Hedging With Option

How put options work with a put option you can sell a stock at a specified price within a given time frame.

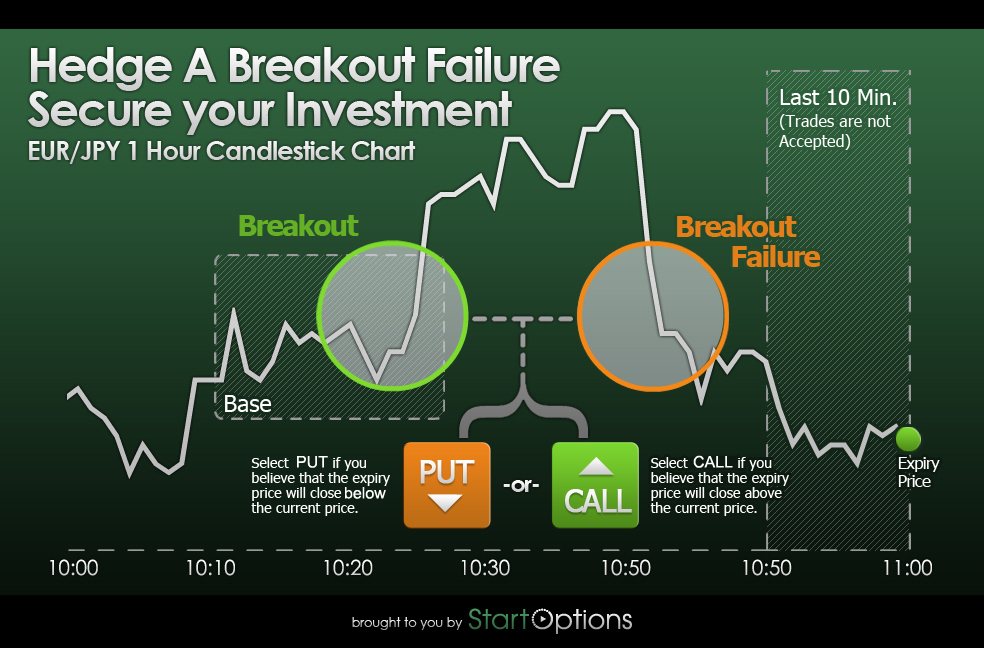

Hedging with option. Hedging with options is a great way to reduce the risks involved with making the purchase but it also reduces your potential profit. Using hedging in options trading. The cost of the hedge whether it is the cost of an option or lost profits from being on the wrong side of a futures contract can t be avoided. An option is the most commonly used derivative.

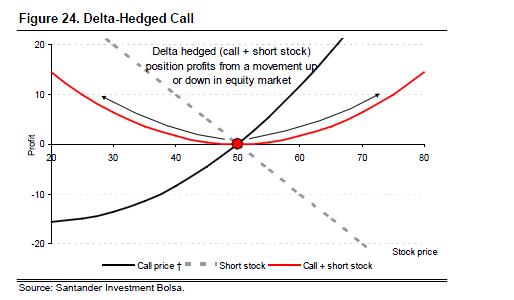

However for the average investor trading those instruments are complex and potentially too risky. A put option on a stock or index is a classic hedging instrument. Unlike using futures to hedge hedging with options offers more possibilities for the holders of an option they may lose their investment in the option when the price moves against. These are financial contracts that derive their value from an underlying real asset such as a stock.

It gives you the right to buy or sell a stock at a specified price within a window of time. There are multiple strategies to carry out the idea of hedging risk with options. Most investors who hedge use derivatives. Hedging in the financial sense means that an investor has protected him or herself against a loss via a price movement of an asset.

The basic principle of the technique is that it is used to reduce or eliminate the risk of holding one particular investment position by taking another position. Cost ratio of you hedging. There is also a possibility to hedge price risks by using options which grant the right but not the obligation to buy or sell a futures contract at a fixed price which in this case will be called the strike price. Portfolio hedging with index put options in reality requires juggling of basis risk you can only hedge in 100 share units and correlation risk where correlation risk is the risk of hedging on the basis of the betas of the components of your portfolio.

Hedging limits profitability but in return can protect from unexpected moves. Long term options can be expensive and a short term option may result in the options. Options can be a great way to hedge against risk and to even eliminate risk in certain cases. Hedging is a technique that is frequently used by many investors not just options traders.

The very large numbers of available options allow you to tailor your put option hedge to cover specific stocks or sectors of the stock market and control the leverage vs. The major downside to using options is the expiration date.

:max_bytes(150000):strip_icc()/HowtoHedgeStockPositionsUsingBinaryOptions4-a71beb3628744845b179de7ad6180449.png)