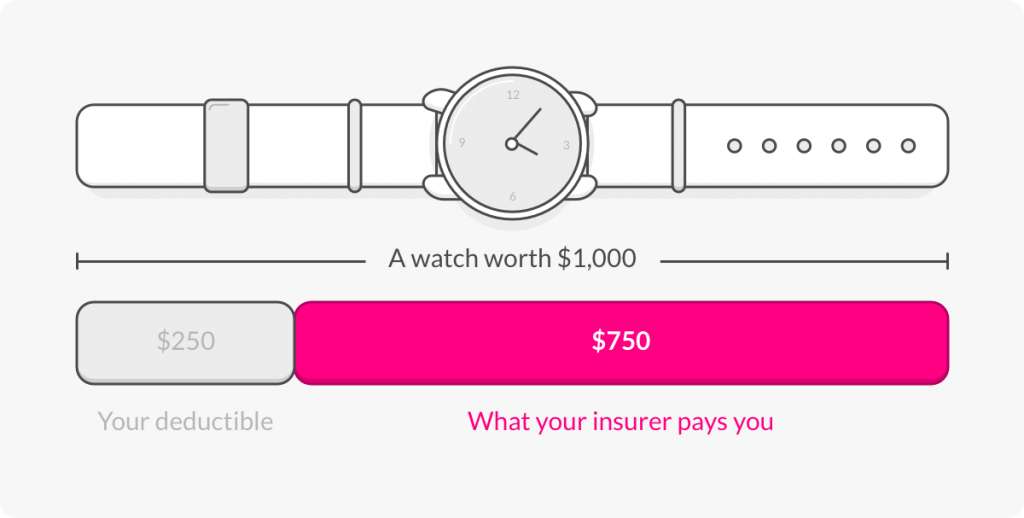

Deductible insurance example. Business expenses may be deductible or non deductible. A deductible is the amount of money an individual pays for expenses before his insurance plan starts to pay. Business expenses are expenses you have paid to run the business. Example of how a deductible works.

A deductible is an amount the insured has to pay as part of a claim whenever it arises and the rest of the amount is paid by the insurance company. 10 000 and the health care claim is of rs. When deductible they reduce your taxable income and the amount of tax you need to pay. For flood insurance claims there may be separate deductibles for your building structure and contents.

In the event of an insurance claim. Some examples are cpf contributions wages renovation advertising etc. For hurricane damage the deductible may apply per season or by calendar year. How it works if your plan s deductible amount is rs.

