Corporation Tax Relief

New employer tax credits.

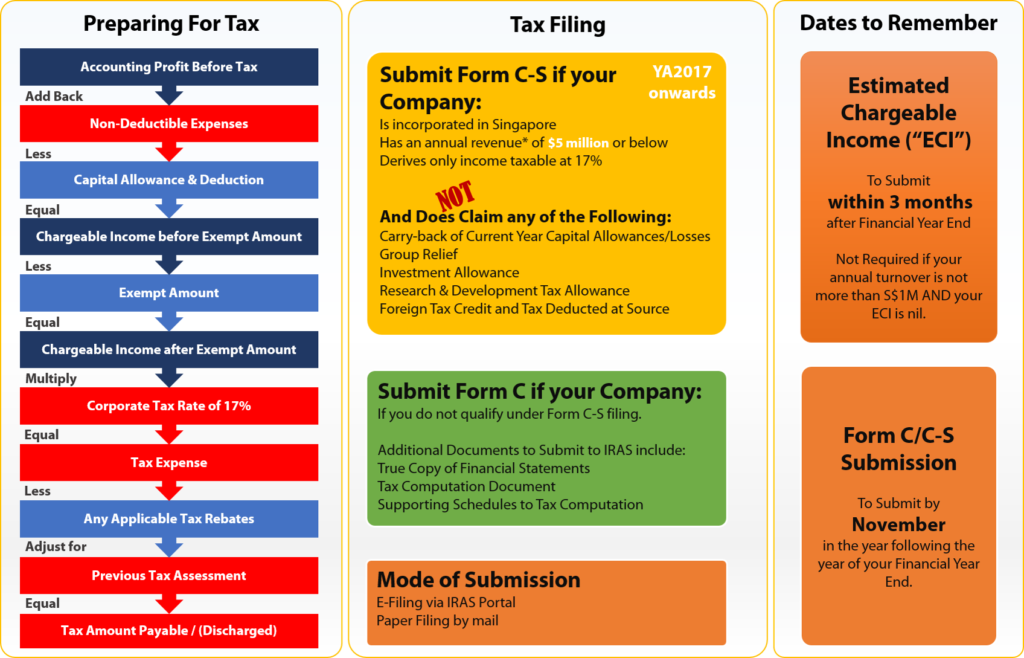

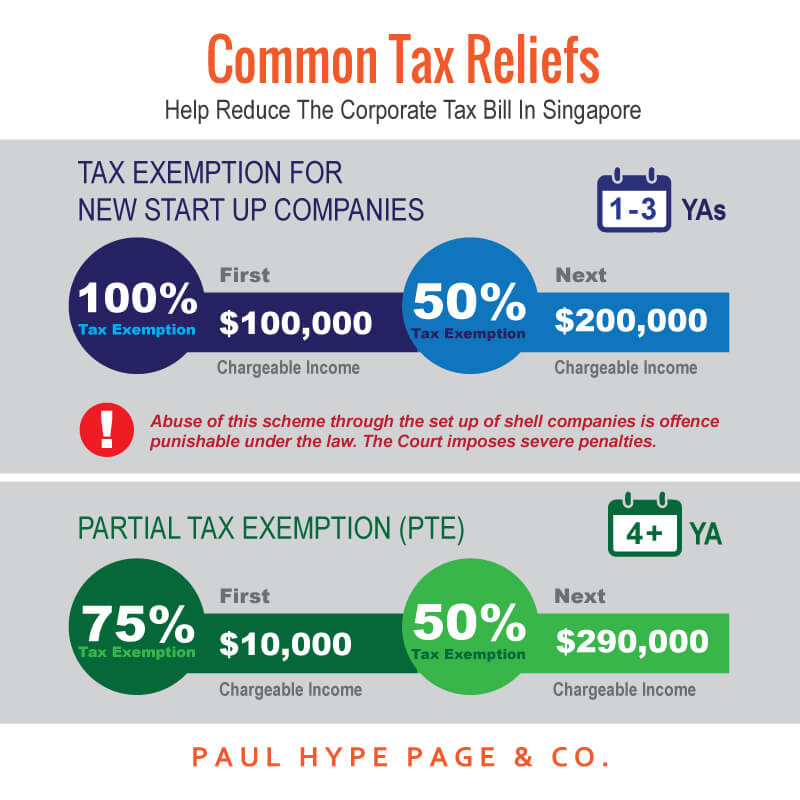

Corporation tax relief. Group relief is a mechanism that allows members of a corporation tax loss relief group for which see below to share the benefit of certain corporation tax losses. This tax relief also known as section 486c tax relief is a reduction of your corporation tax ct for the first three years you trade. Corporation tax relief is available on qualifying research and development r d costs. If you have started a new company you may be able to apply for tax relief for start up companies.

One member of the group can surrender these losses to another member of the group which can deduct the loss from its total profits thus reducing the amount of corporation tax payable. Companies will be granted a 40 corporate income tax rebate capped at 15 000. Companies will be granted a 50 corporate income tax rebate capped at 25 000. Business records that companies must keep.

You may be able to get deductions or claim tax credits on your corporation tax. This r d tax relief allows you to both deduct these costs from your trading income and claim up to an additional 130 230 in total as a corporation tax relief to be deducted from trading profits. Common tax reliefs that help reduce the tax bills. Companies will be granted a 25 corporate income tax rebate capped at 15 000.

Corporate tax rates corporate income tax rebates and tax exemption. Tax residence status of a company. The rate you pay on profits from before 1 april 2015 depends on the. Filing and payment deadlines more for businesses.

So for every 100 your company earns as profit you ll pay corporation tax of 19 reducing the amount you can take from your company as a dividend to 81. Businesses and tax exempt entities. Disincorporation relief if you re closing your company and becoming a sole trader ordinary business partnership or limited partnership terminal capital and property income losses trading losses. Your small or large business or tax exempt organization may be eligible for covid 19 relief.

Paying 100 into an employee s pension fund effectively costs the company only 81 due to the reduction in corporation tax payable and over time the 100 investment can hopefully grow within the pension fund. Basic guide for new companies. Companies will be granted a 20 corporate income tax rebate capped at 10 000. Overview of corporate income tax.

Tax relief and income assistance is available to people affected by the downturn in business due to the covid 19 novel coronavirus. The relief can be applied to the profits from your new trade and on chargeable gains made on assets used in that trade. These are known as reliefs. New company start up kit.

We have a range of ways to help depending on your circumstances. You do not have to be developing or creating leading edge technology to claim r d relief.