Homeowner Insurance Rate Increases

That will change in october.

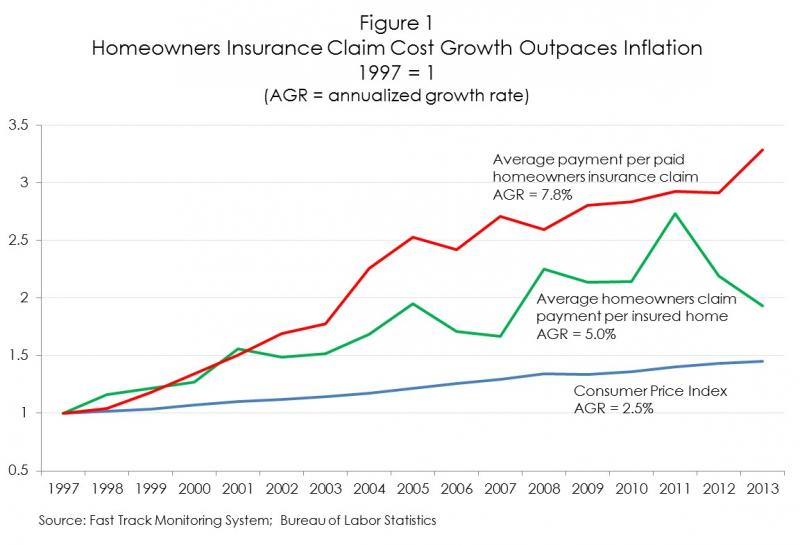

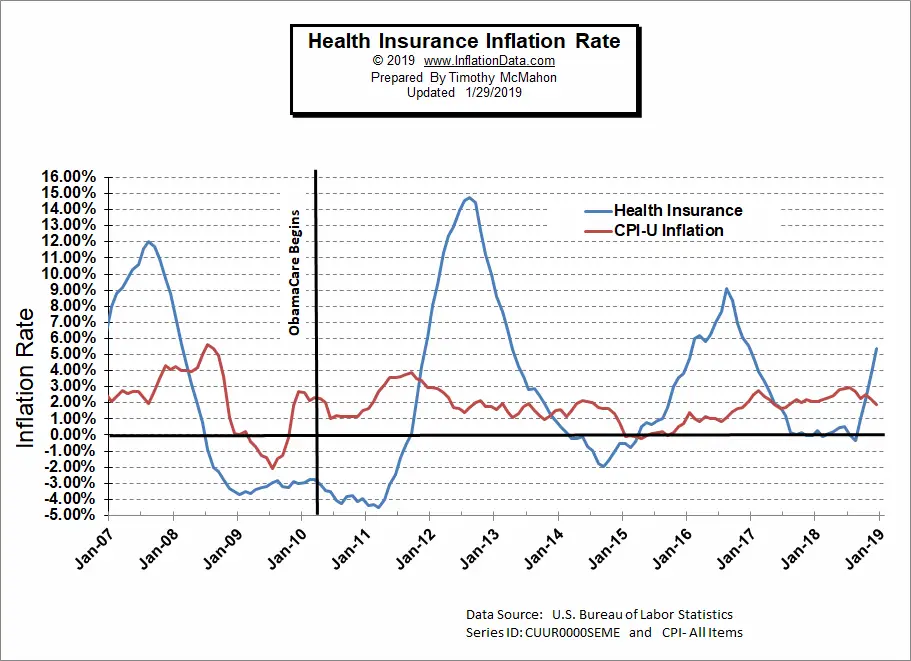

Homeowner insurance rate increases. Replacement cost tends to rise with inflation. As the cost of repairing your home increases with rising construction costs your premium needs to increase to cover those higher costs. Most homeowners insurance policies cover the replacement cost of your home. A renewal notice comes in the mail indicating a rate increase for your homeowners insurance policy.

Homeowners insurance rates in north carolina have not increased since 2012. Updated march 6 2019. Homeowners who want to stay with their insurer can also look into raising their deductible. Increasing their homeowners insurance deductible from 500 to 1 000 will decrease homeowners insurance.

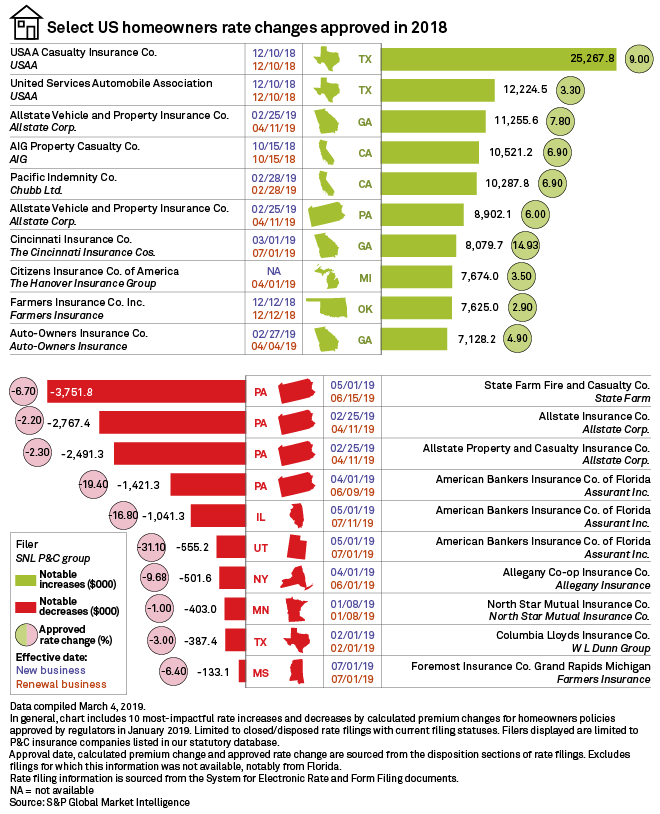

States with higher premiums could have less of a rate increase due to claims. Top 10 states with the highest homeowners insurance rate increases on average massachusetts experienced the highest rate homeowners insurance rate increase among all 50 states and washington d c. If it s bad enough an insurer can say the risks are too high and may not write a homeowners insurance policy said daniel. Rates can increase in some states due to an insurance claim but that could be because these states have lower premiums to begin with.

200 000 dwelling with 1 000 deductible and 300 000 liability. Rates will rise an average of 4 8 statewide after state officials settled a legal dispute with north carolina insurers who originally sought an 18 7 increase. However a major jump is concerning. To add to the county wide new business shutdowns current homeowners are likely to see some pretty hefty increases.

While others like edison and velocity risk are looking for increases over 20. The inflation rate for 2018 was 1 9 percent. Many of our partner insurance companies have announced increases over 10 such as avatar florida peninsula and universal. Following the steps listed below is a good starting point but you can also call and discuss your rate increases with a licensed representative at policygenius who can help you better understand your bill and get those rates down.

Rates go up a bit although never at the same pace auto insurance does. Average homeowners insurance rates by state for three common coverage levels. This situation is to be expected to a certain extent. Another major factor behind higher insurance rates sharp increases in.

Even a small claim can cause your rates to increase because in the eyes of insurers you re more of a risk.