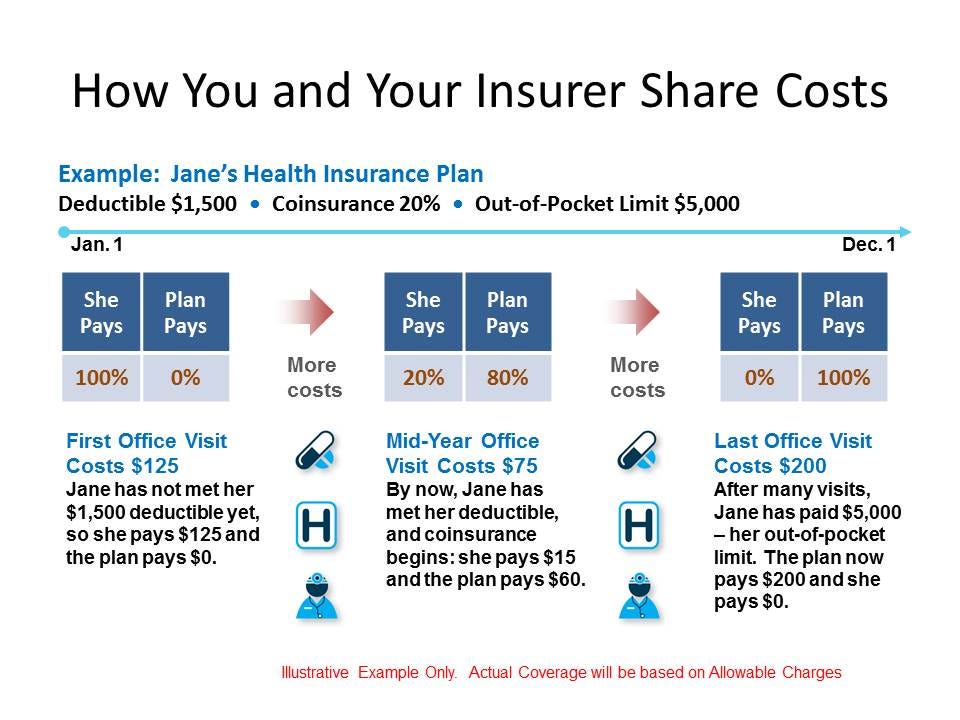

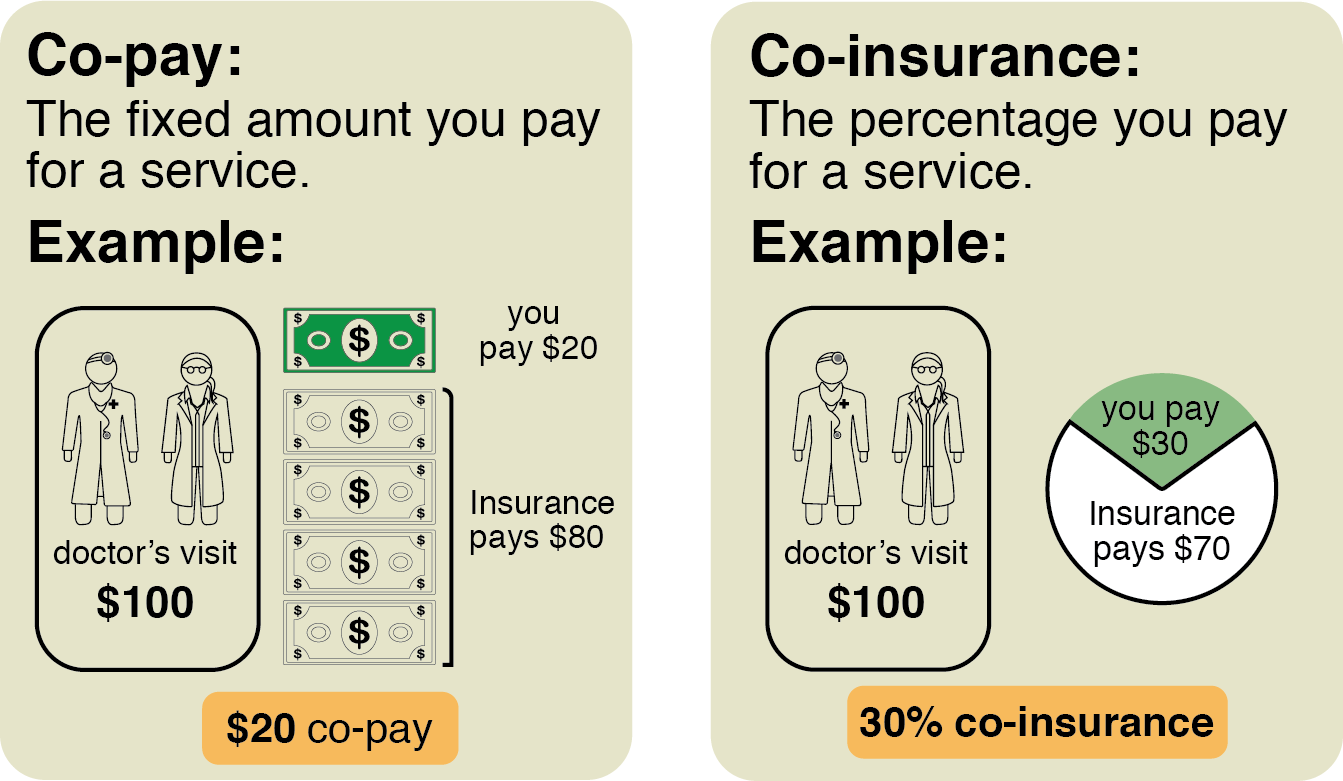

What is deductible in health insurance. After you pay your deductible you usually pay only a copayment or coinsurance for covered services. There are two types of deductibles when it comes to car or auto insurance. Your insurance company pays the rest.

