Defined Benefit Plan Versus Defined Contribution Plan

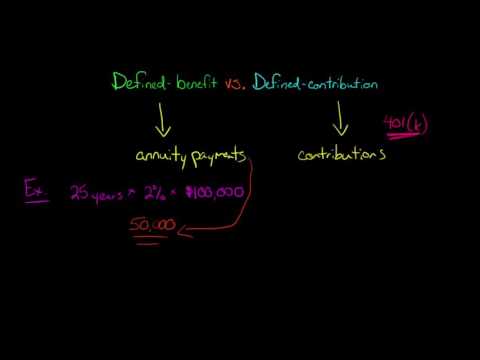

Defined contribution plans in the form of 401k s did not exist until the early 1980 s.

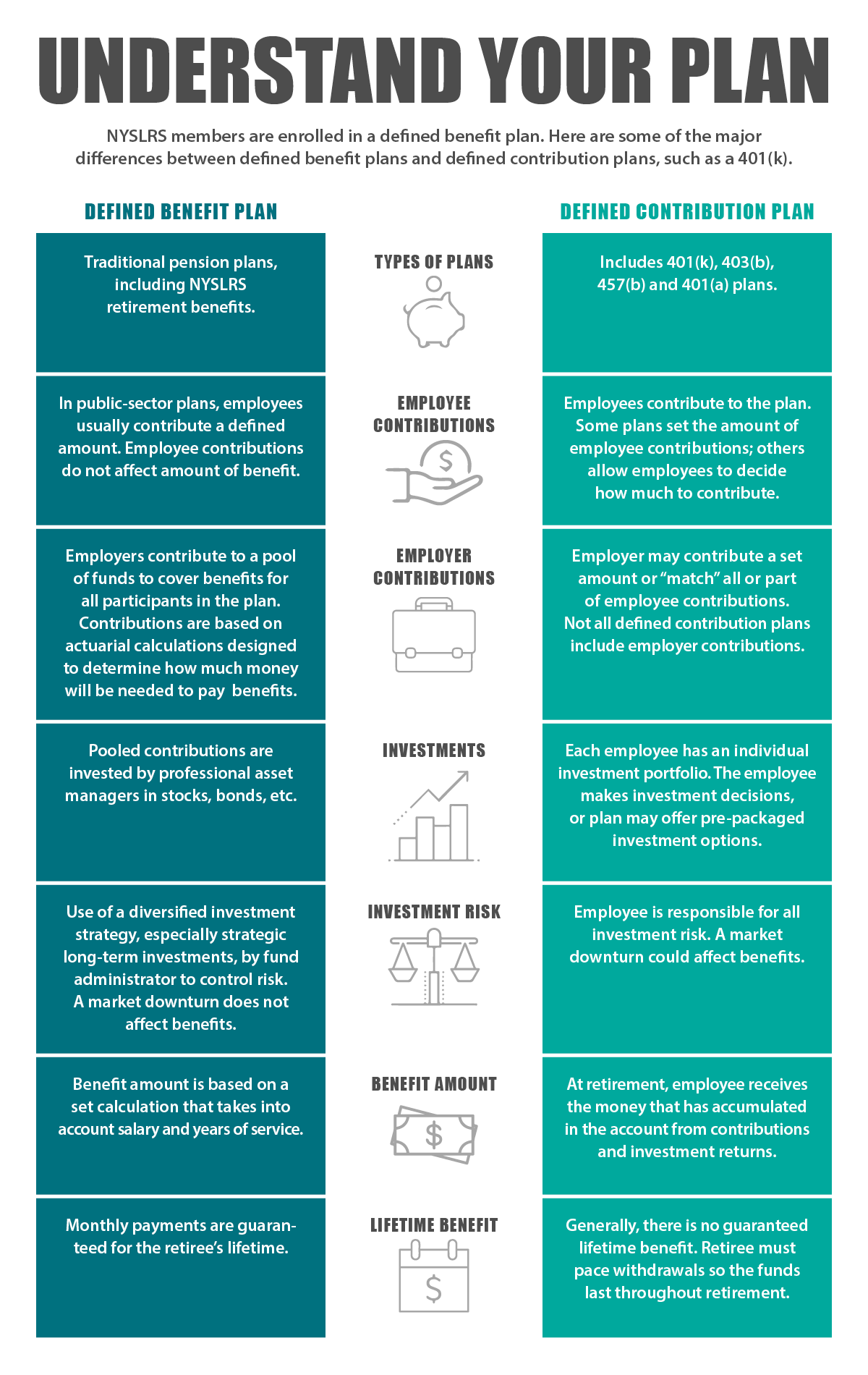

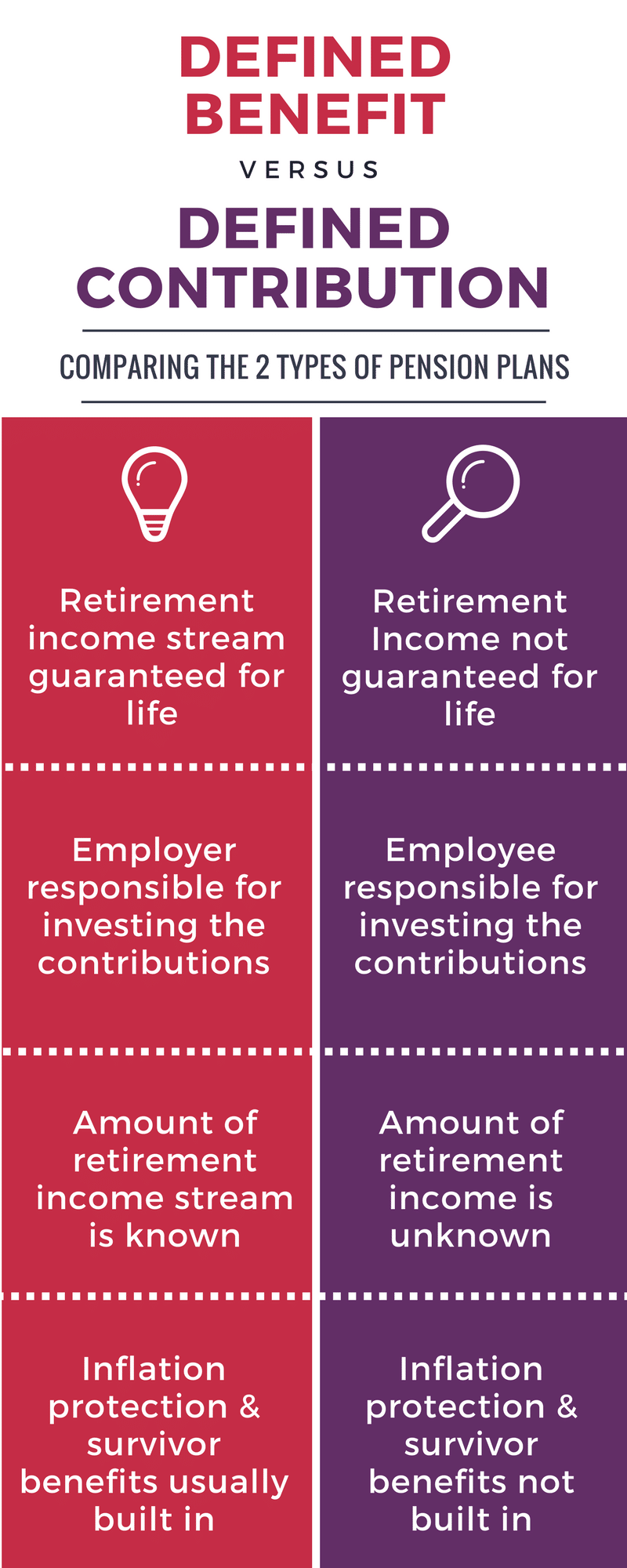

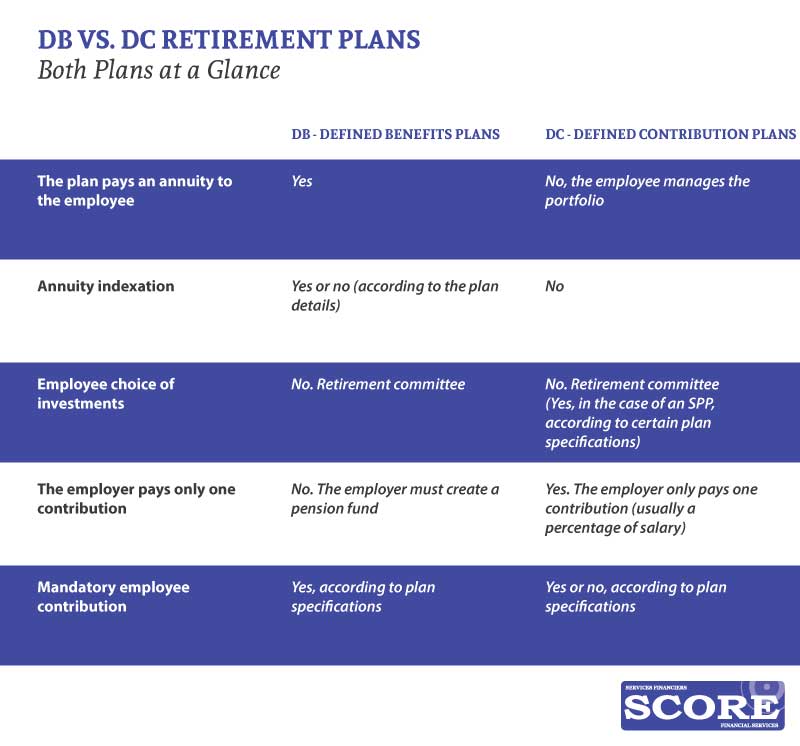

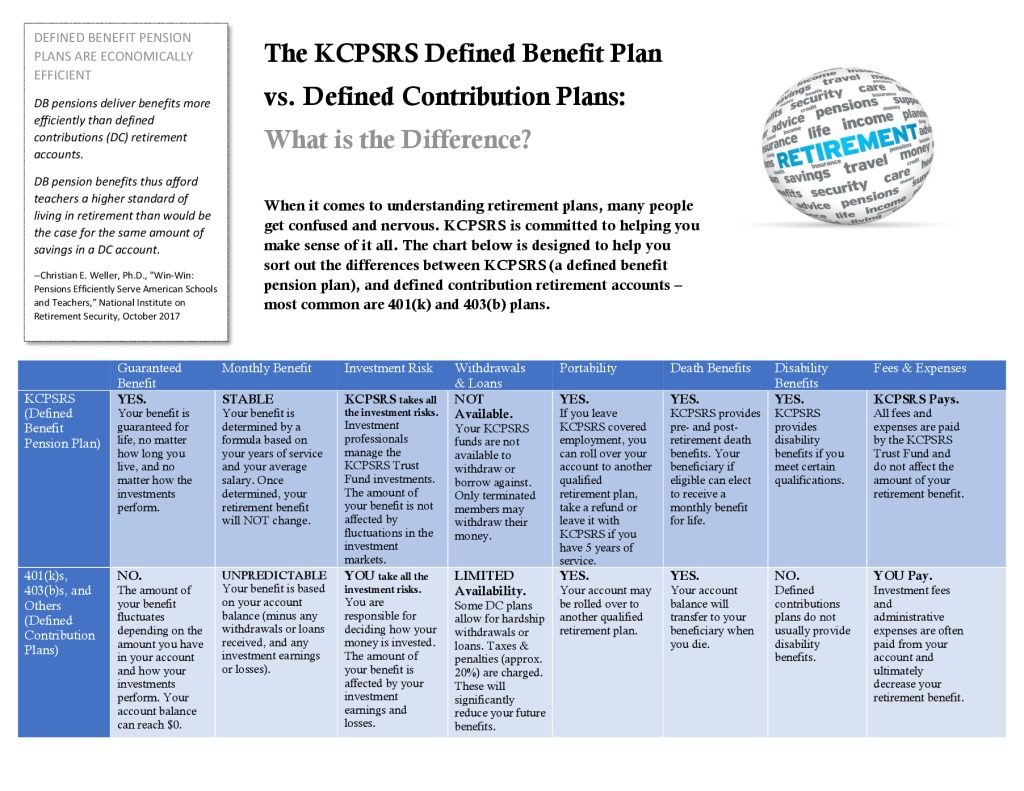

Defined benefit plan versus defined contribution plan. An employer might contribute towards an employee s pension pot based on the latter s age salary and years of service with the business. At a high level defined benefit plans allow for much higher contributions than defined contribution plans. Defined benefit plans and defined contribution plans as the. Under a defined contribution plan employees and the employer are allowed to contribute money towards the pension plan.

Employer sponsored retirement plans are divided into two major categories. Because defined benefit plans are more costly for employers than defined contribution plans most of them have you guessed it scaled back dramatically or eliminated these plans altogether in recent years. An example of how this might work follows. A defined contribution plan is a plan that does not pay a specific benefit when you retire but allows you to save money in a tax deferred account.

A 401k is a common type of defined contribution plan. A defined contribution plan like a 401 k or 403 b requires you to put in your own money.