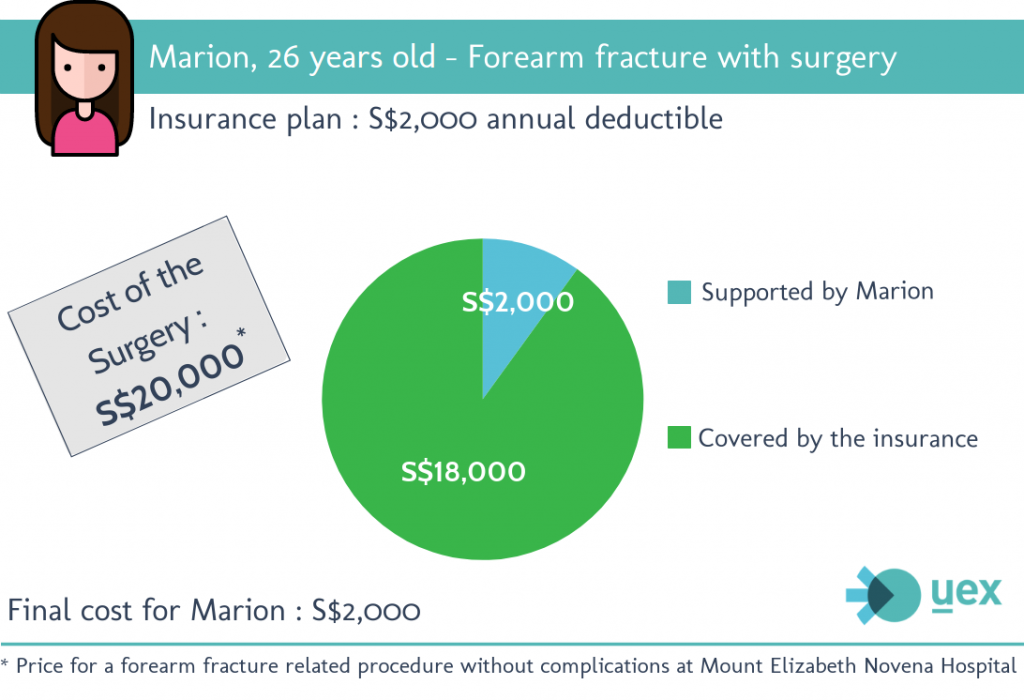

The first type is a collision deductible which is for covering the cost of repairs to a vehicle in case of a collision unless you are deemed at fault for the accident. An aggregate deductible is often part of product liability policies or family health insurance policies and any other policies that might result in a large number of claims during a specific period. Once that annual amount met then the insurance company starts paying the benefit to the provider for the services rendered. With a 2 000 deductible for example you pay the first 2 000 of covered services yourself.

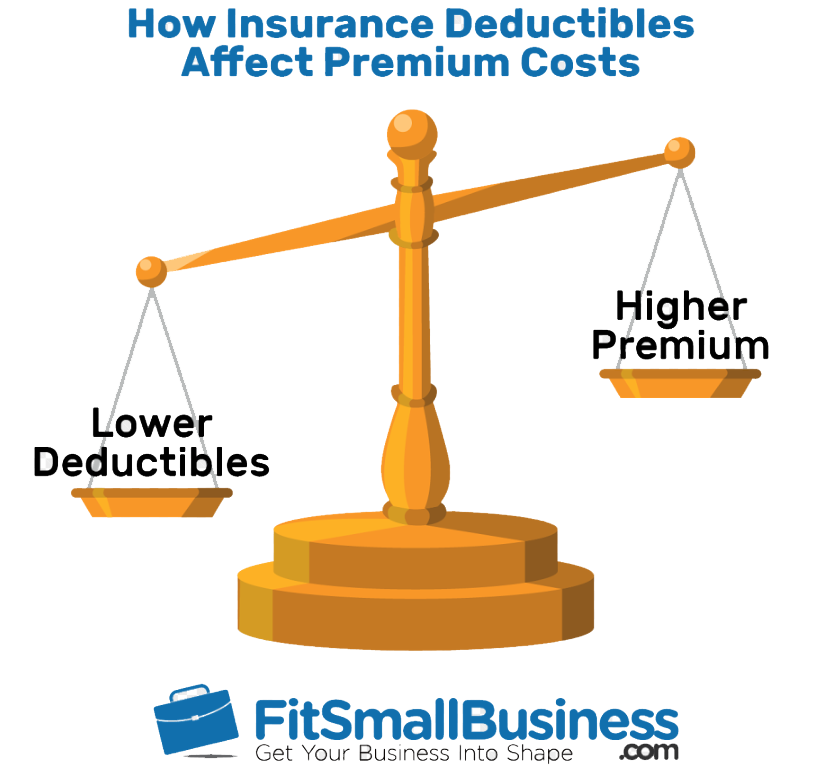

One plan may have a premium of 1 087 a month with a 6 000 deductible while a competitive plan may have a premium of 877 a month with a 12 700 deductible. For example health insurance companies offer plans with high premiums and low deductibles or plans with low premiums and high deductibles. Some home insurance deductibles are based instead on a percentage of the property s insured value. Many plans pay for certain services like a checkup or disease management programs before you ve met your.